Last Update 23 Apr 25

Fair value Increased 37%Key Takeaways

- Rapid growth in optical, automotive, and solar segments, propelled by innovation and market shifts, positions Corning for substantial margin and revenue expansion above consensus.

- Advanced glass technologies in consumer electronics, AR/VR, and displays drive premium pricing and sustained volume growth, strengthening Corning's competitive advantage and operating leverage.

- Ongoing trade tensions, customer concentration, slow innovation monetization, regulatory pressures, and rising material competition threaten Corning's growth, margins, and long-term market position.

Catalysts

About Corning- Operates in optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses.

- Analyst consensus sees Gen AI data center optical demand as a key driver, but this significantly understates Corning's upside, as a rapid shift from copper to fiber for scale-up AI node architectures could expand Corning's enterprise optical sales by two to three times their current level, driving both revenue and gross margin growth well above current expectations.

- Consensus expects continued optical margin improvement toward 20% by 2026, but Corning's capacity, tightness on new products, and proven pricing power with advanced optical innovations suggest margin expansion could exceed 20%, compounding the impact on net income as high-value products reach full utilization and benefit from further scale.

- The accelerating electrification and data connectivity of vehicles-spanning autonomous driving and EV platforms-creates an inflection for Corning's specialty glass, ceramics, and sensor products, positioning automotive sales to triple and establish a higher-margin, diversified revenue base by late decade.

- Corning's expanded end-to-end leadership in solar, from polysilicon to U.S.-made modules, combined with strong customer commitments and supportive domestic manufacturing policies, sets the stage for solar segment revenues to potentially surpass $2.5 billion before 2028 and enhance free cash flow well beyond current targets.

- Ongoing breakthroughs in next-gen glass for consumer electronics, AR/VR, and advanced display applications are positioning Corning to secure premium pricing and consistent volume increases, supporting both top line growth and operating leverage as new technologies like foldables and wearables achieve mainstream adoption.

Corning Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Corning compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Corning's revenue will grow by 16.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.8% today to 15.8% in 3 years time.

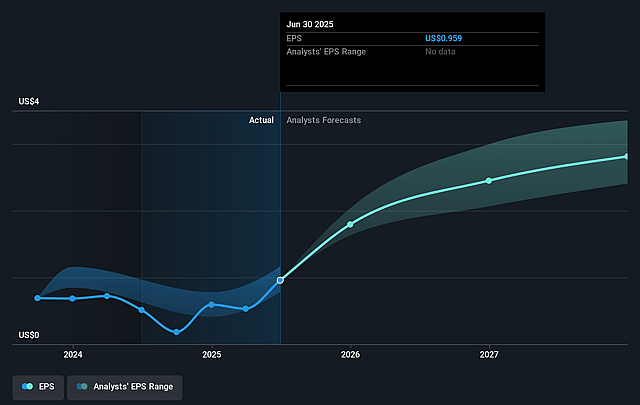

- The bullish analysts expect earnings to reach $3.5 billion (and earnings per share of $4.21) by about September 2028, up from $819.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 26.2x on those 2028 earnings, down from 75.7x today. This future PE is greater than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.53%, as per the Simply Wall St company report.

Corning Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Corning faces structural risks from accelerating deglobalization and rising protectionist trade policies, as evidenced by tariff-related pull-forward activity and ongoing management commentary, which threatens to inflate supply chain costs, disrupt cross-border sales, and ultimately weigh on revenue growth and net margin long term.

- Continued heavy reliance on major customers like Apple and Samsung, with customer concentration risks apparent in the Specialty Materials and Display segments, exposes Corning to demand volatility and significant pricing pressure, potentially resulting in unpredictable swings in earnings and net margin if customer contracts or market share shift.

- The company's ability to monetize new innovations outside its core glass and ceramics lines remains unproven, as signaled by delayed adoption of foldable tech, incremental rather than transformative advances in new markets, and ongoing ramp costs in solar and semiconductor ventures; this trend raises the risk that R&D spending will outpace revenue growth, constraining long-term profitability.

- Growing regulation related to ESG and environmental compliance, particularly for energy-intensive manufacturing and chemical processes inherent in Corning's operations, is likely to impose higher costs and operational limitations, putting sustained pressure on net margins and potentially curtailing expansion opportunities, especially in mature markets.

- The specialty glass and advanced materials space continues to face rising commoditization and substitution threats from new technologies and alternative materials such as flexible OLEDs, plastics, and synthetic sapphire, which may erode Corning's competitive moat in display and electronic markets and could accelerate pricing pressure, leading to long-term margin compression and slower revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Corning is $84.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Corning's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $84.0, and the most bearish reporting a price target of just $47.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $22.2 billion, earnings will come to $3.5 billion, and it would be trading on a PE ratio of 26.2x, assuming you use a discount rate of 8.5%.

- Given the current share price of $72.39, the bullish analyst price target of $84.0 is 13.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.