Narratives are currently in beta

Key Takeaways

- T-Mobile's digitalization and strategic initiatives are expected to enhance customer experience, reduce operational costs, and potentially boost margins and profitability.

- Expansion in broadband and industry-leading revenue growth underscore strong market positioning, with investments in 5G supporting continued top-line growth.

- Hurricanes, market competition, regulatory challenges, and economic uncertainty could strain T-Mobile's operational costs, net margins, subscriber growth, and financial strategies.

Catalysts

About T-Mobile US- Provides mobile communications services in the United States, Puerto Rico, and the United States Virgin Islands.

- T-Mobile's digitalization efforts, such as the increase in digital preorders of iPhones and other digital sales initiatives, are expected to enhance customer buying experience and reduce operational costs, thereby potentially boosting margins and profitability.

- The expansion in broadband, with T-Mobile reaching 6 million customers and aiming for 12 million by 2028, underscores potential revenue growth from increasing market penetration in the high-speed internet sector, leveraging their leading 5G network.

- Industry-leading service revenue growth, driven by postpaid service revenue growth and the highest average revenue per account (ARPA) growth in 7 years, suggest a strong revenue outlook that may continue to outpace competitors.

- Capital investments in expanding and enhancing 5G technology, such as spectrum acquisitions and proprietary technologies, are expected to sustain T-Mobile's network advantages, supporting both top-line growth and operational efficiency.

- Strategic initiatives like customer-driven coverage and machine learning-driven network expansions could enhance network utilization and efficiency, potentially lowering costs and supporting net margin expansion.

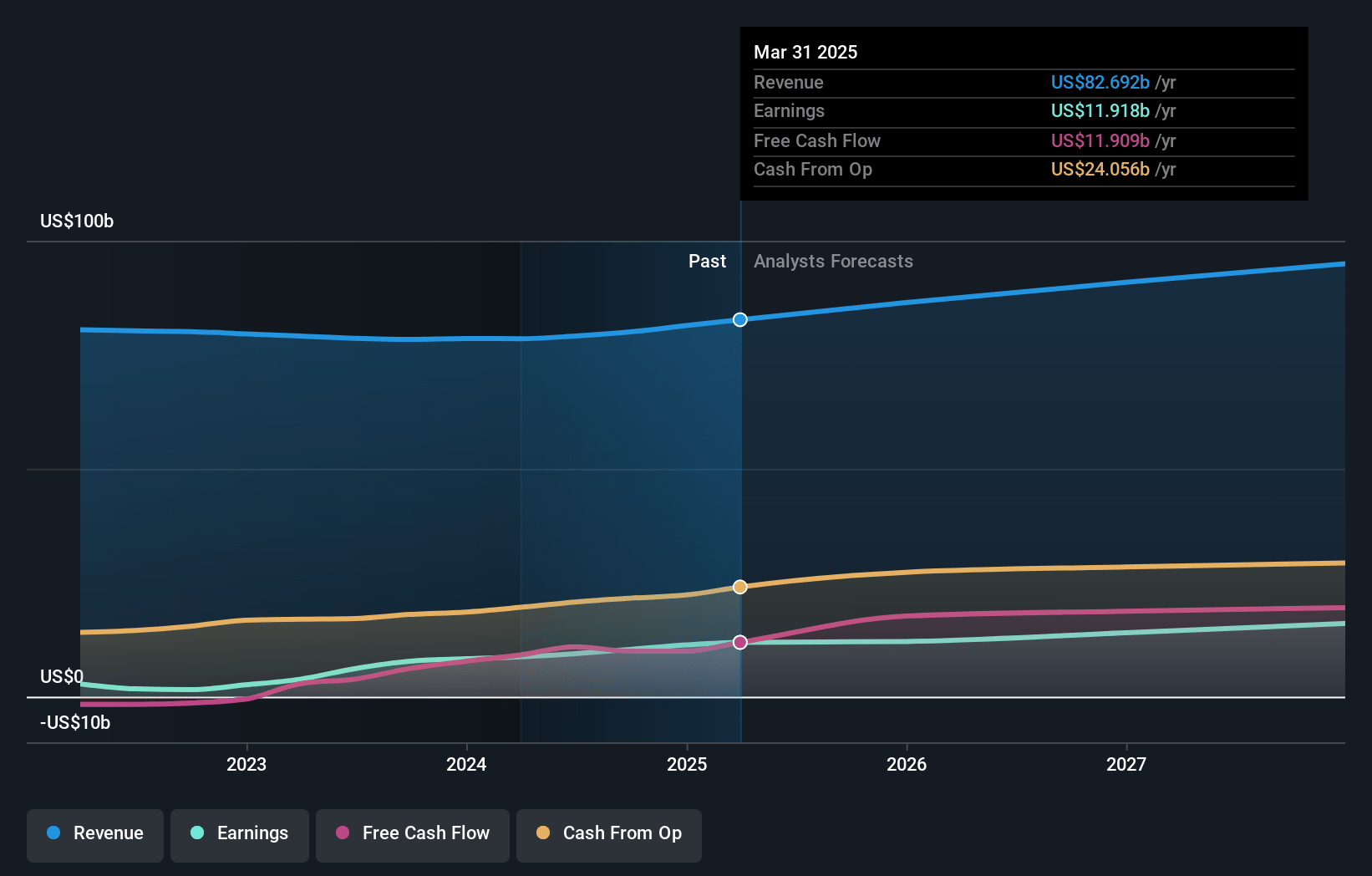

T-Mobile US Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming T-Mobile US's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.0% today to 16.1% in 3 years time.

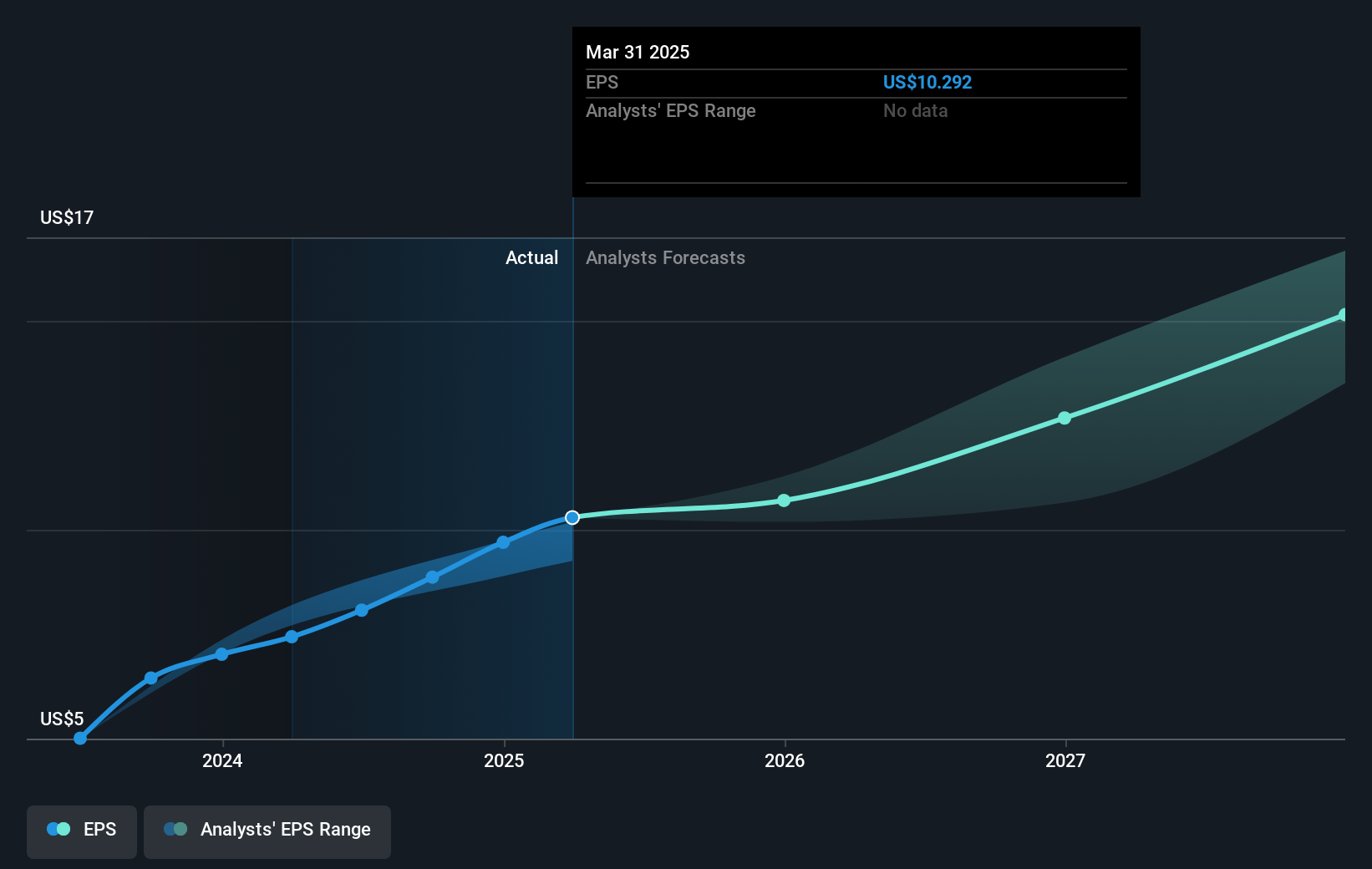

- Analysts expect earnings to reach $14.8 billion (and earnings per share of $14.26) by about January 2028, up from $10.4 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $12.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.3x on those 2028 earnings, down from 23.8x today. This future PE is greater than the current PE for the US Wireless Telecom industry at 14.5x.

- Analysts expect the number of shares outstanding to decline by 3.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

T-Mobile US Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The impacts of hurricanes Helene and Milton could strain operational expenses and affect infrastructure, resulting in potential increases in maintenance costs and disruptions in service, affecting net margins and earnings.

- The slower buyback pace and the interdependencies with share price movements indicate that financial strategies to return value to shareholders could be impacted by share pricing volatility, affecting capital distribution outcomes and possibly revenue growth perceptions.

- Challenges in the U.S. Federal Communications Commission (FCC) regarding spectrum usage, such as opposition to PCS spectrum use for direct-to-device services, could delay spectrum deployment and lead to increased costs or operational inefficiencies, impacting net margins and long-term earnings.

- Competitive pressures and aggressive promotional activities necessary to maintain subscriber growth, especially in underpenetrated areas and rural markets, could strain net margins as higher acquisition costs and promotional discounts become necessary.

- Economic uncertainty or potential downturns could lead to a slower gross add environment, impacting T-Mobile’s ability to sustain the current customer growth rate and thereby affecting service revenue growth over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $243.72 for T-Mobile US based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $280.0, and the most bearish reporting a price target of just $184.95.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $92.2 billion, earnings will come to $14.8 billion, and it would be trading on a PE ratio of 20.3x, assuming you use a discount rate of 5.9%.

- Given the current share price of $212.33, the analyst's price target of $243.72 is 12.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

WallStreetWontons

Community Contributor

TMUS: Fairly Priced with Growing Margins Among its Peers, Verizon and AT&T

Catalysts Products or Services Impacting Sales or Earnings T-Mobile (TMUS) has several key products and services that could significantly impact its sales and earnings: 5G Network Expansion : T-Mobile’s aggressive rollout of its 5G network is a major growth driver. The company has been leading in 5G coverage and performance, which attracts more customers and increases service revenues.

View narrativeUS$201.69

FV

8.6% overvalued intrinsic discount4.30%

Revenue growth p.a.

4users have liked this narrative

0users have commented on this narrative

3users have followed this narrative

3 months ago author updated this narrative