Key Takeaways

- US operations and recycling initiatives are set to boost margins, cash flow and resilience due to regulatory tailwinds, operational improvements, and growing demand for ESG-compliant metals.

- Investments in renewables and early entry into lithium supply will enhance earnings stability, cost savings, and market positioning amid industry shifts toward sustainability and batteries.

- Structural demand risks, operational headwinds, rising costs, competition from recycling, and high leverage threaten long-term profitability and financial flexibility.

Catalysts

About Sibanye Stillwater- Operates as a precious metals mining company in South Africa, the United States, Europe, and Australia.

- Analyst consensus acknowledges the positive impact of Section 45X tax credits and successful US trade remedies, but market expectations may understate the tailwind as Sibanye Stillwater will likely realize multi-year after-tax windfalls, coupled with potential antidumping duties on Russian palladium imports, driving substantial margin uplift and cash flow far beyond near-term forecasts.

- While consensus highlights the gradual reduction in Stillwater's all-in sustaining costs, current operational improvements and mine mechanization are poised to accelerate cost curve repositioning, making the US PGM operations substantially more resilient and profitable in an environment of persistent supply constraints and rising PGM prices, directly boosting group earnings and margins.

- The acquisition and rapid integration of Reldan and Metallix position Sibanye's recycling platform for structural growth as global demand for secondary, ESG-compliant metals rises, supporting higher-margin and less cyclical revenue streams that enhance overall earnings stability.

- Sibanye's commitment to renewable energy and decarbonization is set to unlock significant cost savings and reduce operational risk across South African operations, increasing long-term net margins as power supply reliability and sustainability premiums become critical for access to global markets.

- The ramp-up of the fully-permitted Keliber lithium project in a protected European ecosystem means Sibanye will be an early mover in battery-grade lithium hydroxide supply just as deficits emerge, capturing price upside and diversified EV market exposure that will drive top-line growth and reduce group earnings volatility over time.

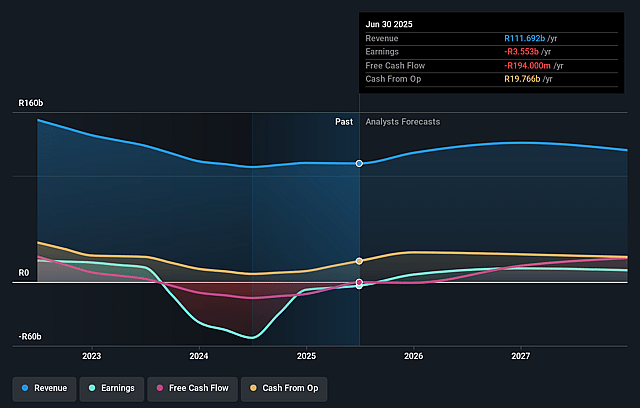

Sibanye Stillwater Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Sibanye Stillwater compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Sibanye Stillwater's revenue will grow by 8.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -3.2% today to 7.0% in 3 years time.

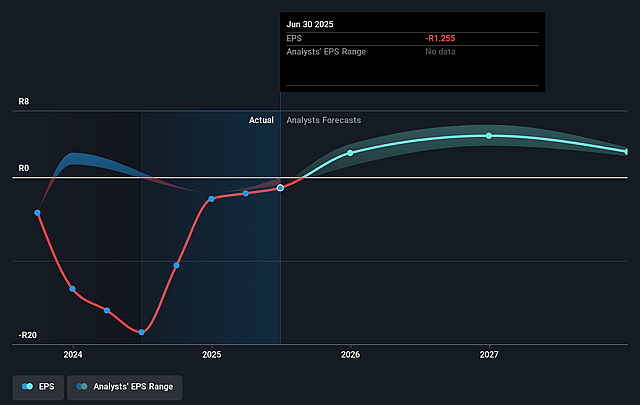

- The bullish analysts expect earnings to reach ZAR 10.2 billion (and earnings per share of ZAR 5.28) by about September 2028, up from ZAR -3.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 23.7x on those 2028 earnings, up from -30.2x today. This future PE is greater than the current PE for the US Metals and Mining industry at 17.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.35%, as per the Simply Wall St company report.

Sibanye Stillwater Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global shift toward renewable energy and electric vehicles is likely to structurally reduce long-term demand for platinum group metals used in internal combustion engine autocatalysts, which threatens Sibanye Stillwater's core revenue base and could drive sustained price and volume pressure on their primary products.

- Sibanye Stillwater faces mounting operational headwinds in South Africa, including persistent labor unrest, unreliable electricity supply, and an unpredictable regulatory environment, all of which could trigger frequent production interruptions, lead to elevated operational costs and lost revenue, and compress net margins over the long term.

- The company's South African gold and PGM operations are burdened by aging mine assets and declining ore grades, pushing up operating costs and capital expenditure needs in future years, eroding profitability, and ultimately threatening net earnings unless offset by significant new finds or technology improvements.

- Rapid advancements in metal recycling and the substitution of PGMs-such as the growing scale and efficiency of recycled critical minerals and pressure from alternative materials-may directly reduce demand for newly mined metals and hurt Sibanye Stillwater's top-line growth, further curbing volumes and earnings over time.

- Elevated leverage levels and an aggressive acquisition strategy may strain Sibanye Stillwater's financial flexibility in volatile commodity environments, leaving less capacity for shareholder returns and reinvestment, while rising interest expenses could further pressure bottom-line earnings if commodity prices fall or projects underperform.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Sibanye Stillwater is ZAR50.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sibanye Stillwater's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR50.0, and the most bearish reporting a price target of just ZAR19.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ZAR144.2 billion, earnings will come to ZAR10.2 billion, and it would be trading on a PE ratio of 23.7x, assuming you use a discount rate of 19.4%.

- Given the current share price of ZAR37.95, the bullish analyst price target of ZAR50.0 is 24.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.