Key Takeaways

- Initial integration costs from acquisitions and plant conversions may slow revenue growth and impact short-term margins despite long-term efficiency improvements.

- Strategic solar and storage projects indicate future earnings growth, but reliance on third-party capital and regulatory risks may pressure cash flow and growth.

- Regulatory and legislative uncertainties, along with risks from market reforms, could impact Vistra's revenue projections and future earnings.

Catalysts

About Vistra- Operates as an integrated retail electricity and power generation company in the United States.

- Vistra's acquisition of new nuclear sites and the addition of 1 million retail customers along with nearly 2,000 new team members have not yet fully translated into revenue growth, as the integration and optimization processes may initially slow down projected revenue benefits.

- The conversion of the Coleto Creek coal plant to a gas fuel plant and the extension of the Baldwin coal plant's operations suggest future efficiency improvements and operational cost benefits, but these transformations involve upfront costs that may impact net margins in the short term.

- The expected increase in demand from various sectors, such as AI data centers, and the shift towards cleaner energy sources are promising for future revenue growth. However, uncertainties in regulatory and legislative frameworks, particularly in Texas, pose risks that may hinder the anticipated growth rate.

- Vistra's strategic focus on developing solar and energy storage projects using existing infrastructure supports longer-term earnings growth potential. However, the capital expenditure and reliance on third-party capital introduce risk factors that may pressure cash flow conversion rates.

- The enactment of extensive share repurchases and dividend distributions reflects a commitment to returning capital to shareholders, which aligns with EPS growth expectations. Yet, these allocations might constrain future leverage capacity, affecting the company's ability to rapidly capitalize on emerging market conditions.

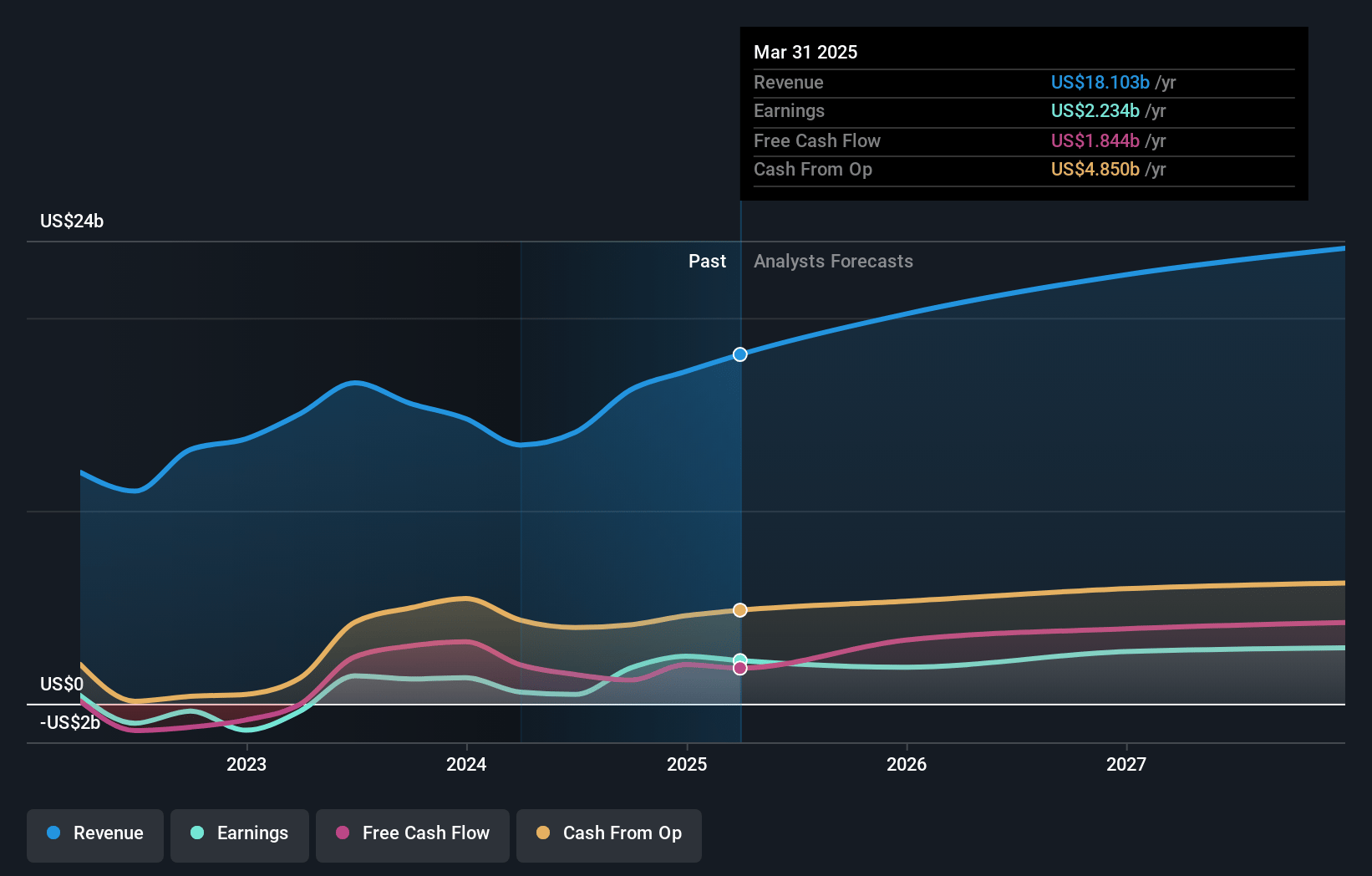

Vistra Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Vistra compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Vistra's revenue will decrease by 0.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 14.3% today to 11.0% in 3 years time.

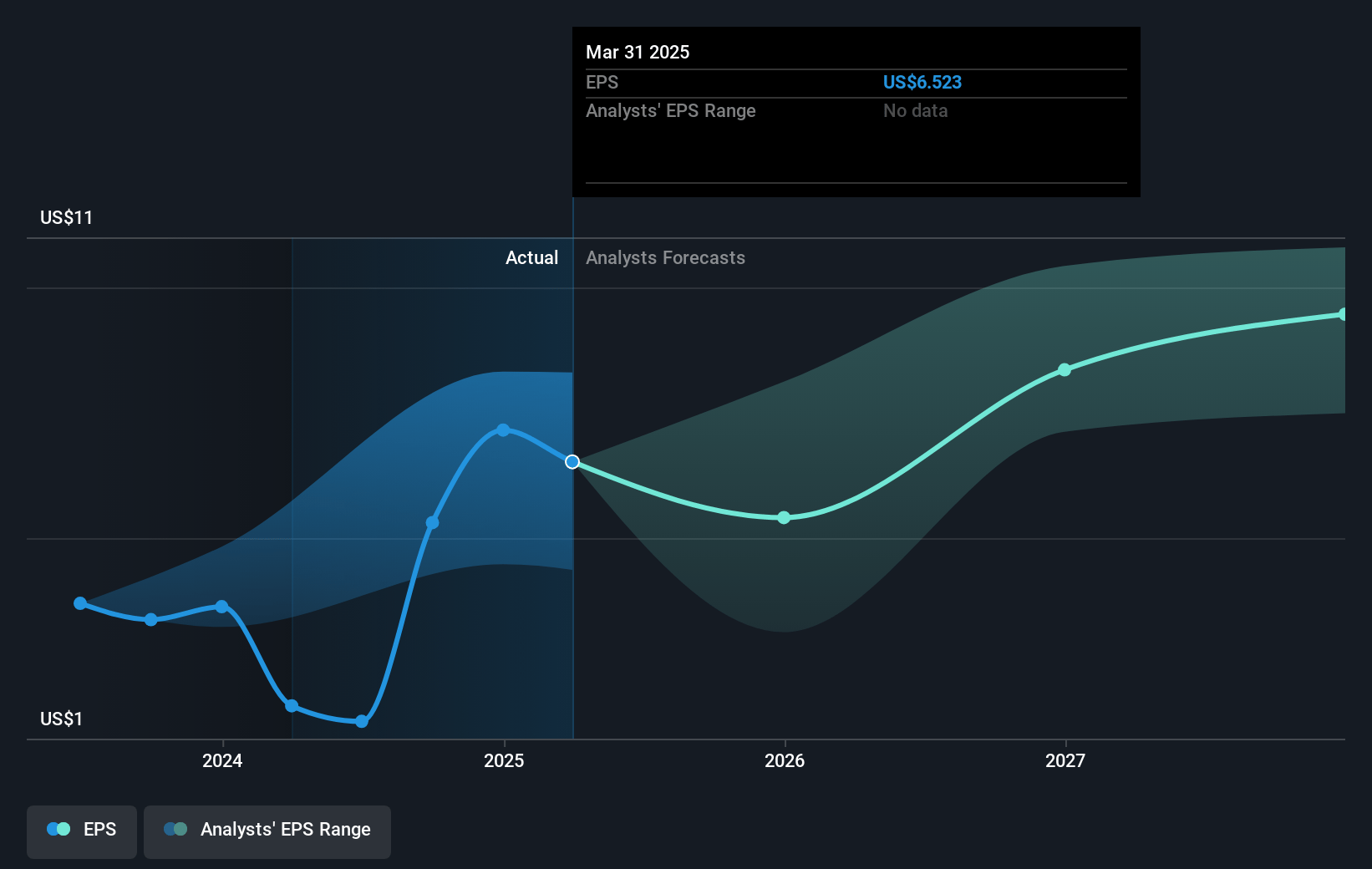

- The bearish analysts expect earnings to reach $1.9 billion (and earnings per share of $5.69) by about April 2028, down from $2.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 26.3x on those 2028 earnings, up from 15.9x today. This future PE is lower than the current PE for the US Renewable Energy industry at 29.9x.

- Analysts expect the number of shares outstanding to decline by 2.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.58%, as per the Simply Wall St company report.

Vistra Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory and legislative uncertainties, especially regarding market reforms and capacity auctions in PJM and ERCOT, could affect the outlook for wholesale power prices, impacting revenue projections for Vistra.

- The complexity and delays in executing deals for colocation with data centers, due to unresolved regulatory frameworks, pose risks to anticipated growth in earnings from long-term contracts.

- Potential impacts from incidents such as the Moss Landing fire and associated insurance recoveries may introduce financial strain, affecting overall net margins and cash flow.

- The rapid growth in energy demand within the ERCOT market might not be fully captured by forward prices, leading Vistra to potentially lock in suboptimal prices if long-term contracts are signed at current market rates, impacting future earnings.

- Concerns about new regulatory proposals in Texas, such as changes to grid charges or the introduction of remote disconnects, could discourage data center development and affect Vistra’s expected revenue growth from these projects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Vistra is $127.93, which represents one standard deviation below the consensus price target of $167.67. This valuation is based on what can be assumed as the expectations of Vistra's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $232.0, and the most bearish reporting a price target of just $56.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $16.9 billion, earnings will come to $1.9 billion, and it would be trading on a PE ratio of 26.3x, assuming you use a discount rate of 6.6%.

- Given the current share price of $115.42, the bearish analyst price target of $127.93 is 9.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:VST. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.