Key Takeaways

- Accelerated demand for AI-driven cybersecurity and observability tools positions the company for sustained growth and potential market leadership as digital transformation intensifies.

- Increasing high-value contracts, strong financial health, and strategic capital deployment point to greater revenue predictability and enhanced long-term profitability.

- Shifting industry trends, technological challenges, and overdependence on volatile contracts threaten NetScout's growth prospects, profitability, and ability to compete in a rapidly evolving market.

Catalysts

About NetScout Systems- Provides service assurance and cybersecurity solutions to protect digital business services against disruptions in the United States, Europe, Asia, and internationally.

- While analyst consensus points to growth in cybersecurity and service assurance driven by new AI and edge offerings, this likely understates NETSCOUT's positioning as customers rapidly expand digital transformation and AI initiatives, which could lead to sustained double-digit revenue growth in both service assurance and cybersecurity for multiple years as NETSCOUT's integrated solutions become core infrastructure.

- Analysts broadly agree that AI innovation in cybersecurity will drive product differentiation and margin expansion, but the scale of AI adoption and cyber threat evolution suggests NETSCOUT's AI-driven platform could vault it to category leadership, enabling premium pricing, taking share from competitors, and significantly lifting both gross and operating margins above historical norms.

- The expansion of cloud, 5G, and IoT with ever-increasing network complexity is likely to accelerate demand for NETSCOUT's observability and assurance tools at a faster-than-expected pace, potentially doubling its total addressable market over the next decade and boosting long-term top-line growth.

- NETSCOUT's strong traction across enterprise and federal government verticals-including multi-solution wins and earlier-than-expected large deals-signals that recurring, high-value contracts are becoming more frequent, which could drive a shift toward higher-quality, increasingly predictable subscription-based revenues and higher operating leverage.

- With a pristine balance sheet, robust free cash flow, and active share repurchases alongside no debt, the company is positioned for outsized earnings per share growth through a combination of strategic capital deployment and the ability to seize M&A opportunities that can further accelerate top-line and bottom-line expansion.

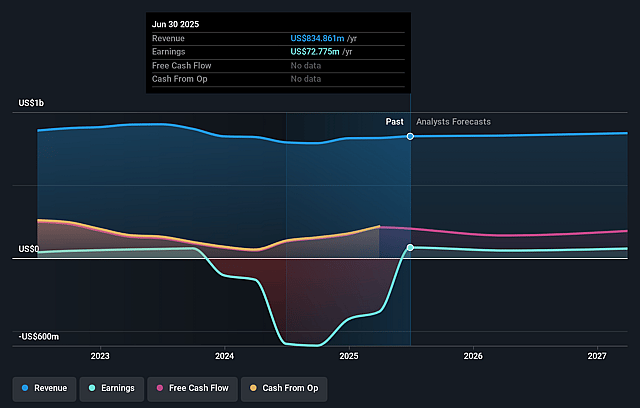

NetScout Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on NetScout Systems compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming NetScout Systems's revenue will grow by 3.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 8.7% today to 6.5% in 3 years time.

- The bullish analysts expect earnings to reach $60.4 million (and earnings per share of $0.88) by about September 2028, down from $72.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 49.8x on those 2028 earnings, up from 24.7x today. This future PE is greater than the current PE for the US Communications industry at 27.2x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.15%, as per the Simply Wall St company report.

NetScout Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NetScout faces long-term headwinds as more enterprises shift to cloud-native architectures and build in-house observability, which could shrink demand for traditional network monitoring tools, leading to pressure on future revenues and limiting addressable market growth.

- The proliferation of encrypted network traffic is making deep packet inspection less effective, undermining a foundational technology for NetScout's products and threatening to erode the competitive edge of its legacy offerings, with negative implications for product revenue and gross margins.

- While cybersecurity is driving current growth, heavy reliance on large, lumpy government and service provider contracts introduces risk of revenue volatility if these customers scale back or shift spending to diversified competitors or internal solutions in the future.

- NetScout's service provider business is showing signs of stagnation, with first quarter service provider revenue declining over five percent, and carrier investment in technology moving at a "measured pace"-this trend could translate to prolonged periods of flat or shrinking earnings as telecom partners increasingly adopt their own tools or delay infrastructure upgrades.

- The company's product portfolio has historically been slow to transition to recurring subscription or as-a-service models; as industry valuation multiples reward recurring revenue streams, this lag could drag on net margins and depress future earnings multiples in a changing investor climate.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for NetScout Systems is $33.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NetScout Systems's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $21.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $933.9 million, earnings will come to $60.4 million, and it would be trading on a PE ratio of 49.8x, assuming you use a discount rate of 8.1%.

- Given the current share price of $25.03, the bullish analyst price target of $33.0 is 24.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.