Key Takeaways

- Rising operating costs and regional dependence create near-term risks for margin improvement and expose the company to local economic and regulatory shocks.

- Environmental regulation and drought-related policy changes could increase capital requirements and slow customer or revenue growth despite long-term demand trends.

- Heavy reliance on a single market, slowing new connections, rising costs, and regulatory uncertainty could threaten revenue growth, margin stability, and free cash flow.

Catalysts

About Global Water Resources- A water resource management company, owns, operates, and manages regulated water, wastewater, and recycled water systems in metropolitan Phoenix and Tucson, Arizona.

- While the integration of the recent Tucson acquisition and ongoing infrastructure investment are expected to support revenue and margin expansion over time, the company's exposure to rising operational, personnel, and maintenance costs-evidenced by operating expenses growing at a faster rate than revenue-poses near-term risks to net margin improvement.

- Despite legislative developments and infrastructure projects in Arizona that are likely to drive long-term population and water demand growth, permit issuance and building activity for new single-family homes in the core market have seen double-digit declines year-over-year, signaling uncertainty around the pace of organic connection and revenue growth in the near future.

- While regulations prioritizing environmental stewardship and water sustainability create barriers to entry favoring Global Water Resources, evolving standards and potential new mandates could force higher compliance and capital expenditures, thereby putting pressure on free cash flow and constraining earnings growth.

- Although the company's successful execution of its acquisition and rate case strategy has enhanced rate base and promises greater operational efficiencies in the years ahead, heavy dependence on a single high-growth region in Arizona increases vulnerability to local regulatory or economic shocks, which could disrupt revenue stability and erode net margins.

- While demographic trends point to long-term water demand resilience in the Sun Corridor, the increasing frequency of droughts and restrictive water management policies could eventually limit consumption volume and slow customer growth, creating headwinds for revenue and EBITDA expansion in the face of ongoing infrastructure and capital needs.

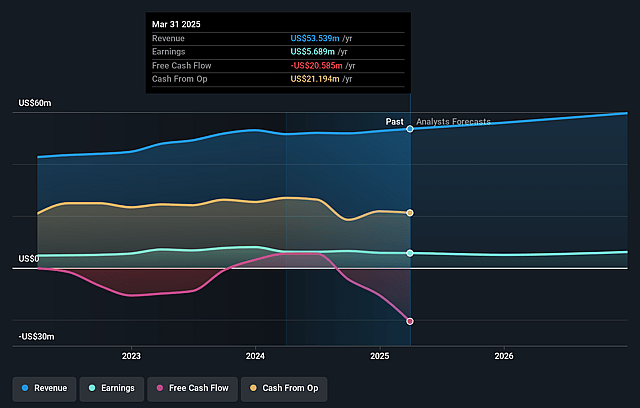

Global Water Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Global Water Resources compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Global Water Resources's revenue will grow by 6.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 10.3% today to 10.8% in 3 years time.

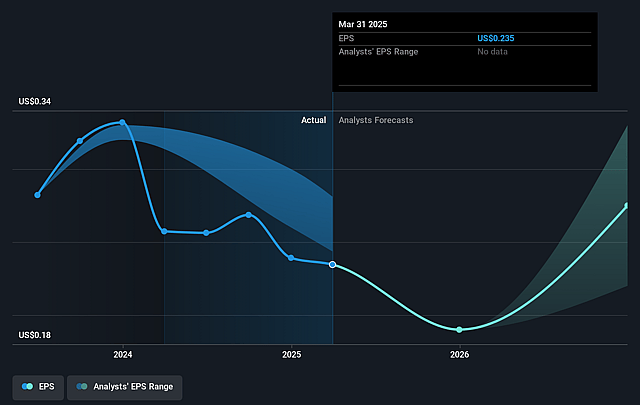

- The bearish analysts expect earnings to reach $7.1 million (and earnings per share of $0.28) by about September 2028, up from $5.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 73.7x on those 2028 earnings, up from 48.4x today. This future PE is greater than the current PE for the US Water Utilities industry at 22.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Global Water Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy dependence on Arizona and specifically the City of Maricopa exposes it to significant geographic concentration risk, meaning any local economic downturns, regulatory changes, or adverse water policy developments in Arizona could disrupt future revenue growth and earnings stability.

- Despite recent population growth figures, there is a notable slowdown in new building permits both regionally and in the core Maricopa market, which may signal weakening long-term organic customer growth and thus potentially challenge future revenue and service connection increases.

- Rising operating expenses, including higher depreciation, personnel, and service provider costs outpacing revenue growth, may pressure net margins and earnings if cost increases persist ahead of expected rate adjustments.

- The company's need for new rate increases to offset elevated costs and capital investments relies on successful and timely regulatory approvals, and if rate cases are delayed or outcomes prove unfavorable, this could depress net income and operating cash flow for an extended period.

- Ongoing significant capital expenditures for infrastructure improvements and integration of acquisitions, combined with increasing depreciation, may compress free cash flow and reduce the company's ability to support both growth initiatives and investor returns if funding becomes more costly or less accessible.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Global Water Resources is $13.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Global Water Resources's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $13.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $65.6 million, earnings will come to $7.1 million, and it would be trading on a PE ratio of 73.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of $9.82, the bearish analyst price target of $13.0 is 24.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.