Narratives are currently in beta

Key Takeaways

- Growth in AI infrastructure and advanced networking solutions is expected to drive significant revenue increases through market penetration and product diversification.

- Strategic supply chain improvements and R&D investments are poised to strengthen Arista's competitive position and improve net margins.

- Increasing competition and manufacturing challenges, coupled with financial unpredictability and sector-specific reliance, could pressure Arista's margins and market position.

Catalysts

About Arista Networks- Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

- Arista Networks anticipates significant growth in AI networking, with expectations for large-scale deployments connecting thousands of GPUs, which could drive revenue growth through increased demand for AI infrastructure and services.

- The introduction of Arista's new Etherlink portfolio, capable of supporting high-throughput and non-blocking performance for AI workloads, is poised to capitalize on the increasing need for advanced networking solutions, potentially boosting earnings.

- Arista's expansion of its total addressable market (TAM) to $70 billion by 2028, driven by AI and campus networking initiatives, highlights opportunities for substantial revenue increases through market penetration and product diversification.

- With supply chain improvements and strategic component purchases, Arista aims to support rapid AI network deployments and reduce lead times, which could help stabilize or improve net margins by streamlining operations.

- Arista's commitment to R&D and its innovative AI networking solutions are expected to strengthen its competitive position and drive long-term revenue growth, supporting sustainable increases in earnings over the forecast period.

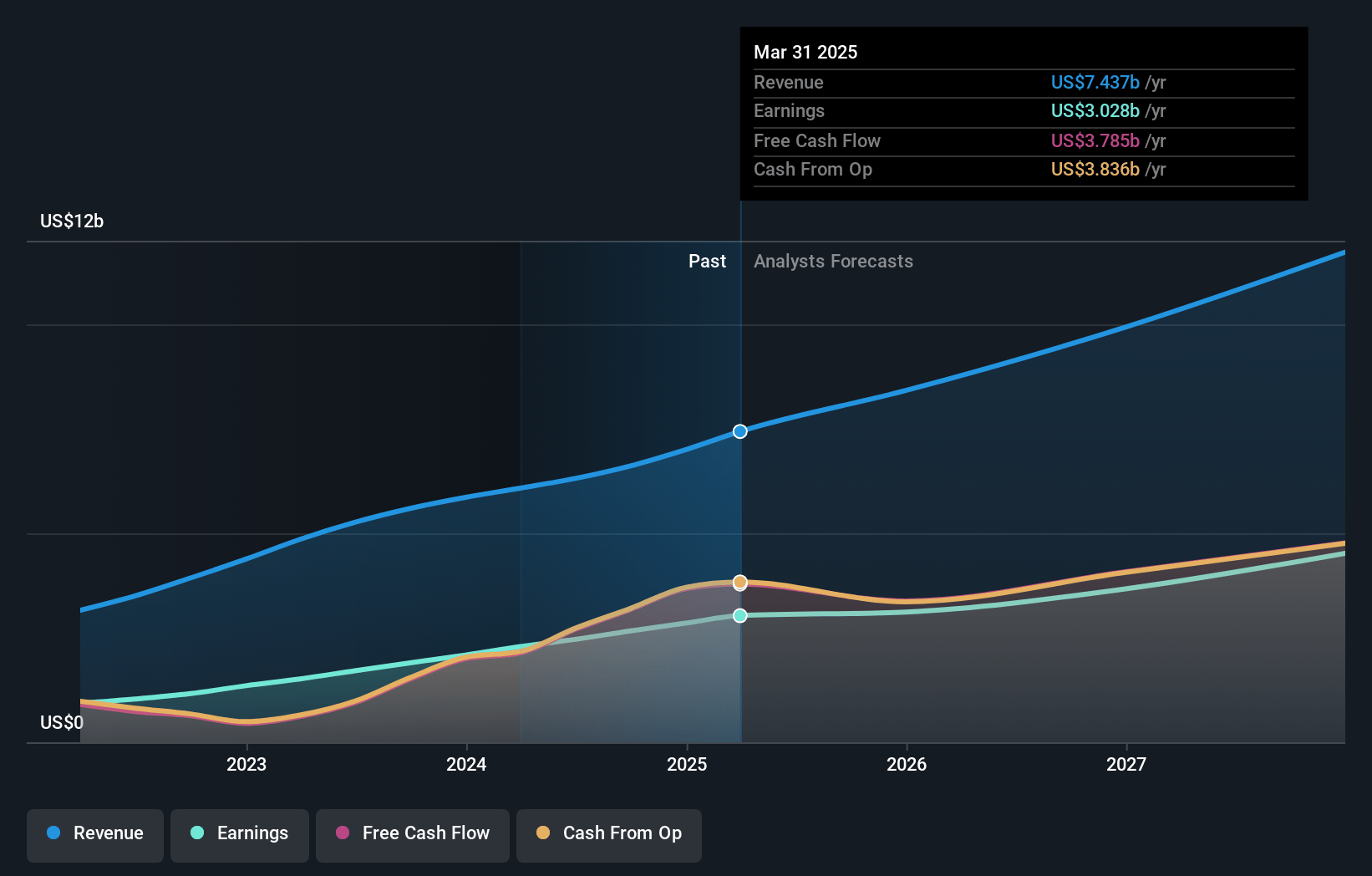

Arista Networks Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Arista Networks's revenue will grow by 23.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 40.3% today to 32.3% in 3 years time.

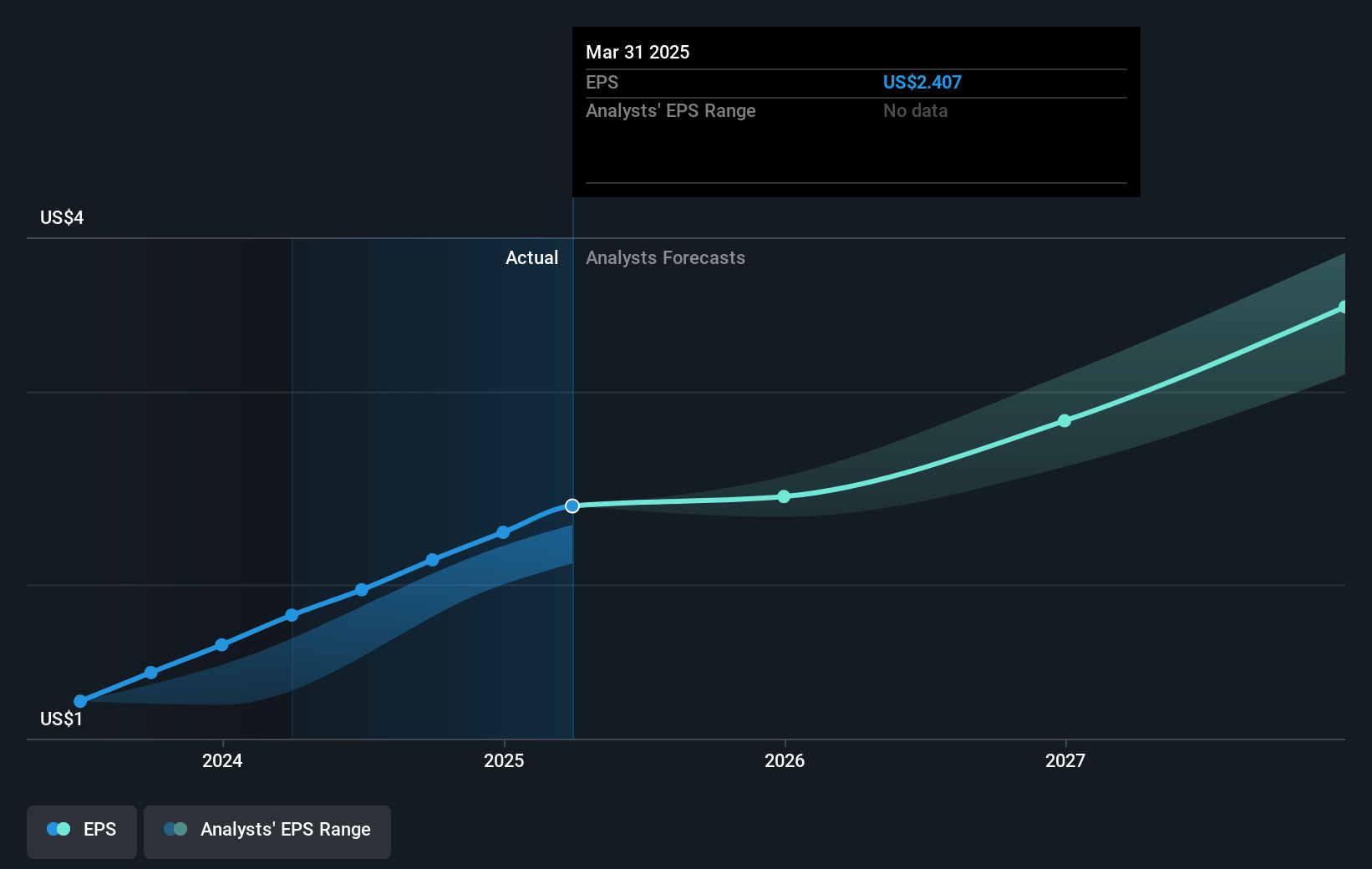

- Analysts expect earnings to reach $4.0 billion (and earnings per share of $3.13) by about January 2028, up from $2.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 43.3x on those 2028 earnings, down from 50.4x today. This future PE is greater than the current PE for the US Communications industry at 25.2x.

- Analysts expect the number of shares outstanding to grow by 0.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.46%, as per the Simply Wall St company report.

Arista Networks Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There are concerns about extended lead times for advanced semiconductors, which could impact manufacturing output and delay customer deliveries, affecting revenue recognition and growth.

- The variability in revenue linked to customer-specific acceptance clauses and product deferred revenue balances may lead to financial unpredictability, potentially impacting revenue and earnings projections.

- The heavily weighted revenue mix toward cloud and AI customers could pressure gross margins, which are projected to decline to 60%-62% in FY 2025, impacting net margins and overall profitability.

- Increasing competition from companies like NVIDIA, with substantial market share gains in data center switching, could challenge Arista's market position, potentially impacting future revenue and market share growth.

- There's a risk of underperformance or slower growth in non-AI and non-campus business sectors, which could lead to slower overall company revenue growth despite strong AI and campus projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $112.5 for Arista Networks based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $75.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $12.3 billion, earnings will come to $4.0 billion, and it would be trading on a PE ratio of 43.3x, assuming you use a discount rate of 6.5%.

- Given the current share price of $106.54, the analyst's price target of $112.5 is 5.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

TO

Tokyo

Community Contributor

The "Porsche" of Internet Switches

My main narrative for ANET: Young company (founded 2004, IPO 2014), disrupting CISCO in the High Speed Switch Market (for Datacenter, Cloud and AI) Very successful introduction of Fast Internet Switches for Brokerage (High Speed Trading) Internet Speed will continuously increase to meet “tactile internet” capabilities (control robots or vehicles over distance (through internet) with nearly no delay) Perfect fit of Arista HW and Arista SW, as known from Apple devices, leads to high customer satisfaction and customer binding I focus also on: More equity than debt. Ratio is at 0%.

View narrativeUS$127.06

FV

10.4% undervalued intrinsic discount15.00%

Revenue growth p.a.

7users have liked this narrative

0users have commented on this narrative

30users have followed this narrative

about 2 months ago author updated this narrative