Catalysts

About Ondas Holdings

Ondas Holdings develops and acquires technologies in autonomous systems, counter drone solutions and industrial wireless networking for defense, security and critical infrastructure customers.

What are the underlying business or industry changes driving this perspective?

- The company is pushing aggressively into a counter drone build out in Europe and other regions where infrastructure is still largely undeployed. If governments move slower than management is planning, the current cost base and acquisition spend could weigh on revenue growth and delay any improvement in earnings.

- OAS is being built as a multi domain defense platform that depends on integrating many acquired businesses. If technical integration of air, ground, sensing and Cyber over RF systems proves harder or slower, that could limit the ability to cross sell and hold back margins and operating leverage.

- The shift from early platform sales to longer term service and Data as a Service style contracts is central to the story. If defense customers continue to favor one time purchases and commercial customers adopt more gradually, recurring revenue and gross margin mix may fall short of what current expectations imply.

- Management is leaning heavily on a programmatic M&A model, with more than 20 targets in the pipeline and seven at advanced stages. If acquired revenues or synergies fail to materialize as assumed, the enlarged cost structure and integration expense could pressure operating losses and push out any path to positive EBITDA.

- The large equity raises in 2025 have created one of the largest cash positions in the peer group. This also raises the hurdle for future returns, and if the company cannot convert that cash into productive projects and disciplined acquisitions, shareholders may see ongoing dilution while revenue, gross profit and net income lag the scale of the balance sheet.

Assumptions

This narrative explores a more pessimistic perspective on Ondas Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

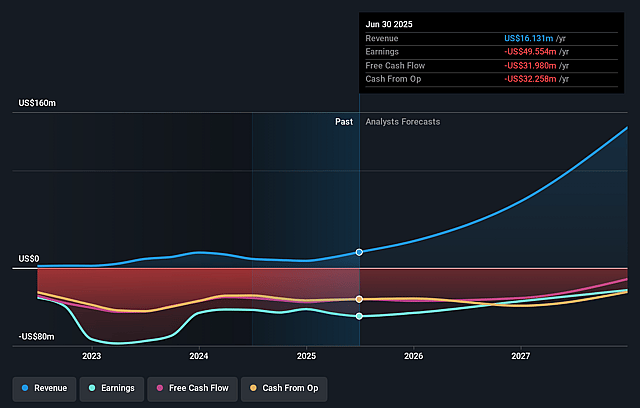

- The bearish analysts are assuming Ondas Holdings's revenue will grow by 179.1% annually over the next 3 years.

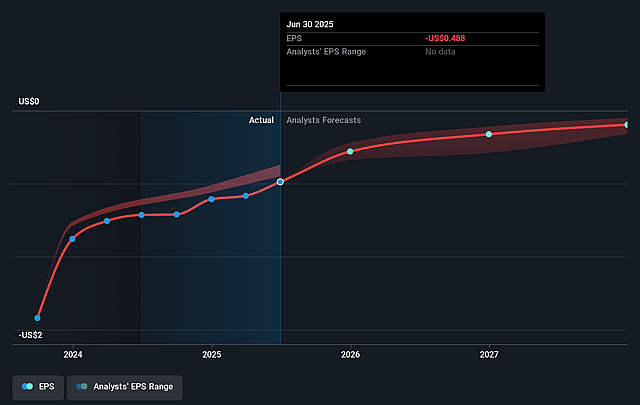

- The bearish analysts are not forecasting that Ondas Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Ondas Holdings's profit margin will increase from -192.6% to the average US Communications industry of 8.3% in 3 years.

- If Ondas Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $44.5 million (and earnings per share of $0.1) by about January 2029, up from $-47.7 million today.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 127.9x on those 2029 earnings, up from -106.2x today. This future PE is greater than the current PE for the US Communications industry at 37.6x.

- The bearish analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.05%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The company reports that autonomous and unmanned systems, defense and security markets are at an adoption inflection point and that Ondas is already seeing what management describes as a counter drone build out. If this were sustained, it could support ongoing demand for Optimus, Iron Drone and related platforms and therefore support revenue and order backlog rather than a prolonged slowdown in revenue.

- Management describes Ondas as having what it views as one of the strongest balance sheets in its peer group, with cash of US$433.4 million at 30 September 2025 and pro forma cash of US$840.4 million after the October equity raise. This could give the company more flexibility to fund acquisitions, production and working capital without relying on high cost capital, supporting the ability to pursue growth without immediate pressure on net margins.

- The OAS segment recorded US$10.0 million of revenue in the third quarter of 2025 and a backlog at OAS of US$22.2 million, rising to more than US$40 million when including announced acquisitions. If this backlog were converted into deliveries, it could continue to support top line growth and help absorb fixed costs over time, with potential benefits for operating loss and EBITDA.

- Sentrycs reports more than 200 global deployments across over 25 countries and highlights a counter drone market size estimate that rises from US$2.4 billion in 2024 to more than US$10.5 billion by 2030. If this were reflected in continued contract wins across airports, defense facilities and critical infrastructure, it could support higher software rich revenue and contribute to gross margins that Sentrycs describes as in the upper 70% range.

- Ondas Networks is now aligned with the Association of American Railroads decision to select dot16 across all AAR owned frequencies, and management notes ongoing field trials and initial production shipments. If these activities were to convert into broader adoption for rail communications, they could create another source of high value contracts over time, supporting consolidated revenue and improving the company’s ability to spread central costs over a larger earnings base.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Ondas Holdings is $10.0, which represents up to two standard deviations below the consensus price target of $12.0. This valuation is based on what can be assumed as the expectations of Ondas Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2029, revenues will be $537.9 million, earnings will come to $44.5 million, and it would be trading on a PE ratio of 127.9x, assuming you use a discount rate of 8.0%.

- Given the current share price of $13.18, the analyst price target of $10.0 is 31.8% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Ondas?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.