Last Update07 May 25Fair value Increased 1.59%

Key Takeaways

- Expanding rural connectivity, 5G rollout, and monetizeable spectrum assets set the stage for new revenue streams and improved service offerings.

- Strategic shift to tower operations, cost optimization, and asset divestitures drive efficiency, recurring cash flows, and margin improvement.

- Persistent customer losses, intense competition, heavy investment needs, and shrinking rural markets threaten long-term revenue, profitability, and growth prospects.

Catalysts

About United States Cellular- Provides wireless telecommunications services in the United States.

- United States Cellular’s established rural network and expanding fiber footprint position the company to capitalize on increasing connectivity demand in underserved regions, bolstered by accelerating government funding and infrastructure programs—this is likely to drive new customer growth and higher service revenues.

- The completion of 5G network coverage in rural and expansion areas unlocks opportunities to offer higher-margin, premium data plans and advanced IoT solutions for smart cities and connected vehicles, which can boost both average revenue per user and overall revenue growth.

- Monetization of spectrum assets, particularly valuable C-band and other retained spectrum holdings, offers a unique opportunity to unlock substantial one-time and potentially recurring income, which can be deployed to strengthen the balance sheet and drive net earnings growth.

- After the T-Mobile transaction closes, U.S. Cellular will pivot to focus primarily on its rapidly growing tower business, which is already showing strong third-party demand and revenue growth; continued industry densification and expanding wireless data demand will further enhance tower operating margins and recurring cash flows.

- Company-wide cost optimization initiatives, digital transformation of operations, and divestiture of non-core assets are expected to meaningfully improve operational efficiency and net margins over the coming years, setting the stage for sustained returns and potential return of capital to shareholders.

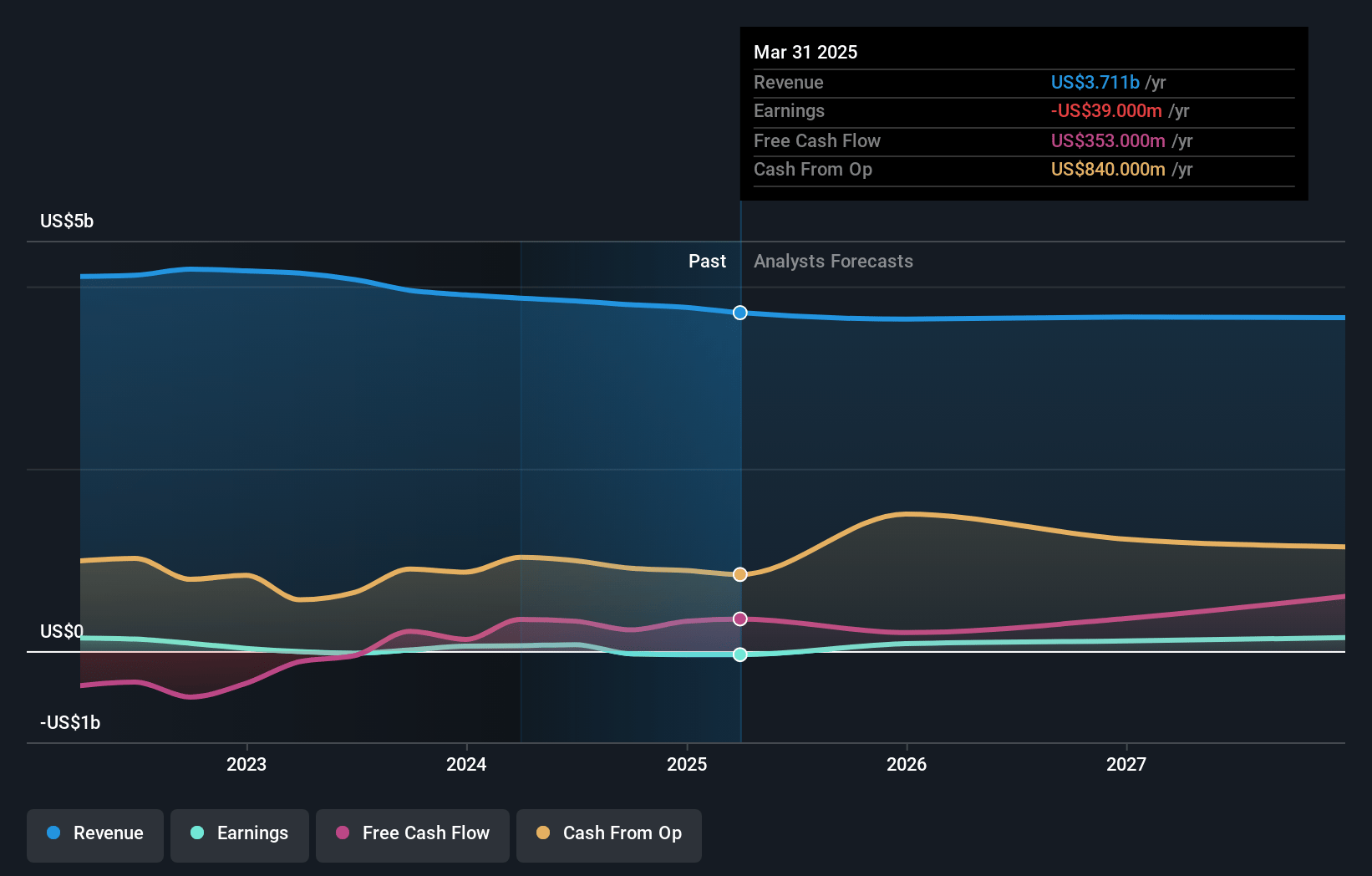

United States Cellular Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on United States Cellular compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming United States Cellular's revenue will decrease by 0.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -1.1% today to 5.9% in 3 years time.

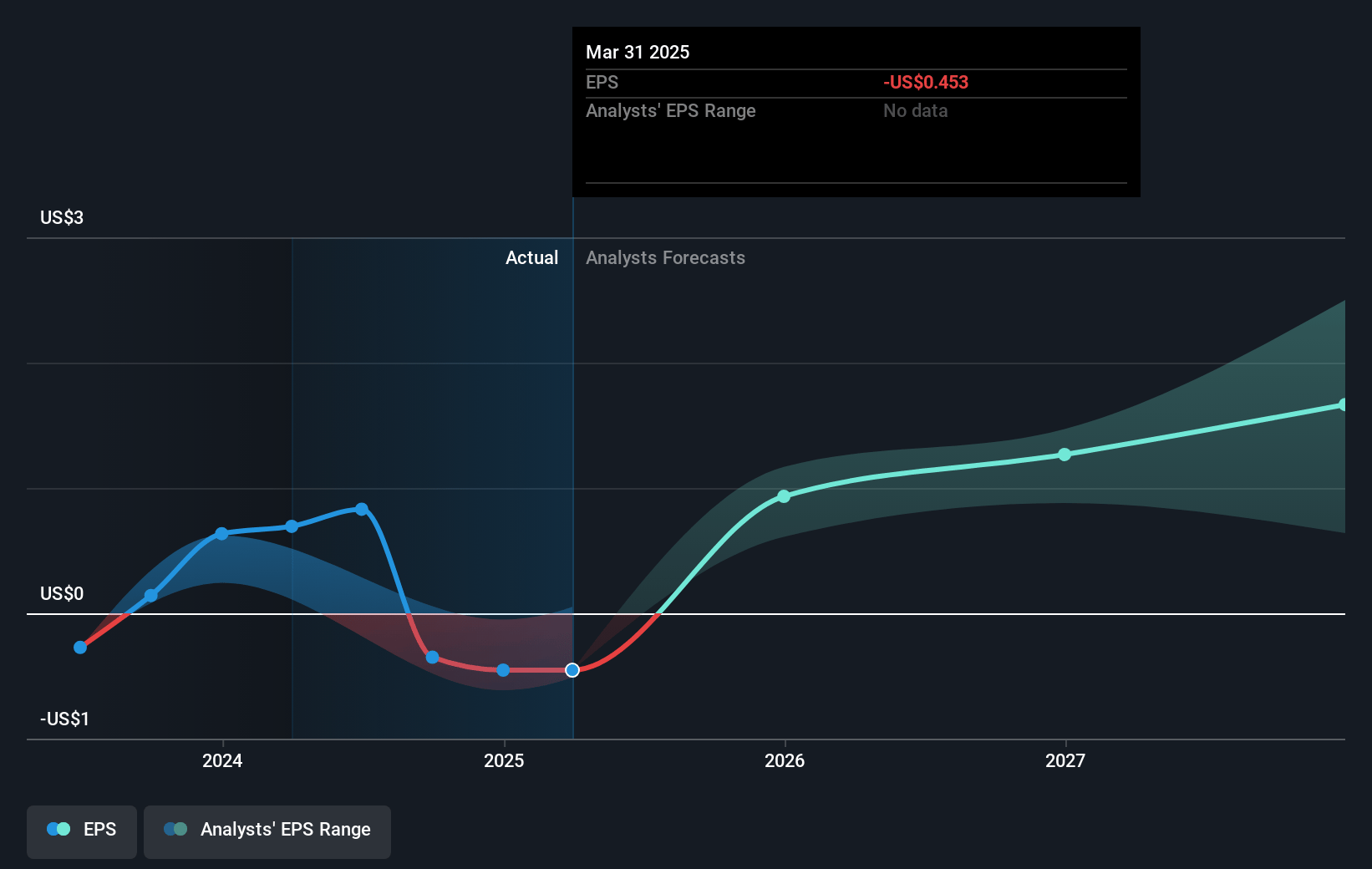

- The bullish analysts expect earnings to reach $220.3 million (and earnings per share of $2.5) by about May 2028, up from $-39.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 41.0x on those 2028 earnings, up from -137.7x today. This future PE is greater than the current PE for the US Wireless Telecom industry at 15.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

United States Cellular Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- UScellular continues to experience persistent subscriber losses and negative net handset additions despite increased promotional activity, indicating ongoing pressure on service revenues that may further depress long-term earnings.

- The company acknowledges that its smaller scale and regional focus make it difficult to compete with national carriers' aggressive pricing, contract buyouts, and bundled offers, which is likely to result in continued revenue compression and shrinking market share.

- High and recurring capital requirements for network upgrades, especially as the industry moves to 5G mid-band deployment and eventually 6G, place sustained pressure on margins and risk reductions to free cash flow and net income as larger operators leap ahead in technology investments.

- The continued demographic decline in rural areas, coupled with urbanization trends, leaves UScellular's primary customer base vulnerable to long-term erosion, which is expected to negatively impact future revenues and limit the company’s growth prospects.

- Industry consolidation and the proliferation of MVNOs and alternative connectivity solutions further fragment UScellular's addressable market, intensifying retention challenges and adding to the risk of declining revenues and deteriorating profitability over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for United States Cellular is $88.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of United States Cellular's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $88.0, and the most bearish reporting a price target of just $59.32.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.7 billion, earnings will come to $220.3 million, and it would be trading on a PE ratio of 41.0x, assuming you use a discount rate of 6.5%.

- Given the current share price of $63.09, the bullish analyst price target of $88.0 is 28.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.