Catalysts

About Plexus

Plexus provides outsourced design, engineering and manufacturing solutions for complex products across Healthcare, Industrial and Aerospace and Defense end markets.

What are the underlying business or industry changes driving this perspective?

- A growing wave of electronics and advanced systems in Aerospace and Defense, including commercial space, unmanned systems and security detection, is feeding a record wins quarter of US$220 million in annualized revenue. This can support higher long term revenue and operating profit as these programs ramp.

- Rising demand for Healthcare and Life Sciences products such as imaging, surgical and monitoring technologies, paired with Plexus wins for next generation imaging systems across multiple regions, points to an expanding mix of higher value programs that can lift revenue and support operating margin resilience.

- Increasing complexity and capital intensity in semiconductor equipment and data center related power, storage and thermal solutions is encouraging OEMs to outsource to partners with deep engineering and manufacturing capabilities. This can translate to ongoing semi cap and Industrial program ramps and help sustain revenue growth and asset utilization.

- Customer preference for partners that combine engineering, manufacturing and services, as seen in wins that shift production from internal factories and in security detection solutions, can widen Plexus’ share of customer spend and contribute to operating margin efficiency and earnings leverage on the existing footprint.

- Company wide adoption of automation, robotics and AI in material handling, production planning and quoting, with quick paybacks and headcount savings per deployment, can support non GAAP operating margin improvements, capital spending efficiency and ultimately stronger earnings and free cash flow conversion.

Assumptions

This narrative explores a more optimistic perspective on Plexus compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

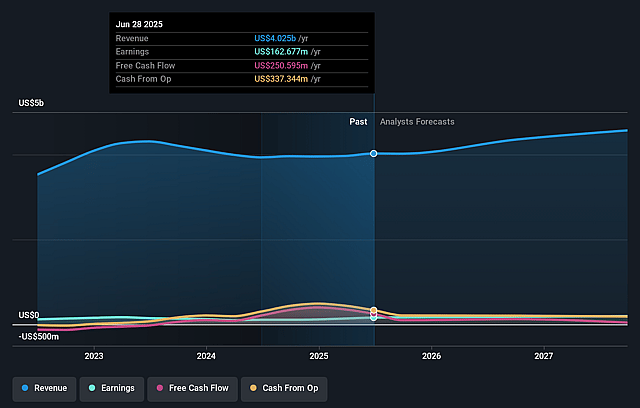

- The bullish analysts are assuming Plexus's revenue will grow by 8.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.3% today to 4.9% in 3 years time.

- The bullish analysts expect earnings to reach $257.2 million (and earnings per share of $9.61) by about January 2029, up from $176.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 28.3x on those 2029 earnings, down from 30.2x today. This future PE is greater than the current PE for the US Electronic industry at 26.6x.

- The bullish analysts expect the number of shares outstanding to decline by 1.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.47%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The bullish view relies heavily on continued Aerospace and Defense wins. Management notes that higher defense spending implied by headlines and higher build rates at Boeing and Airbus are not fully visible in customer orders, so any slowdown or cancellation in these long cycle programs could cap revenue growth and limit operating margin expansion and earnings.

- Semi cap equipment demand is described as being in the early stages of improvement, with management cautious about how that plays out. If this upswing stalls or reverses, the Industrial sector could fall short of expectations and weigh on revenue growth and non GAAP operating margin.

- Plexus is making sizable investments in new capacity and automation, including the new Malaysia and Thailand facilities and US$100 million to US$120 million of capital spending in fiscal 2026. If these sites and tools do not ramp as planned or fail to deliver the expected productivity gains, return on invested capital and free cash flow could come under pressure.

- Working capital is already rising, with a 6 day increase in inventory days and cash cycle at 69 days tied to anticipated revenue growth. If end market demand softens or ramps slip, inventory could remain elevated and reduce free cash flow and flexibility for buybacks and other cash returns.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Plexus is $220.0, which represents up to two standard deviations above the consensus price target of $196.2. This valuation is based on what can be assumed as the expectations of Plexus's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $220.0, and the most bearish reporting a price target of just $150.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2029, revenues will be $5.2 billion, earnings will come to $257.2 million, and it would be trading on a PE ratio of 28.3x, assuming you use a discount rate of 8.5%.

- Given the current share price of $199.33, the analyst price target of $220.0 is 9.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Plexus?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.