Key Takeaways

- Dependence on a concentrated customer base and evolving supply chain risks could increase revenue volatility and compress profitability over time.

- Rising adoption of commoditized, cost-effective alternatives threatens Arista's pricing power and long-term competitive differentiation in the networking market.

- Arista’s differentiated technology, expanding market reach, and diversified customer base position it as a leading beneficiary of AI-driven networking trends and sustained industry growth.

Catalysts

About Arista Networks- Engages in the development, marketing, and sale of data-driven, client to cloud networking solutions for AI, data center, campus, and routing environments in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

- Increasing geopolitical tensions and evolving tariff regimes present a persistent and unpredictable risk to Arista’s supply chain and manufacturing footprint, with new or higher tariffs threatening to drive up component costs, increase working capital requirements, and drag down gross and net margins in the medium to long term, especially as supply chain alternatives become more expensive or harder to optimize.

- The ongoing reliance on a handful of hyperscale cloud and AI customers leaves Arista acutely vulnerable to sudden shifts in cloud spending, customer consolidation, or insourcing of networking solutions; any reduction or delay in hyperscaler capital expenditures for next-generation data center and AI infrastructure is likely to sharply curtail revenue growth and amplify top-line volatility.

- Intensifying adoption of white-box, open-source, and internally-developed networking hardware and software by hyperscalers and cloud titans undermines Arista's differentiated hardware-software model, threatening long-term pricing power and structural gross margin as high-functionality, lower-cost alternatives become more viable at scale.

- Potential industry-wide commoditization of high-performance switching and routing—driven by increased standardization, cost-driven architectures, and the gradual decoupling of hardware-software stacks—could rapidly erode both ASPs and the need for premium solutions, applying sustained pressure to net margins and overall profitability for established players such as Arista.

- Emerging environmental and regulatory headwinds around large-scale AI data centers—such as energy usage scrutiny, new sustainability mandates, or outright restrictions on further expansion—could spur customers to curtail or delay infrastructure investments, suppressing both Arista’s addressable market and the durability of its long-term revenue trajectory.

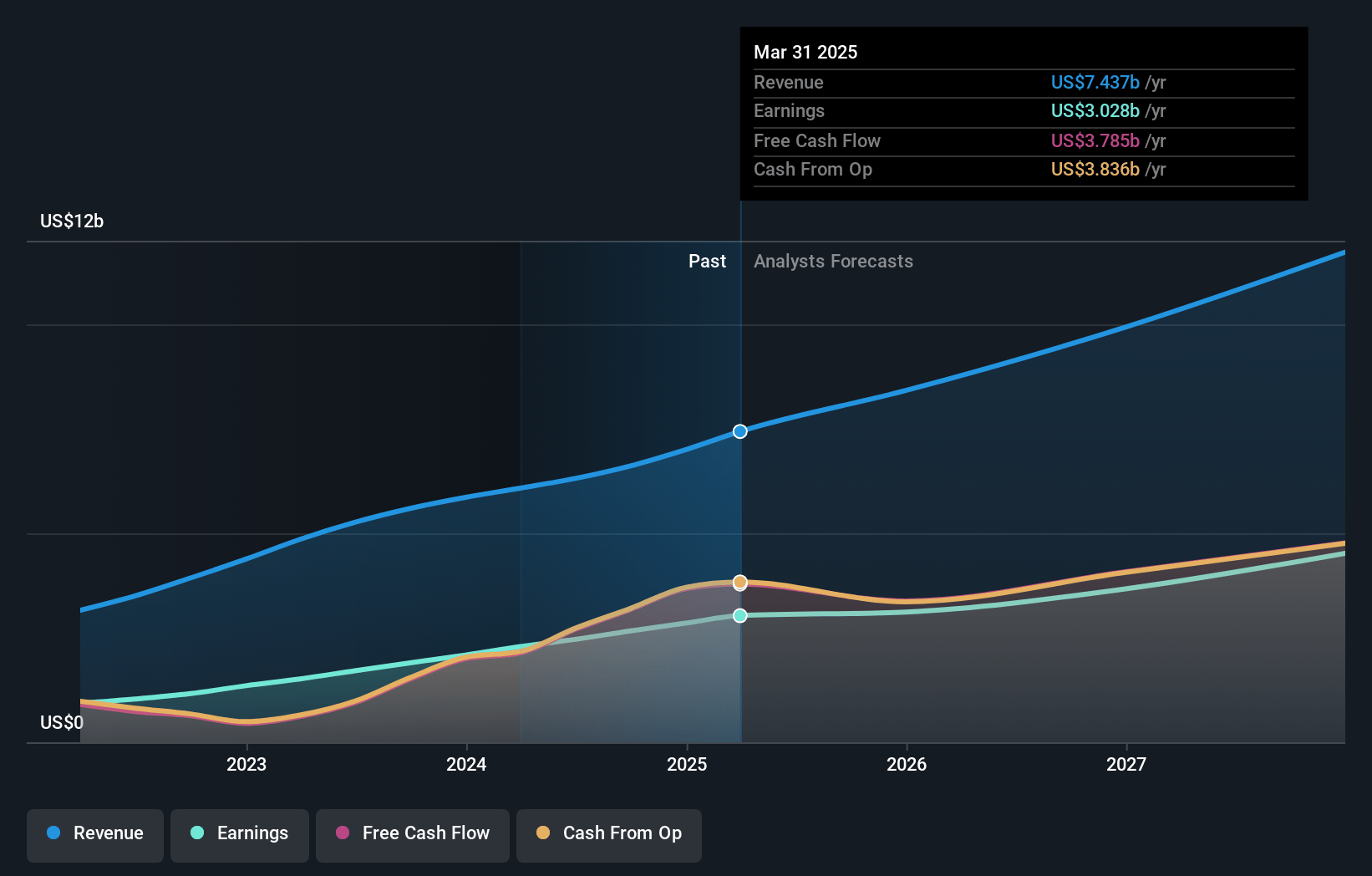

Arista Networks Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Arista Networks compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Arista Networks's revenue will grow by 14.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 40.7% today to 37.8% in 3 years time.

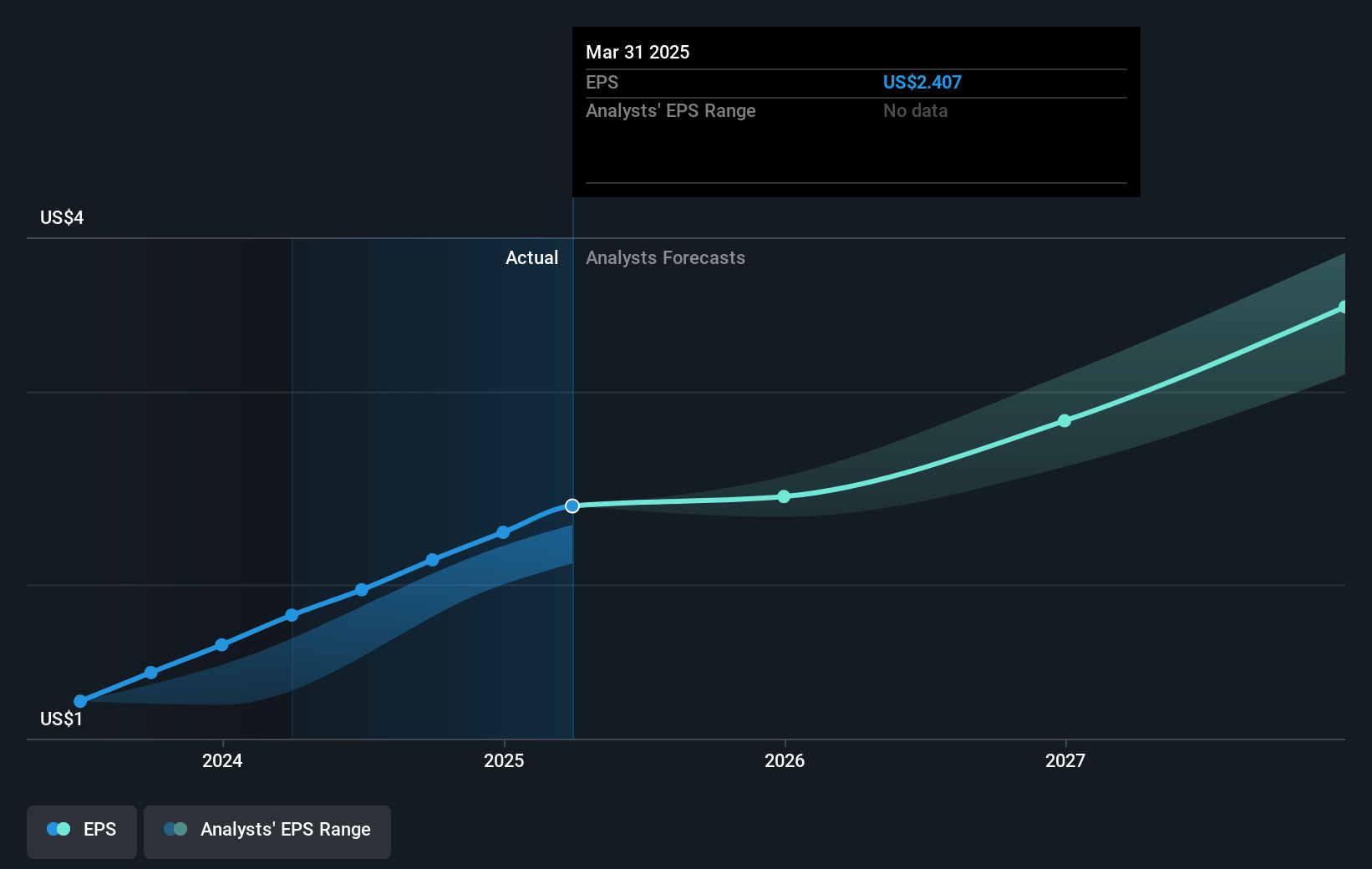

- The bearish analysts expect earnings to reach $4.2 billion (and earnings per share of $3.29) by about July 2028, up from $3.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 30.1x on those 2028 earnings, down from 46.9x today. This future PE is greater than the current PE for the US Communications industry at 28.4x.

- Analysts expect the number of shares outstanding to decline by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.33%, as per the Simply Wall St company report.

Arista Networks Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The strong secular trend of AI and cloud growth is directly benefiting Arista, as seen by their increasing customer wins and their confidence in achieving a $750 million AI back-end target in 2025 and robust deferred revenue tied to leading-edge products, which supports top-line revenue growth.

- Arista is experiencing accelerated adoption of next-generation 800-gig silicon and Ethernet switching, particularly in AI clusters, with hyperscalers and new web 3.0 and decentralized infrastructure customers opting for Arista’s solutions, which expands their addressable market and supports long-term revenue.

- The company is displaying momentum across core hyperscale, enterprise, and federal sectors, with particular strength in cloud titan and non-cloud verticals, indicating revenue diversification and reduced earnings volatility driven by expanded customer base.

- Arista’s proprietary software (EOS) and hardware integration, combined with consistent investment in R&D and leadership bench strength, continues to differentiate the company from white-box competitors, supporting pricing power and sustaining industry-leading gross margins.

- The transition from InfiniBand to Ethernet in AI workloads, as well as the rise of edge computing and distributed cloud architectures, plays directly into Arista’s portfolio strengths, positioning the company as a preferred vendor for mission-critical, high-performance, and scalable networking, supporting long-term profitability and revenue visibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Arista Networks is $82.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Arista Networks's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $82.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $11.2 billion, earnings will come to $4.2 billion, and it would be trading on a PE ratio of 30.1x, assuming you use a discount rate of 7.3%.

- Given the current share price of $113.04, the bearish analyst price target of $82.0 is 37.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.