Catalysts

About Sono-Tek

Sono-Tek supplies ultrasonic thin film coating systems used in electronics, medical devices, clean energy and other industrial applications.

What are the underlying business or industry changes driving this perspective?

- Although demand for high ASP clean energy systems has supported recent revenue and gross profit, management is already anticipating a decline in clean energy orders. Any extended slowdown in solar and related projects could weigh on equipment revenue and reduce gross margin mix benefits tied to those large systems.

- While medical device orders, including balloon catheter coating systems, are gaining traction across the U.S., Europe and China, this niche is still developing. If adoption takes longer than expected or key customers delay expansion, the uplift to revenue growth and operating margin from these higher value medical systems may moderate.

- Although the company is gaining medical device wins in China despite copycat vendors and tariffs, persistent pricing pressure from local competitors and potential changes in trade policy could limit pricing power and compress net margins on future international shipments.

- While forward deployed engineering and customized high ASP platforms are helping turn lab projects into production orders, this model is resource intensive. If complex deployments require more engineering time or rework than planned, it could cap operating leverage and slow improvement in earnings.

- Although expansion into semiconductor and optics applications, including moves toward 300 millimeter fab tools and new optics OEM relationships, broadens the addressable market, long qualification cycles and reliance on partners in areas where the company has less historical experience could delay meaningful revenue contribution and keep earnings growth more gradual.

Assumptions

This narrative explores a more pessimistic perspective on Sono-Tek compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

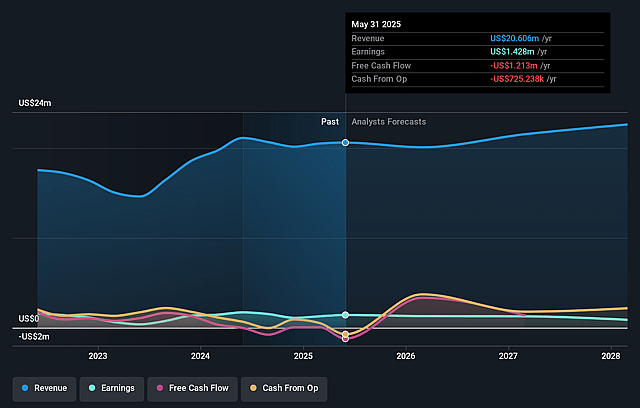

- The bearish analysts are assuming Sono-Tek's revenue will grow by 10.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 7.7% today to 7.6% in 3 years time.

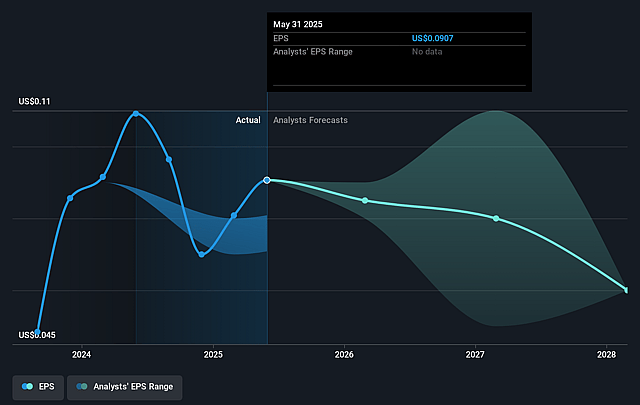

- The bearish analysts expect earnings to reach $2.1 million (and earnings per share of $0.13) by about January 2029, up from $1.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 47.7x on those 2029 earnings, up from 41.0x today. This future PE is greater than the current PE for the US Electronic industry at 26.6x.

- The bearish analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.37%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- A slowdown or pause in customer expansion plans in clean energy after the recent shipment of six high ASP solar systems could leave Sono-Tek with fewer repeat projects in that segment over time. This would put pressure on revenue and limit the mix benefit that currently supports gross margin and operating income.

- Medical device demand, including balloon catheter and stent coating systems, is still at an early stage and depends on a relatively small set of leading manufacturers choosing Sono-Tek as a preferred supplier. Delays in customer ramp ups or loss of key accounts to lower priced competitors could soften long term revenue growth and reduce earnings leverage from higher ASP systems.

- Reliance on forward deployed engineering and customized large platforms means projects are complex and resource intensive. If deployments take longer than expected or require more engineering effort, the added cost could limit operating margin expansion and reduce the earnings contribution from the current backlog of US$11.2 million.

- Greater exposure to China and other international markets, where management already highlights copycat vendors and tariff effects, raises the risk that future pricing pressure or policy changes could erode pricing power for high value systems. This would weigh on gross margin and net income even if unit demand holds up.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Sono-Tek is $5.0, which represents up to two standard deviations below the consensus price target of $6.38. This valuation is based on what can be assumed as the expectations of Sono-Tek's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.75, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2029, revenues will be $27.4 million, earnings will come to $2.1 million, and it would be trading on a PE ratio of 47.7x, assuming you use a discount rate of 8.4%.

- Given the current share price of $4.11, the analyst price target of $5.0 is 17.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Sono-Tek?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.