Key Takeaways

- Expanding electrification, renewable energy projects, and IoT adoption drive increased demand for Littelfuse’s safety and sensing solutions, supporting strong top-line growth.

- Operational improvements and targeted acquisitions are set to enhance margins, broaden the customer base, and boost both near

- and long-term earnings.

- Increased costs, shifting customer needs, market reliance, intensifying competition, and regulatory complexity could pressure margins and hinder long-term profitability.

Catalysts

About Littelfuse- Designs, manufactures, and sells electronic components, modules, and subassemblies worldwide.

- Accelerating demand for high-voltage, high-current protection solutions in applications like electric vehicles, grid-scale storage, and next-generation data centers positions Littelfuse to meaningfully increase its addressable content per system as electrification expands, driving future revenue growth.

- Substantial market share gains are expected as greater investment flows into renewable energy infrastructure and grid modernization projects worldwide, since Littelfuse’s core products are indispensable for safety and reliability, supporting long-term recurring revenue streams.

- The surge in connectivity and proliferation of IoT and automation across industrial and automotive sectors is prompting greater adoption of Littelfuse’s advanced sensing and circuit protection technologies, resulting in deeper customer engagement and sustained top-line growth.

- Ongoing operational initiatives—including manufacturing automation, footprint optimization, and supply chain localization—are expected to drive durable improvements in gross and operating margins, which should enhance earnings growth over time.

- Active pursuit of strategic acquisitions targeting high-growth niches and complementary technologies is likely to fuel both near

- and long-term inorganic earnings expansion, increase product cross-selling opportunities, and broaden the company’s global customer base.

Littelfuse Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Littelfuse compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Littelfuse's revenue will grow by 8.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.3% today to 14.2% in 3 years time.

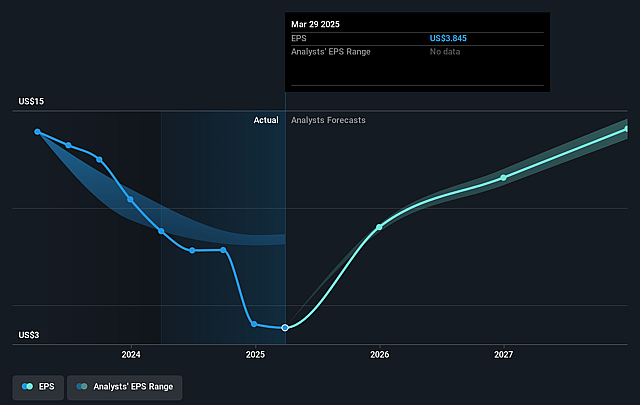

- The bullish analysts expect earnings to reach $398.9 million (and earnings per share of $16.43) by about July 2028, up from $95.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.4x on those 2028 earnings, down from 59.9x today. This future PE is lower than the current PE for the US Electronic industry at 23.8x.

- Analysts expect the number of shares outstanding to decline by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.99%, as per the Simply Wall St company report.

Littelfuse Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Littelfuse’s efforts to align manufacturing and supply chains closer to customers and diversify its global footprint in response to reshoring trends could increase manufacturing and operating costs over time, potentially compressing margins and reducing profitability.

- There is continued weak demand in semiconductor products and ongoing softness in the power semiconductor segment, while shifting customer needs toward solid-state or vertically integrated solutions may reduce Littelfuse’s traditional fuse and circuit protection revenues over the long term.

- The company remains heavily reliant on automotive and transportation markets, which experienced organic sales declines in the passenger car and commercial vehicle segments; this reliance exposes Littelfuse to end-market cyclicality and to the risk that the transition to electric vehicles may favor different suppliers or technologies, causing further revenue volatility.

- Intensifying competition and industry commoditization, especially as larger customers consider developing in-house solutions or favor standardized, lower-margin products, could erode Littelfuse’s pricing power, placing pressure on both revenue growth and gross margins.

- Ongoing integration risks and capital deployment toward acquisitions, combined with increasing regulatory complexity and sustainability expectations, may raise operating and R&D costs, presenting risks of inefficiencies, impairment charges, and lower net margins that could ultimately weigh on long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Littelfuse is $296.12, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Littelfuse's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $296.12, and the most bearish reporting a price target of just $200.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.8 billion, earnings will come to $398.9 million, and it would be trading on a PE ratio of 22.4x, assuming you use a discount rate of 8.0%.

- Given the current share price of $230.93, the bullish analyst price target of $296.12 is 22.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Littelfuse?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.