Key Takeaways

- Worsening competitive disadvantages and limited scale hinder network upgrades, leading to higher customer churn and ongoing declines in market share and earnings stability.

- Urban migration and intensifying rival offerings reduce the addressable rural market, forcing price competition that compresses revenue and further challenges sustainable growth.

- The T-Mobile transaction, cost discipline, and strategic asset management are expected to unlock shareholder value, boost margins, and support stable long-term growth.

Catalysts

About United States Cellular- Provides wireless telecommunications services in the United States.

- Accelerating capital intensity, combined with the rapid pace of technological obsolescence in wireless infrastructure, will continue to pressure free cash flow and increase leverage risk for the remaining tower and spectrum business as it struggles to keep up with larger, national network competitors, impairing long-term margins and earnings stability.

- Despite persistent growth in mobile data usage and connected devices, intensifying competition from cable, fiber, and satellite broadband providers in US Cellular’s core rural footprint will force increasingly aggressive pricing and higher promotional spending, further compressing ARPU and shrinking service revenue over time.

- Ongoing declines in rural populations and migration to urban areas are expected to erode the addressable market within US Cellular’s legacy service areas, contributing to a declining subscriber base and undermining the potential for sustainable topline growth.

- The company’s lack of scale, even post-transaction, will restrict the ability to reinvest in network upgrades and 5G densification, exacerbating chronic coverage and quality gaps that drive higher customer churn and limit the ability to attract premium postpaid subscribers, directly reducing future revenue and margin potential.

- Following industry consolidation, larger carriers are expected to further leverage their scale for network investment and pricing power, threatening US Cellular’s remaining market share and resulting in sustained pressure on both EBITDA and long-term earnings growth as competitive disadvantages deepen.

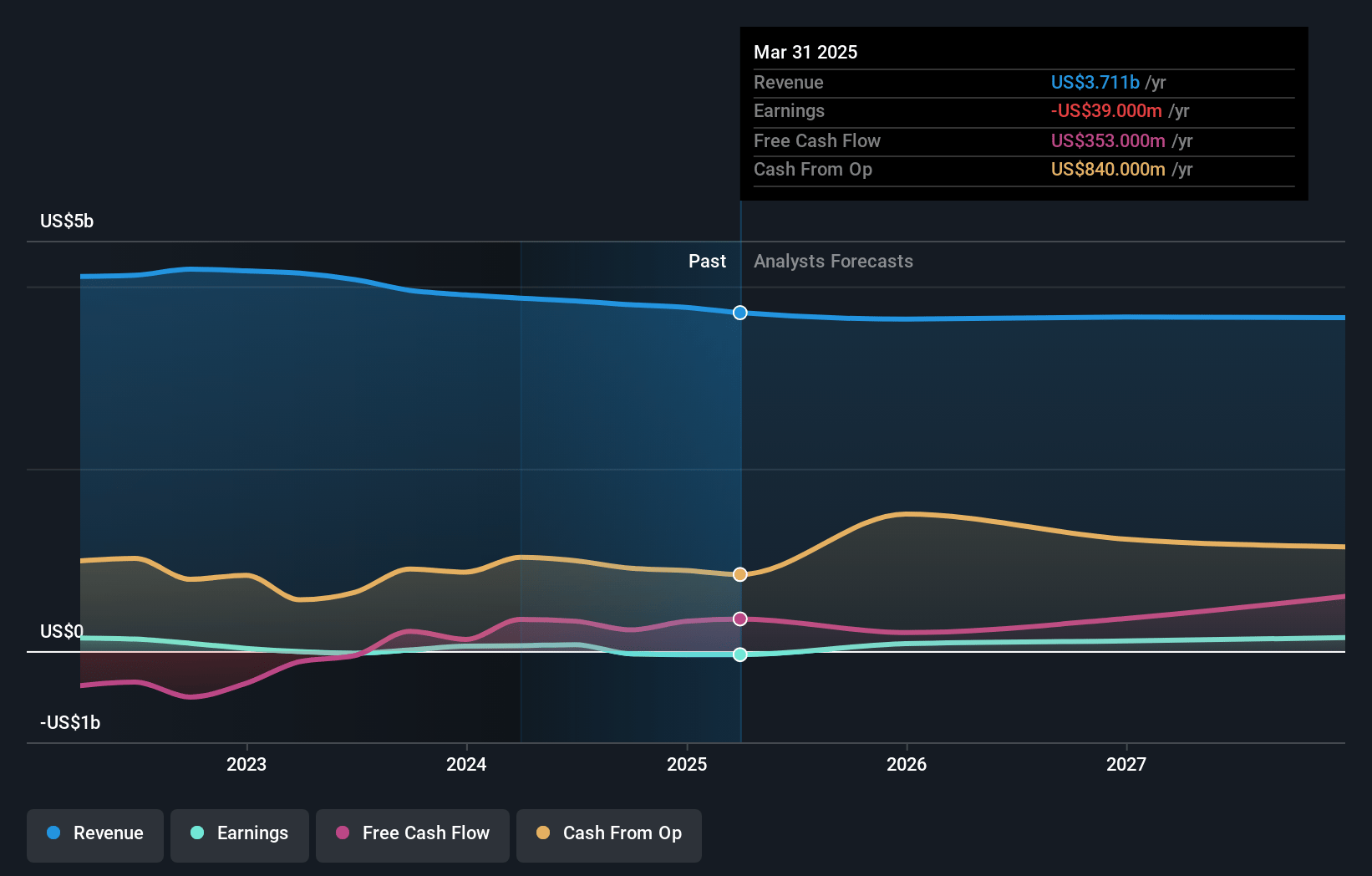

United States Cellular Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on United States Cellular compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming United States Cellular's revenue will decrease by 1.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -1.1% today to 2.1% in 3 years time.

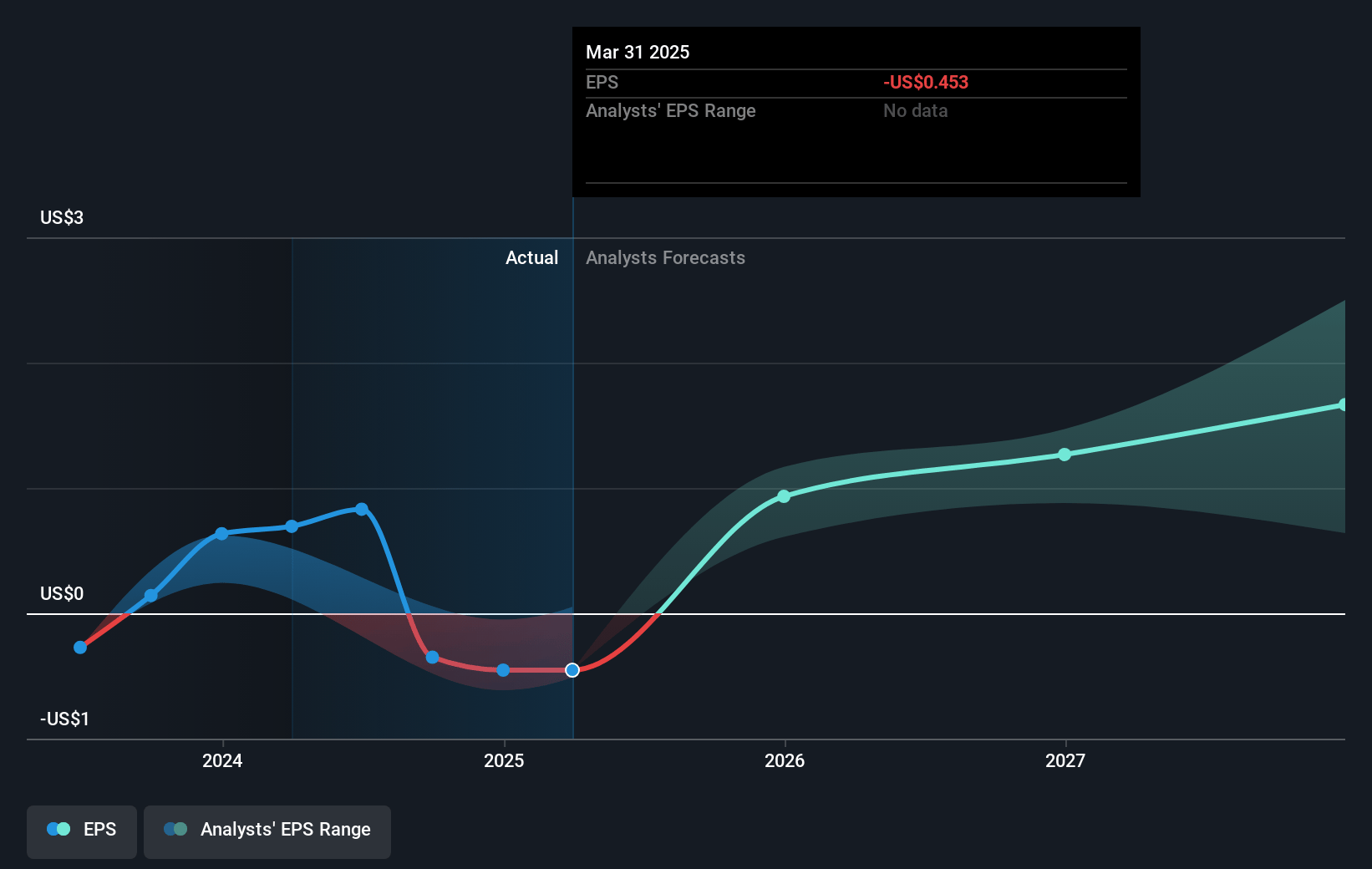

- The bearish analysts expect earnings to reach $75.9 million (and earnings per share of $0.84) by about July 2028, up from $-39.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 77.2x on those 2028 earnings, up from -153.8x today. This future PE is greater than the current PE for the US Wireless Telecom industry at 22.2x.

- Analysts expect the number of shares outstanding to decline by 1.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

United States Cellular Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The anticipated closing of the transaction with T-Mobile is expected to deliver substantial cash proceeds and enable UScellular to declare a special dividend to shareholders, potentially unlocking significant near-term and long-term shareholder value and improving overall returns.

- UScellular’s tower business recorded 6 percent year-over-year revenue growth, driven by new collocations and lease escalators, with additional opportunity expected from the new Master Lease Agreement (MLA) with T-Mobile, suggesting the potential for ongoing stable cash flows and higher margins from recurring tower revenue.

- Retained spectrum holdings, particularly in C-band, provide flexibility for future monetization—either through outright sale or lease—allowing UScellular to capitalize on growing demand for wireless capacity and thus potentially to realize additional asset value and earnings in the years ahead.

- Ongoing cost optimization and capital discipline, with year-over-year reductions in cash costs, declining capital expenditures due to the completed 5G build, and targeted cost savings programs, are increasing free cash flow and setting a foundation for healthier net margins post-transaction.

- Continued strong demand for wireless and broadband connectivity, especially in underserved and rural markets, combined with population/business growth in these areas, could support long-term revenue stability for UScellular and its remaining businesses.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for United States Cellular is $59.32, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of United States Cellular's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $59.32.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $75.9 million, and it would be trading on a PE ratio of 77.2x, assuming you use a discount rate of 6.4%.

- Given the current share price of $70.48, the bearish analyst price target of $59.32 is 18.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.