- Thailand

- /

- Consumer Finance

- /

- SET:THANI

3 Asian Penny Stocks With Market Caps Under US$400M To Watch

Reviewed by Simply Wall St

As global markets react to recent trade discussions and economic policy shifts, investors are keeping a close eye on opportunities across various sectors. Despite the vintage feel of the term "penny stocks," these smaller or newer companies can still present intriguing investment prospects, especially when they possess strong financial foundations. In this article, we explore three Asian penny stocks that showcase potential for growth and stability, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Advice IT Infinite (SET:ADVICE) | THB4.78 | THB2.96B | ✅ 4 ⚠️ 3 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.60 | THB1.65B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.43 | SGD174.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.186 | SGD37.05M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.12 | SGD8.34B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.86 | HK$3.22B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.06 | HK$46.48B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.09 | HK$687.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.35 | HK$2.25B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.16 | HK$1.8B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,180 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Central Wealth Group Holdings (SEHK:139)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Central Wealth Group Holdings Limited is an investment holding company involved in securities and futures dealing, debts and equity investment trading, and money lending, with a market cap of approximately HK$977.59 million.

Operations: The company's revenue is primarily derived from Brokerage and Commission services at HK$36.11 million and Financial Investments and Services at HK$38.84 million.

Market Cap: HK$977.59M

Central Wealth Group Holdings, with a market cap of HK$977.59 million, faces challenges as it remains unprofitable with a negative return on equity of -11.34%. The company's revenue primarily stems from Brokerage and Commission services (HK$36.11 million) and Financial Investments (HK$38.84 million). Recent earnings revealed a decreased revenue of HK$75.71 million for 2024 compared to the previous year, although net losses have narrowed from HK$132.86 million to HK$83.14 million. Despite high volatility in its share price and increased weekly volatility, the company maintains sufficient cash runway for over three years based on current free cash flow levels and has reduced its debt-to-equity ratio significantly over five years.

- Click to explore a detailed breakdown of our findings in Central Wealth Group Holdings' financial health report.

- Gain insights into Central Wealth Group Holdings' historical outcomes by reviewing our past performance report.

Tong Ren Tang Technologies (SEHK:1666)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tong Ren Tang Technologies Co. Ltd., with a market cap of HK$6.31 billion, produces and distributes Chinese medicine products in Mainland China and Hong Kong through its subsidiaries.

Operations: The company generates revenue primarily from its operations in Mainland China, contributing CN¥4.46 billion, and from its Chinese medicine segment, which adds CN¥1.47 billion.

Market Cap: HK$6.31B

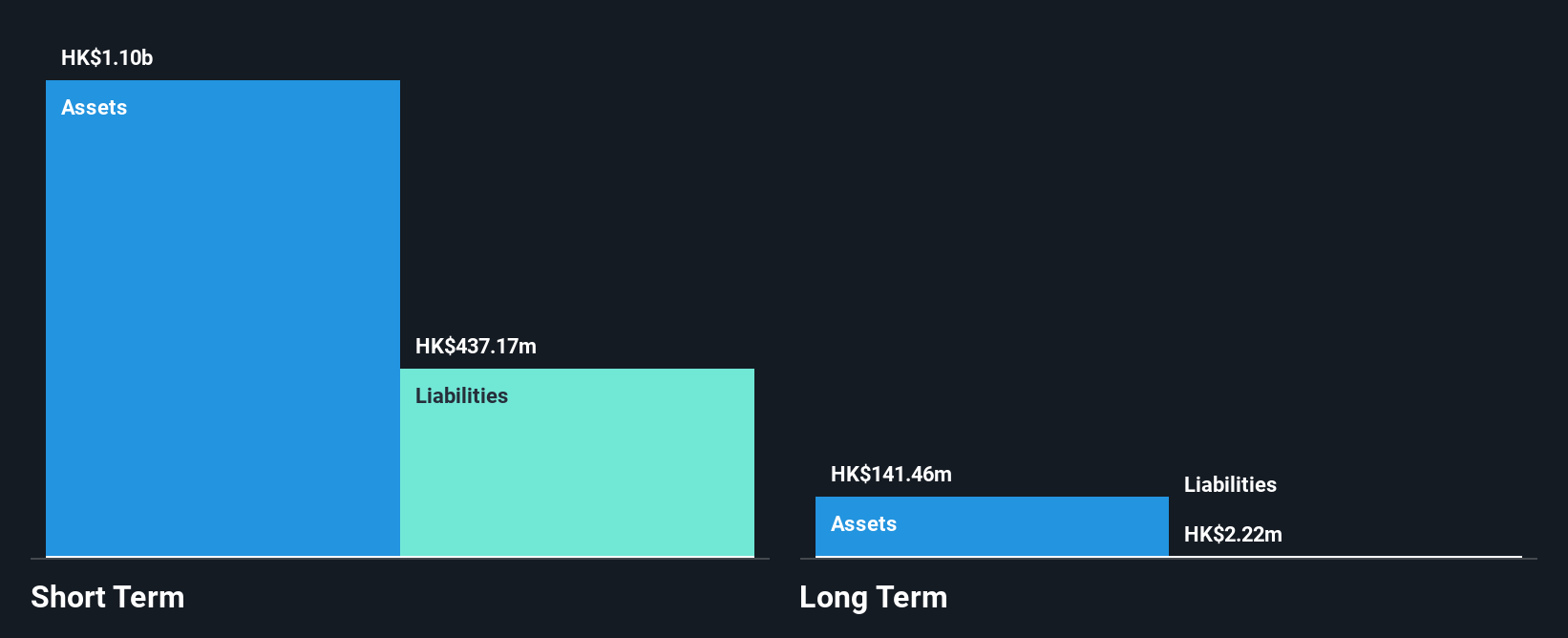

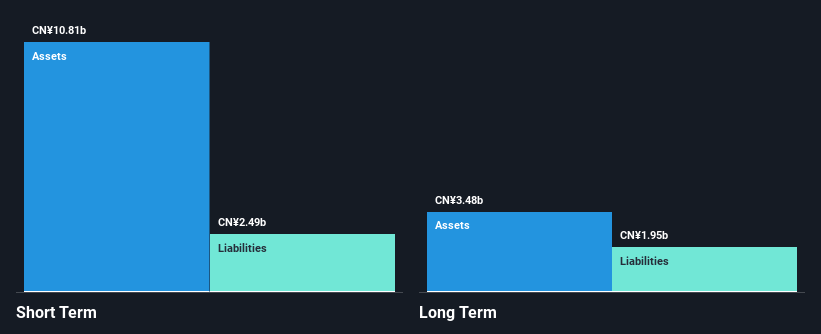

Tong Ren Tang Technologies, with a market cap of HK$6.31 billion, operates in the Chinese medicine sector and reported sales of CN¥7.26 billion for 2024, reflecting growth from the previous year. However, net income decreased to CN¥521.8 million from CN¥590.19 million, indicating challenges in profit margins which fell to 7.2% from 8.7%. The company’s short-term assets comfortably cover both its short- and long-term liabilities, although its debt is not well covered by operating cash flow at just 0.7%. Despite trading below estimated fair value and stable weekly volatility (5%), earnings growth was negative last year at -11.6%, contrasting with a five-year annual growth rate of 9.7%. A proposed dividend of RMB 0.18 per share for FY2024 highlights ongoing shareholder returns but is not well covered by free cash flows.

- Click here to discover the nuances of Tong Ren Tang Technologies with our detailed analytical financial health report.

- Examine Tong Ren Tang Technologies' earnings growth report to understand how analysts expect it to perform.

Ratchthani Leasing (SET:THANI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ratchthani Leasing Public Company Limited, along with its subsidiary, offers hire-purchase and leasing services in Thailand and has a market cap of THB10.15 billion.

Operations: Ratchthani Leasing generates its revenue primarily through hire-purchase and leasing services within Thailand.

Market Cap: THB10.15B

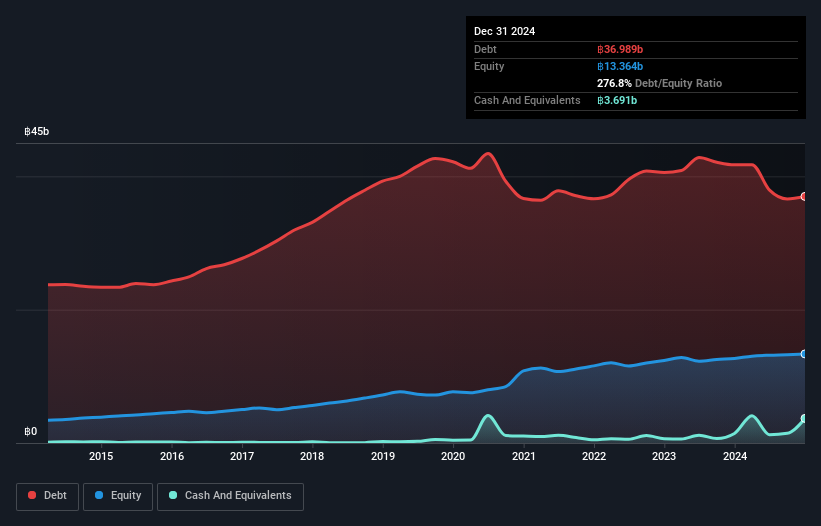

Ratchthani Leasing, with a market cap of THB10.15 billion, reported a decline in revenue to THB997.96 million for Q1 2025 from THB1.11 billion the previous year, alongside a decrease in net income to THB253.6 million from THB343.19 million. Despite stable weekly volatility and no shareholder dilution recently, its earnings growth has been negative at -39.8%. The company's debt level remains high with a net debt to equity ratio of 222.9%, although it has improved over five years from 547%. Short-term assets exceed liabilities, yet its dividend track record is unstable and return on equity is low at 5.2%.

- Jump into the full analysis health report here for a deeper understanding of Ratchthani Leasing.

- Gain insights into Ratchthani Leasing's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Get an in-depth perspective on all 1,180 Asian Penny Stocks by using our screener here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ratchthani Leasing, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:THANI

Ratchthani Leasing

Together with its subsidiary, provides hire-purchase and leasing services in Thailand.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives