Catalysts

About Sono-Tek

Sono-Tek designs and manufactures ultrasonic thin film coating systems used in electronics, medical devices, industrial applications and clean energy.

What are the underlying business or industry changes driving this perspective?

- Rising demand for precision coatings in medical devices, including balloon catheters and stents across the U.S., Europe and China, positions Sono-Tek to sell more high priced production systems. This can support higher revenue and an improved gross margin mix over time.

- Growing use of advanced coatings in clean energy applications such as next generation solar, fuel cells, green hydrogen and carbon capture, backed by commercial customers like airlines and solar manufacturers, supports demand for large in-line systems. This can underpin higher average selling prices and earnings.

- Expansion of forward deployed engineering and custom engineered solutions, with engineers working on customer production floors, can shorten sales cycles and increase multi system follow-on orders. This can support operating margin improvement as more projects move from pilot to full production.

- A broader product line and higher capability platforms, including larger fully integrated systems with curing, cleaning and motion control, allow Sono-Tek to move from single purpose tools to full production solutions. This can raise system pricing and contribute to improved net margins.

- Entry into higher value technology areas such as semiconductor production, optics and 300 millimeter fab related tools, supported by strong interest at industry trade shows, broadens the addressable market. This can support long term growth in backlog, revenue and operating income.

Assumptions

This narrative explores a more optimistic perspective on Sono-Tek compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

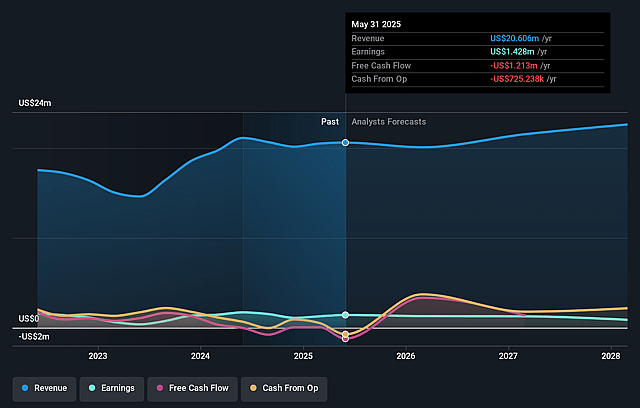

- The bullish analysts are assuming Sono-Tek's revenue will grow by 10.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 7.7% today to 7.6% in 3 years time.

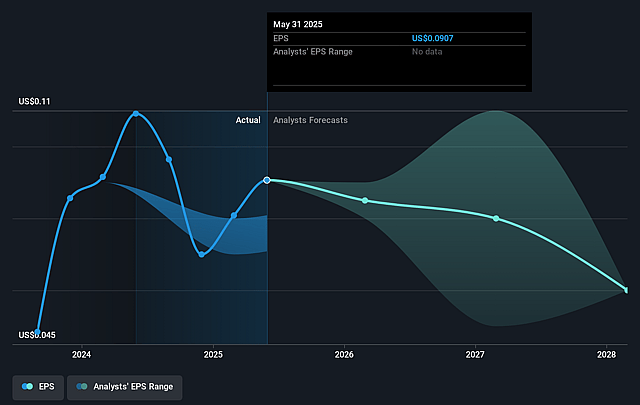

- The bullish analysts expect earnings to reach $2.1 million (and earnings per share of $0.13) by about January 2029, up from $1.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 73.8x on those 2029 earnings, up from 40.7x today. This future PE is greater than the current PE for the US Electronic industry at 27.1x.

- The bullish analysts expect the number of shares outstanding to decline by 0.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.4%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Clean energy is an important end market, and management explicitly anticipates a decline in clean energy orders this year. Recent strength has been tied to a single major solar customer whose large fiscal 2025 order did not repeat and for which no further near term orders are projected. If commercial solar and carbon capture projects stall or that customer delays expansion plans further, revenue and backlog could be weaker than expected and earnings growth could slow.

- The business is increasingly concentrated in large, high priced, customized systems that can sell for $300,000 to $1,000,000 or more. These projects have long build times and can be pushed out at the request of customers, so any sustained slowdown in capital spending or a pause in multi system rollouts could leave periods of flat or lumpy revenue and pressure operating margins when fixed costs remain in place.

- Several areas that supported recent performance came from one time or non recurring factors, such as a very large fiscal 2025 European glass coating order, strong semiconductor system sales that did not repeat in fiscal 2026 and favorable warranty expenses. If these do not reappear and are not fully replaced by new programs, revenue growth could temper and net margins could narrow from current levels.

- The plan to move deeper into semiconductor, optics and 300 millimeter fab tools relies on new product platforms, trade show leads and OEM partnerships in markets where the company currently has limited experience. If qualification cycles are slower than hoped, if competitors win key design slots or if these partners do not ramp volumes, the expected expansion of the addressable market may be delayed, which could cap longer term revenue and backlog growth.

- Growth in medical device coatings, including balloon catheters and stents, depends on tight quality and regulatory requirements, but also faces copycat ultrasonic vendors, tariff exposure in China and customer concentration as a few leading manufacturers can drive much of the demand. A loss of share to local competitors, regulatory setbacks for coated devices or a slowdown at a major customer could weigh on segment revenue and limit the lift to gross margins that management is currently seeing from higher ASP systems.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Sono-Tek is $7.75, which represents up to two standard deviations above the consensus price target of $6.38. This valuation is based on what can be assumed as the expectations of Sono-Tek's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.75, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2029, revenues will be $27.3 million, earnings will come to $2.1 million, and it would be trading on a PE ratio of 73.8x, assuming you use a discount rate of 8.4%.

- Given the current share price of $4.08, the analyst price target of $7.75 is 47.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Sono-Tek?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.