Last Update 23 Apr 25

Fair value Increased 6.75%Key Takeaways

- Exposure to shifting trade policies, concentrated customer risk, and foreign competition threatens Corning's revenue growth, pricing power, and stability across key product segments.

- Technological shifts and policy-driven end-markets create uncertainties for recent manufacturing investments, endangering capital recovery, profitability, and long-term earnings momentum.

- Diversified growth across high-demand technology segments, operational efficiency, and ongoing innovation strengthen Corning's market position, stability, and long-term profitability.

Catalysts

About Corning- Operates in optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses.

- Corning's major growth initiatives are heavily exposed to ongoing trade policy shifts and rising geopolitical tensions, as highlighted by supply chain disruptions, tariff uncertainties, and the company's dependence on U.S.-centric incentives for solar and manufacturing; if these economic or policy environments turn unfavorable-such as a reduction in domestic manufacturing credits or the imposition of retaliatory tariffs-future revenue growth and margins in key segments could face significant downside.

- The company's plans for rapid expansion in data center and AI-adjacent optical communications are vulnerable to the secular risk of technological displacement, where alternative materials such as advanced plastics and sapphire glass could erode demand for Corning's legacy glass and fiber products; this undermines long-term revenue streams and capital recovery on recent high-cost manufacturing upgrades.

- Persistent high customer concentration, particularly in display and specialty glass, leaves Corning highly susceptible to abrupt volume and pricing declines if major clients like Apple or Samsung diversify suppliers or accelerate in-sourcing, with the potential for a sharp drop in top-line revenue and increased sales volatility across product cycles.

- Corning's aggressive investment and expansion in solar and semiconductor capacity requires long payback periods and relies on continued advancement of policy-driven demand; any delay in customer uptake, legislative reversal of support, or overestimation of end-market growth could result in prolonged negative free cash flow and muted earnings growth, especially given the acknowledged start-up and ramp costs pressuring margins well into 2026.

- Intensifying global competition from lower-cost Asian glass and materials producers is likely to compress pricing power and threaten Corning's global market share, especially as advanced electronics undergo further miniaturization; this ongoing trend could reduce absolute volume and utilization rates, directly pressuring profitability and undercutting positive operational leverage from past investments.

Corning Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Corning compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Corning's revenue will grow by 11.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.8% today to 13.0% in 3 years time.

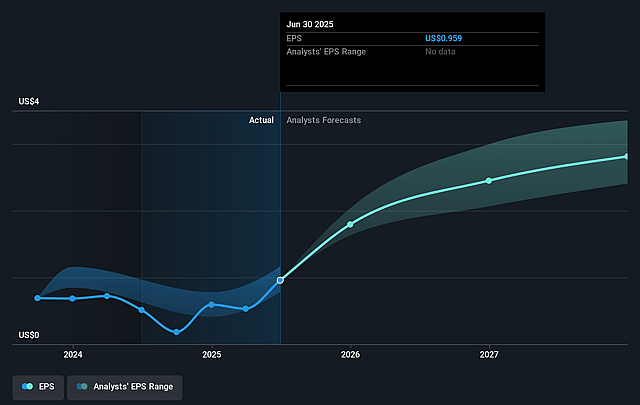

- The bearish analysts expect earnings to reach $2.6 billion (and earnings per share of $2.77) by about September 2028, up from $819.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.4x on those 2028 earnings, down from 78.4x today. This future PE is lower than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.53%, as per the Simply Wall St company report.

Corning Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating adoption of AI, 5G, and data center technologies is driving demand for Corning's optical communications products, and the company is experiencing record sales and rapid growth in this segment, supporting both revenue and margin expansion over the long term.

- Corning's expansion into the U.S.-based solar market, underpinned by confirmed long-term customer commitments and ongoing government incentives for domestic manufacturing, is projected to add over 1.6 billion dollars in annualized revenue and triple sales run rate by 2027, boosting top-line growth and earnings resiliency.

- Persistent innovation in high-margin segments such as Gorilla Glass and next-generation premium glass for consumer electronics, coupled with ongoing adoption by major OEMs, strengthens Corning's market position and supports net margins and operating profitability.

- The company's Springboard plan is successfully driving operating margin expansion, strong EPS growth, and higher free cash flow, reflecting improving operational efficiency and enhancing shareholder value through ongoing buybacks and dividends.

- Corning's diversified exposure to high-growth verticals-including automotive glass, life sciences, and advanced semiconductor materials-reduces dependency on any one segment, stabilizes revenue streams, and supports robust earnings across economic cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Corning is $50.34, which represents two standard deviations below the consensus price target of $69.83. This valuation is based on what can be assumed as the expectations of Corning's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $84.0, and the most bearish reporting a price target of just $47.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $19.8 billion, earnings will come to $2.6 billion, and it would be trading on a PE ratio of 21.4x, assuming you use a discount rate of 8.5%.

- Given the current share price of $74.93, the bearish analyst price target of $50.34 is 48.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.