- Australia

- /

- Metals and Mining

- /

- ASX:CTM

ASX Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

Amidst a backdrop of cautious investor sentiment and ongoing geopolitical tensions, the Australian market has been experiencing slower trading days, with shares tipped to open slightly lower. In such uncertain times, investors often turn their attention to penny stocks—smaller or newer companies that can offer unique growth opportunities at lower price points. Despite being considered somewhat outdated as a term, penny stocks remain relevant for those seeking potential upside when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| CTI Logistics (ASX:CLX) | A$1.55 | A$120.92M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$2.04 | A$150.57M | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$70.76M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.36 | A$363.87M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.63 | A$121.16M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.25 | A$154.21M | ✅ 3 ⚠️ 2 View Analysis > |

| Regal Partners (ASX:RPL) | A$1.88 | A$631.99M | ✅ 4 ⚠️ 3 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.735 | A$458.51M | ✅ 4 ⚠️ 1 View Analysis > |

| NRW Holdings (ASX:NWH) | A$2.40 | A$1.1B | ✅ 5 ⚠️ 1 View Analysis > |

| LaserBond (ASX:LBL) | A$0.385 | A$45.17M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 983 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Australian Strategic Materials (ASX:ASM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Australian Strategic Materials Ltd is an integrated producer of critical metals for advanced and clean technologies in Australia, with a market cap of A$102.46 million.

Operations: The company generates revenue from its operations in Korea (A$0.91 million) and the Dubbo Project (A$1.12 million).

Market Cap: A$102.46M

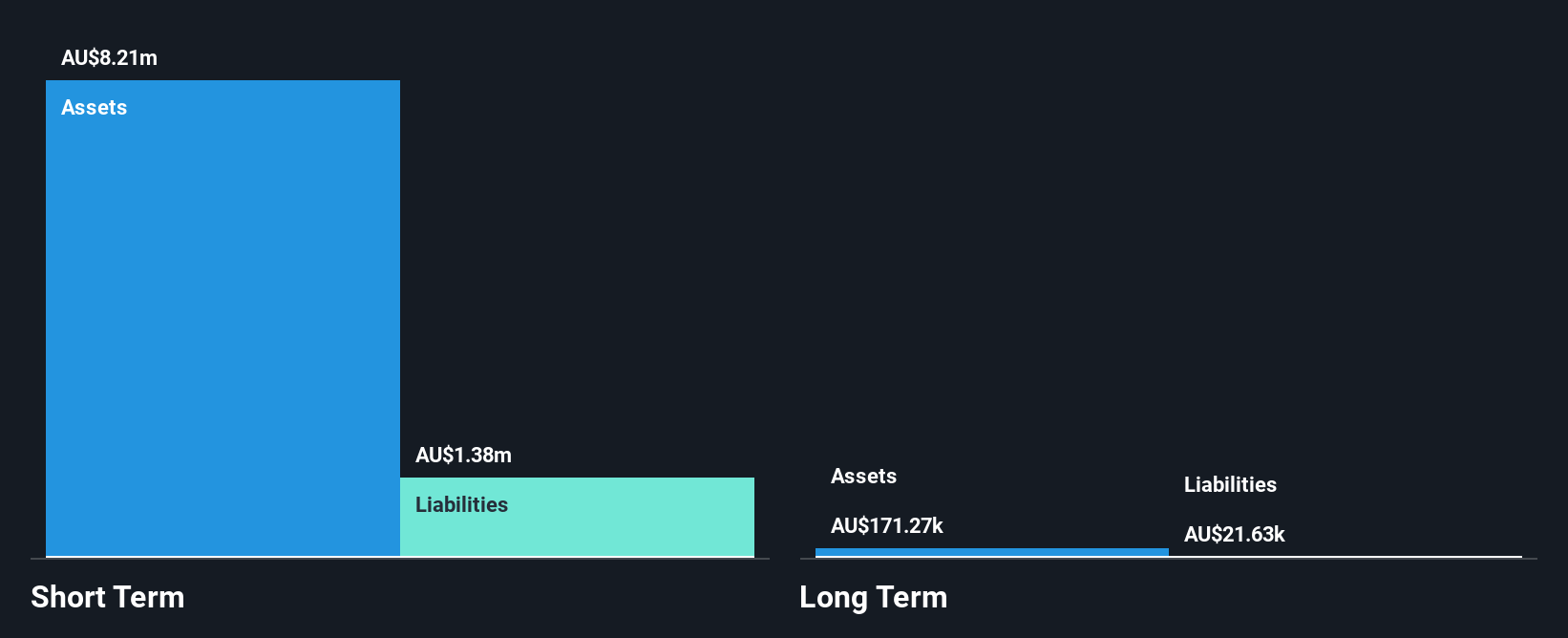

Australian Strategic Materials is currently pre-revenue, with minimal sales of A$1.13 million for the half-year ending December 2024 and a net loss of A$13.96 million. The company faces financial challenges, having less than a year of cash runway and experiencing increased losses over the past five years. Despite these hurdles, ASM's short-term assets exceed both its short- and long-term liabilities, providing some financial stability. Recent board changes include the appointment of Dominic Heaton as an Independent Non-Executive Director, bringing extensive mining sector experience that could support ASM's strategic goals amidst its recent removal from key ASX indices.

- Click to explore a detailed breakdown of our findings in Australian Strategic Materials' financial health report.

- Understand Australian Strategic Materials' track record by examining our performance history report.

Centaurus Metals (ASX:CTM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Centaurus Metals Limited focuses on the exploration and evaluation of mineral resource properties in Brazil, with a market capitalization of A$191.23 million.

Operations: Centaurus Metals Limited does not currently report any revenue segments.

Market Cap: A$191.23M

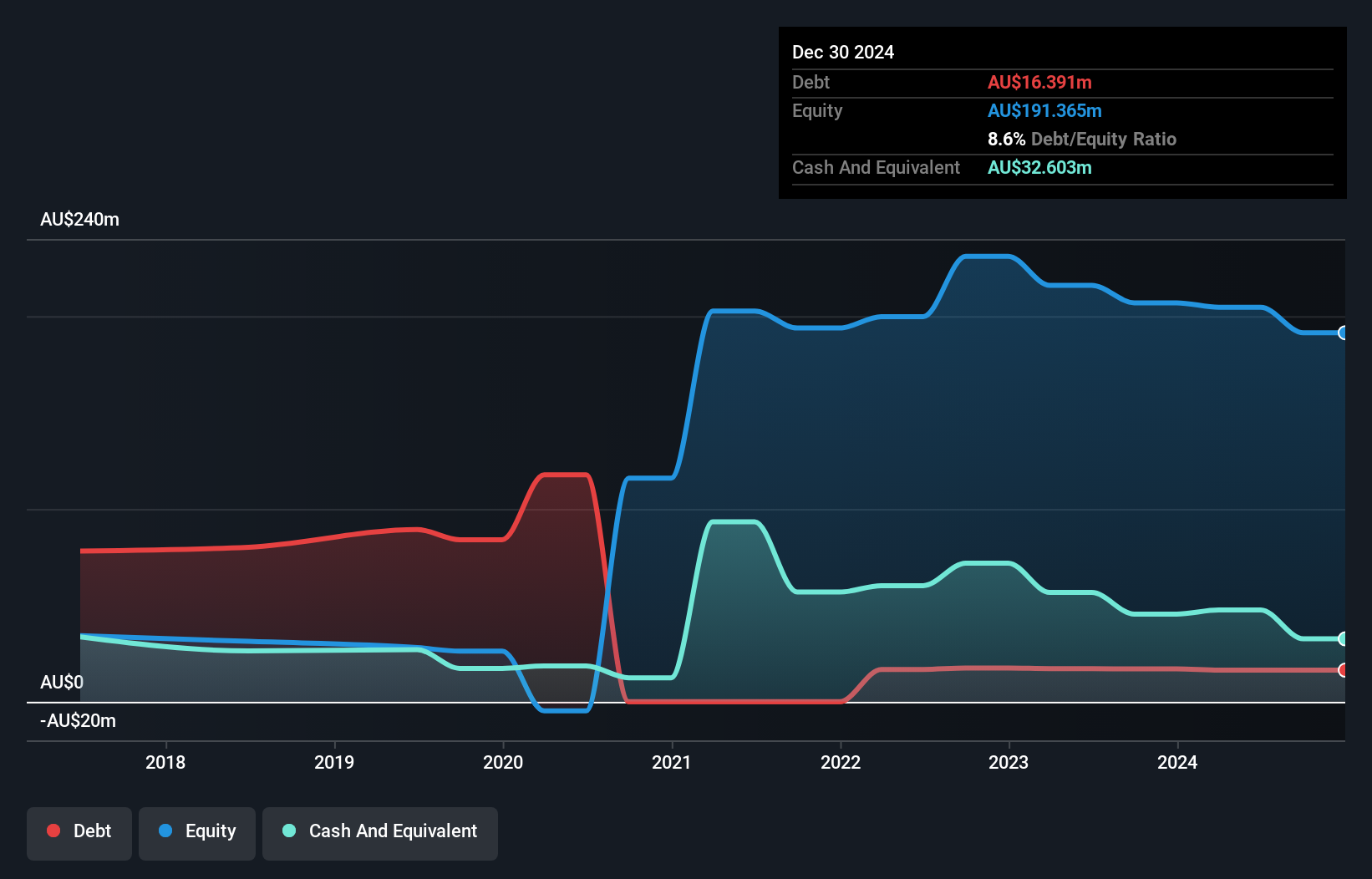

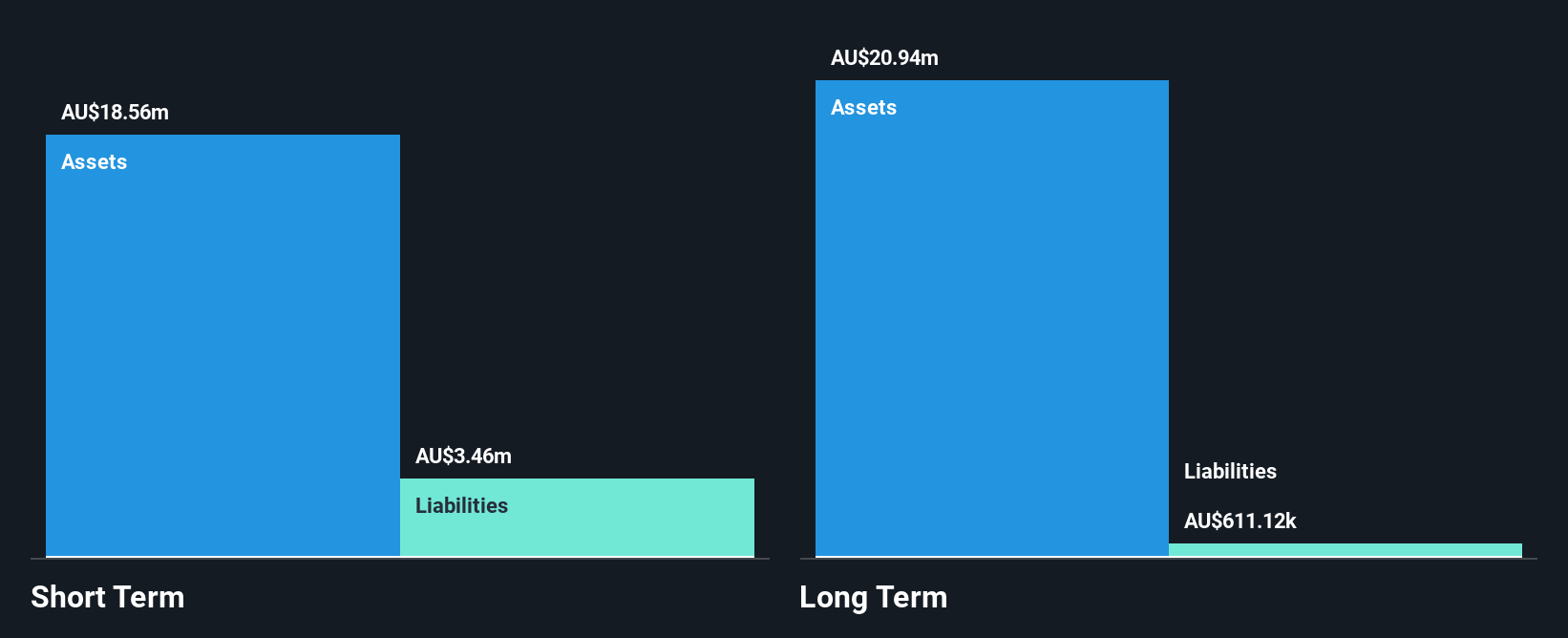

Centaurus Metals Limited is pre-revenue, focusing on mineral exploration in Brazil with a market cap of A$191.23 million. The company reported a net loss of A$18.45 million for 2024, an improvement from the previous year's larger loss. Despite being unprofitable and not expected to achieve profitability in the near term, Centaurus has no debt and sufficient cash runway for over a year based on current free cash flow trends. Its seasoned management and board bring stability, while its short-term assets comfortably cover both short- and long-term liabilities, providing some financial resilience amidst ongoing operational challenges.

- Take a closer look at Centaurus Metals' potential here in our financial health report.

- Understand Centaurus Metals' earnings outlook by examining our growth report.

Magnetic Resources (ASX:MAU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Magnetic Resources NL is involved in the exploration of mineral tenements in Western Australia, with a market cap of A$392.14 million.

Operations: Magnetic Resources does not report any revenue segments.

Market Cap: A$392.14M

Magnetic Resources NL, with a market cap of A$392.14 million, is pre-revenue and engaged in mineral exploration in Western Australia. The company recently completed strong metallurgical test work at its Lady Julie Gold Project (LJGP), achieving a 97.5% recovery rate with an optimized flotation circuit. Despite being unprofitable and having less than a year of cash runway, Magnetic Resources benefits from no debt and short-term assets exceeding liabilities by A$11.45 million. Recent developments include advanced feasibility studies for LJGP, indicating potential for significant resource expansion and enhanced project value through concurrent underground mining operations alongside planned open pits.

- Unlock comprehensive insights into our analysis of Magnetic Resources stock in this financial health report.

- Review our historical performance report to gain insights into Magnetic Resources' track record.

Where To Now?

- Access the full spectrum of 983 ASX Penny Stocks by clicking on this link.

- Searching for a Fresh Perspective? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTM

Centaurus Metals

Engages in the exploration and evaluation of mineral resource properties Brazil.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion