Catalysts

About Ondas

Ondas develops and commercializes autonomous systems, counter drone technologies and industrial wireless connectivity platforms for defense, security and critical infrastructure customers.

What are the underlying business or industry changes driving this perspective?

- Growing reliance on autonomous and unmanned defense solutions, together with Ondas' focus on fielded platforms such as Optimus, Iron Drone Raider and Sentrycs, positions the company to pursue larger platform programs and multi year infrastructure projects that can scale revenue and support higher earnings quality over time.

- Rising drone threats to borders, cities, airports and critical infrastructure are pushing governments and operators to deploy layered counter drone systems. Ondas' combined hard kill and Cyber over RF soft kill portfolio provides a differentiated full stack offering that can support higher product mix and potentially stronger net margins.

- Defense and security buyers are consolidating around suppliers that can deliver interoperable air, ground, sensing and communications solutions. Ondas' system of systems approach across OAS and Ondas Networks positions it to pitch larger integrated deals that can widen backlog and support operating leverage in earnings.

- Global demand to localize and secure critical defense supply chains, including NDAA compliant made in U.S. production and an industrial bridge from Ukraine and Israel to the U.S. and Europe through Ondas Capital, creates opportunities for Ondas to capture funded programs that support revenue visibility and more efficient use of its large cash balance.

- Railroads are moving toward a long term upgrade cycle for communications, with dot16 now selected across all AAR owned frequencies and early field trials under way. This places Ondas Networks at the center of a multi network buildout that can add a second leg of growth and improve the blended gross margin profile as higher margin connectivity products scale.

Assumptions

This narrative explores a more optimistic perspective on Ondas compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

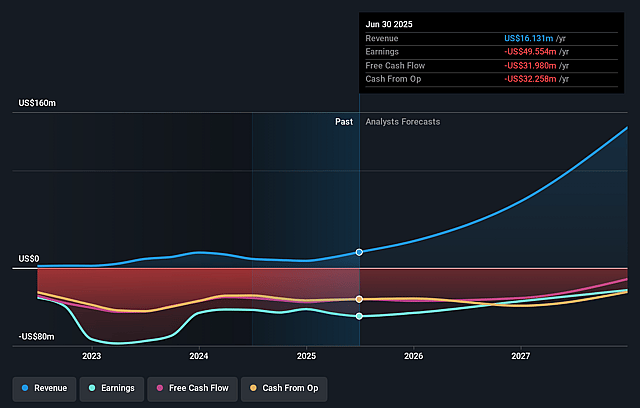

- The bullish analysts are assuming Ondas's revenue will grow by 220.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -192.6% today to 9.5% in 3 years time.

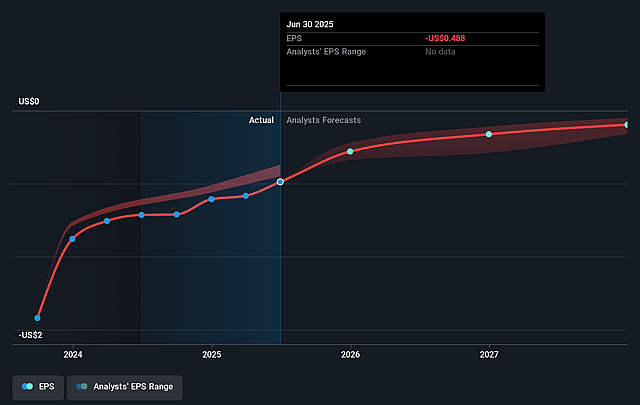

- The bullish analysts expect earnings to reach $77.3 million (and earnings per share of $0.17) by about January 2029, up from $-47.7 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $-63.2 million.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 177.8x on those 2029 earnings, up from -109.0x today. This future PE is greater than the current PE for the US Communications industry at 32.0x.

- The bullish analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.07%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The business model relies on a long multi year adoption cycle for autonomous systems, counter drone solutions and railroad communications. Management also highlights that large network deployments at 900 megahertz remain uncertain and that broader counter UAS infrastructure is only just starting to be deployed. If adoption proceeds more slowly than expected across these markets, platform sales and services could fall short of expectations, pressuring revenue and earnings.

- Ondas is aggressively building a multi domain defense and security platform via acquisitions, with more than 20 companies in the M&A pipeline and advanced work on 7 targets. Operating expenses have already moved to $18.1 million in the quarter with an operating loss of $15.5 million. Any difficulty integrating acquired businesses or realizing operating leverage could keep cost growth ahead of sales, limiting progress towards positive net margins and EBITDA.

- The company has raised very large amounts of equity capital, with cash of $433.4 million at 30 September 2025 and pro forma cash of $840.4 million after an October offering. Management expects the number of shares outstanding to grow by 7.0% per year in the bullish case. If future growth in earnings per share does not keep pace with this equity issuance, existing shareholders could face ongoing dilution that weighs on per share earnings and any future P/E multiple.

- Growth expectations lean heavily on the OAS unit, counter UAS demand and new programs with U.S. and allied defense and security agencies. Management also notes that early revenues are driven by onetime platform and infrastructure sales and that recurring service models will take time to develop. If follow on contracts, services and commercial use cases do not build as planned, revenue visibility and gross margin expansion could be weaker than implied in the optimistic earnings forecasts.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Ondas is $24.11, which represents up to two standard deviations above the consensus price target of $18.38. This valuation is based on what can be assumed as the expectations of Ondas's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2029, revenues will be $816.3 million, earnings will come to $77.3 million, and it would be trading on a PE ratio of 177.8x, assuming you use a discount rate of 8.1%.

- Given the current share price of $12.26, the analyst price target of $24.11 is 49.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Ondas?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.