Last Update 10 Jan 26

LFUS: Buyback Completion And Margin Assumptions Will Shape Balanced Return Outlook

Analysts have maintained their fair value estimate for Littelfuse at US$275.00. Updated assumptions for revenue growth, profit margins, the discount rate, and a slightly higher future P/E are shaping their revised price target narrative.

What's in the News

- Littelfuse reported that between June 29, 2025 and September 27, 2025, it repurchased 0 shares for US$0 million, while completing a previously announced buyback of 129,589 shares for US$29.38 million, representing 0.52% of the company (Key Developments).

- The company issued earnings guidance for the fourth quarter of 2024, targeting net sales in a range of US$570 million to US$590 million (Key Developments).

Valuation Changes

- Fair Value Estimate remained at US$275.00 per share, indicating no change in the analysts' central valuation view.

- The discount rate edged slightly lower from 8.77% to 8.74%, reflecting a modest adjustment to the required return used in the valuation model.

- Revenue growth was revised higher from 7.02% to 9.52%, pointing to stronger top line assumptions in the updated model.

- The net profit margin was adjusted from 14.51% to 12.72%, incorporating a more conservative view on future profitability levels.

- The future P/E moved up from 21.43x to 22.79x, implying a slightly higher multiple applied to Littelfuse's expected earnings.

Key Takeaways

- Leadership in smart electrical solutions positions Littelfuse for growth with increasing demand for energy-efficient technologies and infrastructure advancements.

- Strong cash generation and strategic investments foster long-term profitability and earnings growth, leveraging global operations to manage economic uncertainties.

- Trade uncertainties, reliance on the U.S. market, and competitive pressures may impact Littelfuse's revenues, margins, and earnings despite strong cash generation.

Catalysts

About Littelfuse- Designs, manufactures, and sells electronic components, modules, and subassemblies worldwide.

- Littelfuse's leadership in smart solutions for safe and efficient electrical energy transfer positions it well to capitalize on the growing demand for grid storage and data center advancements, potentially driving future revenue growth.

- The company's diverse capabilities in high-speed fuses, arc-flash, ground-fault protection, and advanced sensor technologies align with the trend towards higher power and energy density in key markets, which could enhance both revenue and net margins.

- Littelfuse's strong global operating model and manufacturing capabilities provide a competitive edge in managing trade uncertainties and economic fluctuations, supporting stable revenue and earnings.

- The company's history of strong cash generation and profitability, coupled with a flexible balance sheet, allows for strategic investments in organic and inorganic growth opportunities, which could lead to improved long-term profitability and earnings per share.

- Initiatives to leverage best practices and enhance operational excellence across its business segments aim to improve margins even in challenging times, contributing to consistent earnings growth.

Littelfuse Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Littelfuse compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Littelfuse's revenue will grow by 5.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.3% today to 13.0% in 3 years time.

- The bearish analysts expect earnings to reach $338.0 million (and earnings per share of $13.55) by about May 2028, up from $95.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.2x on those 2028 earnings, down from 49.4x today. This future PE is lower than the current PE for the US Electronic industry at 20.0x.

- Analysts expect the number of shares outstanding to decline by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.66%, as per the Simply Wall St company report.

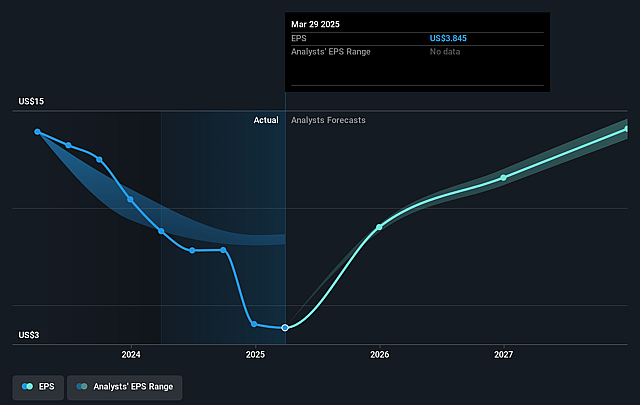

Littelfuse Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing trade uncertainties and potential second half demand risk could negatively impact revenues if market conditions deteriorate.

- There is a significant reliance on the U.S. market sourcing a large share of sales from China, which exposes Littelfuse to potential tariff-related costs that may affect net margins if pricing strategies do not fully mitigate these impacts.

- Competition and possible soft demand conditions in segments like passenger cars, particularly in Europe and North America, could result in reduced revenue and continued margin pressures.

- While strong cash generation provides flexibility, the execution of strategic acquisitions under an uncertain economy may pose integration and operational risks that could impact earnings performance.

- Despite adapting with a flexible operating model, uncertain economic environments and shifting trade policies could affect Littelfuse's ability to maintain current profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Littelfuse is $194.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Littelfuse's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $296.12, and the most bearish reporting a price target of just $194.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.6 billion, earnings will come to $338.0 million, and it would be trading on a PE ratio of 17.2x, assuming you use a discount rate of 7.7%.

- Given the current share price of $190.58, the bearish analyst price target of $194.0 is 1.8% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Littelfuse?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.