Key Takeaways

- Strategic acquisitions and advanced water management position the company for rapid margin expansion, outsized earnings growth, and structural pricing power in high-demand regions.

- Strong policy tailwinds and infrastructure investments drive above-trend demand, attracting sustainable capital and supporting high-return, long-term growth opportunities.

- Reliance on regulatory approval, high infrastructure costs, and geographic concentration create risks to profitability, revenue growth, and market expansion amid economic and environmental challenges.

Catalysts

About Global Water Resources- A water resource management company, owns, operates, and manages regulated water, wastewater, and recycled water systems in metropolitan Phoenix and Tucson, Arizona.

- Analyst consensus anticipates that the Tucson acquisition will provide incremental revenue and cost synergies, but this is likely understated-given the portfolio's proximity and ready-to-integrate systems, accelerated consolidation could rapidly expand net margins, while immediate rate increases in acquired districts may drive outsized earnings surprise versus expectations.

- Analysts broadly expect organic growth from new connections and service area expansion, but the passage of Ag-to-Urban legislation, combined with fully funded transportation infrastructure like the Highway 347 project, positions Global Water to capture several years of compounding, above-trend population and commercial demand growth, potentially driving sustained double-digit revenue gains through the next decade.

- The increasing value and strategic importance of water supply in drought-prone regions is likely to enhance long-term pricing power for Global Water, enabling outsized rate base growth and regulatory support for higher allowed returns, translating to structurally higher future earnings.

- Global Water's advanced integrated water management platform is uniquely positioned as a magnet for sustainable investment capital, which will lower the company's cost of capital and pave the way for high-ROI infrastructure investments, boosting long-term return on invested capital and supporting multiple expansion.

- The company's proactive approach to M&A and demonstrated operational integration expertise position it as a consolidator of choice in a fragmented water utility sector, which could yield a step-change in scale advantages, further supporting margin expansion and accelerating accretive earnings per share growth.

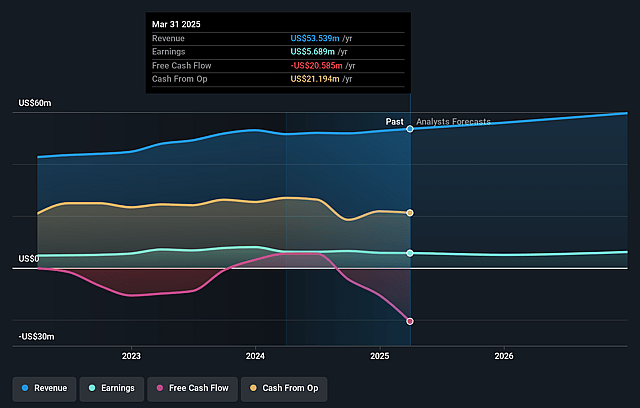

Global Water Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Global Water Resources compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Global Water Resources's revenue will grow by 7.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.3% today to 10.6% in 3 years time.

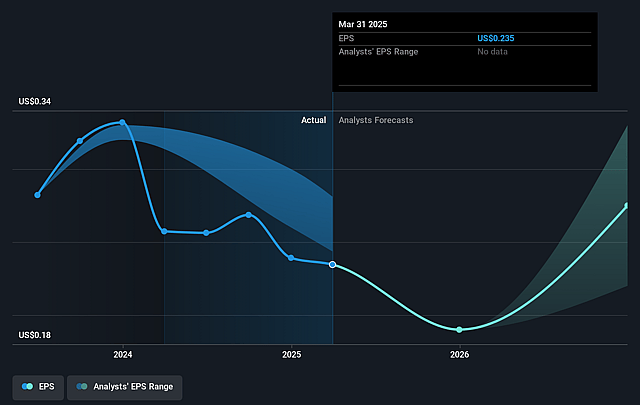

- The bullish analysts expect earnings to reach $7.1 million (and earnings per share of $0.43) by about September 2028, up from $5.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 102.1x on those 2028 earnings, up from 48.4x today. This future PE is greater than the current PE for the US Water Utilities industry at 22.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Global Water Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising interest rates and persistent macroeconomic uncertainty have already contributed to a slowdown in building permits and organic customer growth, which could lead to weaker water demand and ultimately stall revenue growth.

- Regulatory risk remains high, as the company's largest rate increase proposal and other rate cases are pending approval; delays or unfavorable rulings may prevent Global Water Resources from passing higher costs onto consumers, compressing net margins and earnings.

- High capital investment requirements for infrastructure maintenance and integration of recent acquisitions have driven up operating expenses by over eight percent, and if these costs outpace permitted rate increases, future profitability could be pressured.

- Continued geographic concentration in Arizona, particularly in fast-growing but drought-prone areas like Maricopa and Pinal County, exposes the company to regional risks such as population stagnation, adverse weather, or accelerating climate change, heightening revenue volatility.

- The need for ongoing infrastructure upgrades and competition from alternative water sources could raise capital and operating costs, while restricting Global Water Resources' ability to expand market share, thereby limiting both revenue and earnings potential over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Global Water Resources is $18.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Global Water Resources's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $13.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $66.5 million, earnings will come to $7.1 million, and it would be trading on a PE ratio of 102.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of $9.82, the bullish analyst price target of $18.0 is 45.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.