Key Takeaways

- Rapid shift to electric vehicles and stricter sustainability demands are undermining core metal revenues and increasing operational costs.

- Operational instability, weak lithium markets, and regulatory pressures threaten diversification efforts, earnings resilience, and shareholder returns.

- Diversification into battery metals, operational efficiency, and a strong balance sheet position the company to benefit from sustainability trends while supporting long-term margin and profit growth.

Catalysts

About Sibanye Stillwater- Operates as a precious metals mining company in South Africa, the United States, Europe, and Australia.

- Technological innovation and the rapid global adoption of battery electric vehicles are accelerating the substitution of platinum group metals, particularly palladium and platinum, in catalytic converters. This will likely erode Sibanye Stillwater's core PGM revenue and long-term earnings, as evidenced by downward revisions to light-duty vehicle and battery electric vehicle production forecasts.

- Intensifying environmental regulations and increasing global expectations on sustainability are translating into higher compliance and remediation costs. This will raise recurring operational expenditure, compressing net margins and putting pressure on the company's ability to maintain profitability, especially in its South African and French operations which already face headcount and ramp-down challenges.

- Persistent operational instability in South Africa, including labor unrest, safety incidents, aging mine infrastructure, and seismicity-induced stoppages, continues to threaten consistent production. This undermines revenue predictability and increases the risk of costly supply disruptions-which were highlighted by disappointing gold production and guidance cuts.

- Excess supply and depressed near

- and medium-term lithium prices have resulted in significant impairments and will continue to hinder the ramp-up and returns from new mining projects such as Keliber, placing long-term pressure on both Sibanye Stillwater's earnings resilience and its efforts to diversify away from PGMs.

- Supply chain risks, rising resource nationalism, and tightening tax/regulatory regimes-particularly in South Africa, Zimbabwe, and potentially the U.S.-are likely to increase royalties and taxes over time and elevate expropriation risk. This will curtail after-tax returns and may necessitate further capital-intensive investments, restricting free cash flow and value creation for shareholders.

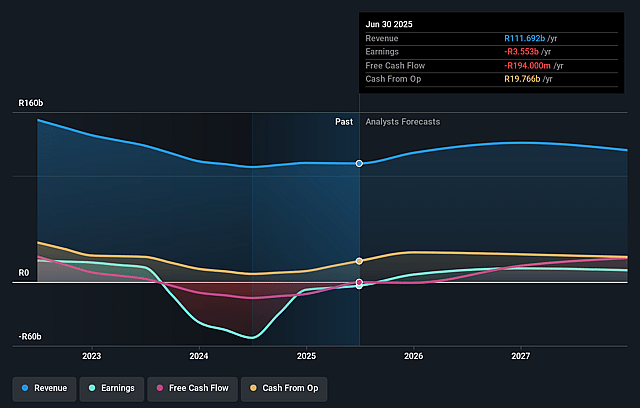

Sibanye Stillwater Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Sibanye Stillwater compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Sibanye Stillwater's revenue will decrease by 0.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -3.2% today to 6.6% in 3 years time.

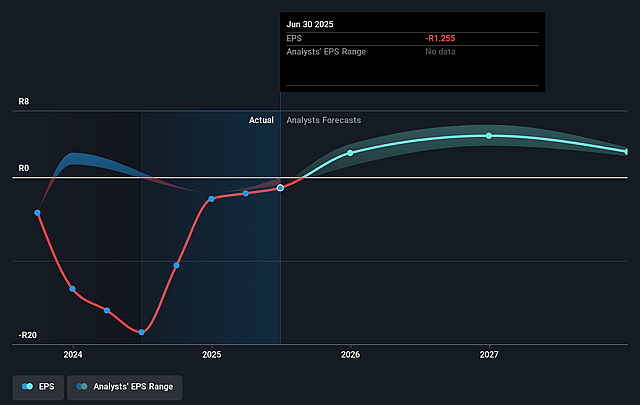

- The bearish analysts expect earnings to reach ZAR 7.4 billion (and earnings per share of ZAR 3.7) by about September 2028, up from ZAR -3.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, up from -31.0x today. This future PE is lower than the current PE for the US Metals and Mining industry at 15.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.15%, as per the Simply Wall St company report.

Sibanye Stillwater Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing energy transition and electrification trends are expected to drive robust long-term demand for battery metals like lithium, nickel, and copper, as well as platinum group metals, supporting Sibanye Stillwater's future revenue growth and insulating earnings from a potential decline in commodity prices.

- Strategic diversification into recycling, battery metals, and circular economy assets positions Sibanye Stillwater to benefit from increased sustainability requirements and supply chain localization for critical minerals, which could enhance revenue stability and support profit margins.

- Operational efficiency improvements, restructuring, and mechanization projects in both South Africa and the U.S. have already led to reduced costs and increased margins, and continuing investment in such initiatives could sustainably raise net margins and earnings.

- Recovery in PGM prices and anticipated supply deficits in both primary and secondary PGM markets after 2026, alongside disciplined cost management, create a favorable environment for stronger long-term EBITDA and free cash flow.

- The company's strong balance sheet, improved liquidity position, and conservative capital allocation-alongside access to tax credits (such as the U.S. Section 45X credits) and government grants-reduce financial risk and could allow for renewed dividend payments and further investment, bolstering both revenue and profit prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Sibanye Stillwater is ZAR19.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sibanye Stillwater's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR50.0, and the most bearish reporting a price target of just ZAR19.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ZAR111.5 billion, earnings will come to ZAR7.4 billion, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 19.1%.

- Given the current share price of ZAR38.9, the bearish analyst price target of ZAR19.5 is 99.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.