Last Update 06 Dec 25

NTCT: Future Returns Will Depend On AI And Cloud Execution

Analysts have raised their price target on NetScout Systems to $35.00 from $33.00. This reflects increased confidence following the latest fiscal Q2 report, while key valuation inputs such as fair value and growth assumptions remain largely unchanged.

Analyst Commentary

Recent commentary from bullish analysts highlights a constructive view on NetScout Systems following the fiscal Q2 report, with a modest price target increase signaling improved confidence without a fundamental shift in long term assumptions.

Bullish Takeaways

- Bullish analysts point to the price target increase as evidence that execution in the latest quarter is tracking ahead of prior expectations, supporting upside to the current valuation range.

- Stronger visibility into near term demand for the company’s core monitoring and security solutions is viewed as enhancing growth durability, helping justify a higher target multiple.

- Stable fair value and growth assumptions, combined with incremental confidence in management’s ability to deliver on guidance, suggest a favorable risk reward skew at current levels.

- Maintaining a positive rating alongside the higher target is seen as reinforcing conviction that operational efficiencies and disciplined cost control can translate into improved earnings leverage over the next few quarters.

Bearish Takeaways

- Bearish analysts caution that the size of the target increase is relatively modest, implying that upside may be limited if execution or demand trends soften.

- With core valuation inputs largely unchanged, some remain concerned that the story is still heavily dependent on consistent quarterly performance, leaving little room for operational missteps.

- Uncertainty around the pace of enterprise and service provider spending leaves questions about the sustainability of recent momentum and the potential for multiple compression if growth slows.

- There is also caution that competitive dynamics in network visibility and security could pressure pricing and margins, which would challenge the assumptions underpinning the raised price target.

What's in the News

- Updated third quarter 2025 guidance calls for revenue between $230 million and $240 million, signaling steady near term demand trends (company guidance).

- Raised fiscal 2026 outlook, with revenue now expected at $830 million to $870 million and higher projected GAAP diluted EPS of $1.13 to $1.23, up from $1.07 to $1.22 (company guidance).

- Completed a significant share repurchase tranche, buying back 740,981 shares in Q3 2025 and totaling 3,478,951 shares, or 4.84 percent of shares, for $73.48 million under the May 2022 authorization (buyback update).

- Launched Omnis KlearSight Sensor for Kubernetes, a new observability solution that uses eBPF to capture encrypted traffic at the kernel level and provide deep, real time insights into complex cloud environments (product announcement).

- Expanded solutions for cable providers and MSOs with Omnis AI Insights, aiming to improve streaming quality, reduce truck rolls, and help operators manage rising FTTH and IoT driven traffic more efficiently (client announcement).

Valuation Changes

- Fair Value: Unchanged at $31.09, indicating no revision to the intrinsic value estimate despite the higher price target.

- Discount Rate: Risen slightly from 8.03 percent to 8.08 percent, reflecting a modest uptick in perceived risk or required return.

- Revenue Growth: Essentially unchanged at 1.94 percent, signaling a stable long term growth outlook.

- Net Profit Margin: Flat at approximately 10.01 percent, with only a negligible downward adjustment in the model assumptions.

- Future P/E: Risen slightly from 31.27x to 31.32x, implying a marginally higher valuation multiple applied to forward earnings.

Key Takeaways

- Investor optimism hinges on NetScout's AI-driven cybersecurity growth and momentum in enterprise and federal segments, fueling high expectations for sustained revenue and margin expansion.

- Risks from cloud migration and IT stack consolidation may be underestimated, potentially threatening long-term stability of legacy products and current margin expectations.

- Strong cybersecurity growth, expanding AI-driven solutions, customer diversification, robust financial health, and favorable industry trends position NetScout for sustained revenue and profit gains.

Catalysts

About NetScout Systems- Provides service assurance and cybersecurity solutions to protect digital business services against disruptions in the United States, Europe, Asia, and internationally.

- Market optimism appears to be driven by strong recent growth in NetScout's cybersecurity segment, underpinned by customers prioritizing spending to counter increasingly complex and expanding cyber threats, which could lead investors to expect above-trend long-term revenue and earnings growth.

- There is a narrative that NetScout's integration of AI-driven capabilities (like Omnis AI Insights and AI-backed enhancements in DDoS defense) positions the company as a differentiated leader in an expanding observability and cybersecurity market, potentially prompting unrealistic expectations for sustained margin expansion and premium revenue multiples.

- Investors seem to be extrapolating robust enterprise and federal segment momentum (with double-digit growth and early large deal wins) as a sign the business can offset declining service provider verticals indefinitely, driving presumptions of consistent top-line stability and EPS growth.

- Expectations may be embedded that NetScout will fully capitalize on proliferation of 5G, AIOps, and ongoing digital transformations-assuming the company can maintain technological leadership and capture a disproportionate share of incremental network monitoring and security spend, causing upward pressure on valuation multiples.

- The market could be underappreciating the risk from continued migration to cloud-native architectures and consolidation of IT/security stacks, overestimating NetScout's ability to mitigate potential long-term pressure on legacy products, thus supporting inflated forecasts for revenue quality and sustainable net margins.

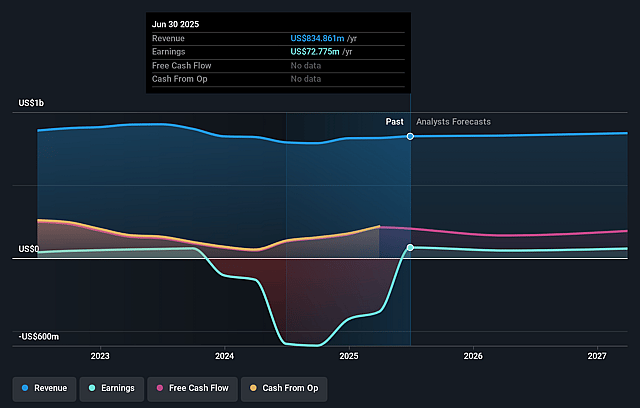

NetScout Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NetScout Systems's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.7% today to 5.5% in 3 years time.

- Analysts expect earnings to reach $49.6 million (and earnings per share of $0.72) by about September 2028, down from $72.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 47.1x on those 2028 earnings, up from 24.4x today. This future PE is greater than the current PE for the US Communications industry at 25.6x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.89%, as per the Simply Wall St company report.

NetScout Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NetScout is experiencing strong growth in its cybersecurity product line (18% year-over-year revenue growth), ongoing enterprise demand for service assurance, and traction with large deals-including a high 7-figure government order and competitive displacement wins-which indicates its solutions are highly valued by customers navigating growing cybersecurity complexity, supporting the potential for sustained revenue and earnings growth.

- AI-driven innovation is expanding NetScout's addressable market, as highlighted by their Omnis AI Insights and AI-powered DDoS protections; these enhance product differentiation and create upsell opportunities as enterprise customers invest in digital transformation and network observability, which could drive higher average contract values and increase long-term margins.

- The company is successfully diversifying its customer base, with no single customer accounting for more than 10% of revenue, and a healthy split between U.S. (54%) and international markets (46%), which reduces revenue volatility risk and supports a more predictable top-line trajectory.

- NetScout is generating robust free cash flow ($71.7 million in Q1), has a strong liquidity position (over $540 million in cash and investments, no debt), and is actively repurchasing shares, all of which can support further investment in R&D, accretive acquisitions, or additional share buybacks-positively impacting earnings per share and shareholder value.

- The company continues to capture value from long-term secular trends such as rising global network complexity, growth in 5G and cloud adoption, and heightened regulatory and cybersecurity requirements, positioning it to benefit from increasing demand for sophisticated network monitoring and security solutions-translating to potential sustained revenue and profit growth in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $25.817 for NetScout Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $21.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $905.7 million, earnings will come to $49.6 million, and it would be trading on a PE ratio of 47.1x, assuming you use a discount rate of 7.9%.

- Given the current share price of $24.73, the analyst price target of $25.82 is 4.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on NetScout Systems?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.