Key Takeaways

- Rapid industry shifts toward cloud, SaaS, and AI-driven solutions are undermining NetScout's legacy product relevance and deepening competitive pressures from larger, integrated vendors.

- Rising costs for innovation and reliance on unpredictable large client spending jeopardize profitability and add volatility to both revenue and earnings prospects.

- Strong cybersecurity growth, AI-driven product differentiation, market expansion, low customer concentration, and disciplined financial management position NetScout for sustainable revenue and margin improvement.

Catalysts

About NetScout Systems- Provides service assurance and cybersecurity solutions to protect digital business services against disruptions in the United States, Europe, Asia, and internationally.

- Surging adoption of cloud-native monitoring and integrated security platforms is expected to steadily erode demand for NetScout's legacy hardware and point solutions, resulting in a shrinking addressable market and long-term downward pressure on revenue growth.

- Increasing implementation of zero-trust security and widespread traffic encryption among large enterprises and government clients is likely to make NetScout's traditional deep packet inspection tools less effective, which diminishes the relevance and competitiveness of its core offerings and threatens future sales.

- The industry-wide movement towards SaaS

- and AI-enabled observability led by large vendors with end-to-end platforms is accelerating vendor consolidation, putting NetScout at a disadvantage when competing for major contracts and resulting in reduced win rates and margin compression as scale becomes essential.

- Despite recent cost discipline, ongoing requirements for heavy investment in research, product development, and go-to-market expansion in order to keep pace with rapid advances in network, 5G, and security technology are set to offset margin improvement, with rising operational expenses squeezing operating earnings over time.

- NetScout's dependence on federal government and large telecom carrier spending leaves it exposed to budget and capex cycles that are notoriously unpredictable, which translates into heightened volatility in both quarterly revenues and long-term earnings, especially as new government contracts become more difficult to win amid increasing competition and procurement delays.

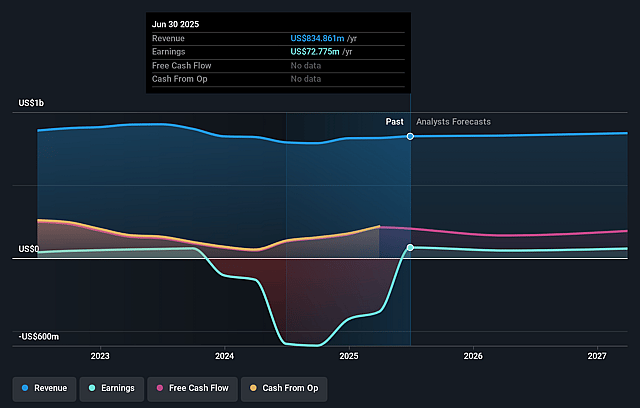

NetScout Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on NetScout Systems compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming NetScout Systems's revenue will grow by 3.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 8.7% today to 6.5% in 3 years time.

- The bearish analysts expect earnings to reach $60.4 million (and earnings per share of $0.88) by about September 2028, down from $72.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 31.4x on those 2028 earnings, up from 24.4x today. This future PE is greater than the current PE for the US Communications industry at 25.7x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.89%, as per the Simply Wall St company report.

NetScout Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NetScout is experiencing robust growth in its cybersecurity segment, with cybersecurity revenue increasing 18 percent year over year and ongoing customer prioritization of spending in this domain, which could drive continued top-line expansion and improve future revenue.

- The company's new AI-driven products, such as Omnis AI Insights and enhancements to Arbor DDoS solutions, are showing strong initial traction and differentiated capabilities, positioning NetScout to capitalize on secular trends like increased demand for AI-powered threat detection, which could boost margins and competitive positioning.

- Expansion into the larger observability market, with its AI-enhanced service assurance offerings, is broadening NetScout's addressable market-previously considered niche-potentially supporting a long-term uplift in sustainable revenue growth.

- NetScout has demonstrated success in both the federal and enterprise customer verticals, with no single customer accounting for more than ten percent of revenues, reducing concentration risk and leading to more stable earnings and cash flows.

- Improvements in gross and operating margins, cost management initiatives, solid free cash flow, and a strong balance sheet with substantial liquidity and ongoing share repurchases indicate operational discipline and shareholder-friendly capital allocation, which may support higher net margins and EPS over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for NetScout Systems is $21.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NetScout Systems's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $21.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $933.4 million, earnings will come to $60.4 million, and it would be trading on a PE ratio of 31.4x, assuming you use a discount rate of 7.9%.

- Given the current share price of $24.73, the bearish analyst price target of $21.0 is 17.8% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.