Last Update12 Oct 25Fair value Increased 2.50%

The analyst price target for Littelfuse has increased from $300 to $307.50. Analysts cite ongoing margin improvements, initial benefits from artificial intelligence initiatives, and industry growth drivers as the basis for their increased optimism.

Analyst Commentary

Following recent coverage, analysts provided a balanced view of Littelfuse’s outlook, highlighting several strengths as well as areas to monitor.

Bullish Takeaways

- Bullish analysts see secular industry growth drivers continuing to provide a tailwind. This positions the company for topline expansion in upcoming quarters.

- Recent investments and initiatives in artificial intelligence are already contributing positively to the company’s results. This suggests early execution success in this area.

- There is still potential for ongoing margin improvement, which could provide further support for earnings growth relative to peers.

- Current valuation remains below historical averages. This offers a favorable risk-reward profile for investors.

Bearish Takeaways

- Some caution is warranted as the pace and scale of benefits from artificial intelligence integration remain unproven over the longer term.

- While margin improvement is expected, execution risk persists, particularly if cost savings or productivity gains fail to materialize as projected.

- Analysts note that, despite relative undervaluation, sector volatility or unexpected headwinds could weigh on future performance.

What's in the News

- The company is actively seeking mergers and acquisitions as part of its long-term strategy. It is focusing on achieving double-digit return on invested capital over the next 3 to 5 years (Key Developments).

- Littelfuse announced a quarterly cash dividend of $0.75 per share, payable on September 4, 2025, to shareholders of record as of August 21, 2025 (Key Developments).

- The company completed the repurchase of 129,589 shares for $29.38 million, representing 0.52% of total shares, under its ongoing buyback program (Key Developments).

- For the third quarter of 2025, Littelfuse expects net sales to range between $610 million and $630 million (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen from $300 to $307.50, reflecting increased optimism in the company’s outlook.

- Discount Rate has edged up slightly from 8.53% to 8.61%, suggesting minimal adjustment to risk assumptions.

- Revenue Growth expectation has dipped slightly, moving from 8.59% to 8.45%.

- Net Profit Margin forecast has improved marginally, rising from 13.82% to 13.87%.

- Future P/E Ratio has increased from 22.96x to 23.59x. This implies higher earnings multiples being assigned to projected earnings.

Key Takeaways

- Expansion in electrification, renewable energy, and key markets is driving higher demand, revenue growth, and improved margins for Littelfuse.

- Operational efficiency and a solutions-focused strategy are enhancing earnings potential and reducing business cyclicality.

- Heavy sector concentration and lagging adaptation to new technologies risk eroding margins and market share amid mounting competitive and integration challenges.

Catalysts

About Littelfuse- Designs, manufactures, and sells electronic components, modules, and subassemblies in the Americas, the Asia-Pacific, and Europe.

- Accelerating global demand for higher voltage, higher energy density, and electrified applications in automotive, industrial, and data center markets is driving increased content per device for Littelfuse's products; management cited share gains in EVs, grid infrastructure, and data centers, supporting long-term revenue growth above current market expectations.

- The rapid buildout of renewable energy infrastructure, grid storage, and sustainable grid ecosystems is resulting in double-digit sales growth and a robust opportunity pipeline for Littelfuse, positioning the company to benefit from continued secular tailwinds and expanding its addressable market, which should positively impact both revenues and margins.

- Strong progress on operational excellence-including global best practice initiatives and manufacturing optimization-has already yielded a record-high segment margin in transportation and substantial margin expansion in industrial, indicating untapped potential for sustained margin improvement and earnings growth as these initiatives scale.

- The company's strategic push toward offering more complete solutions and broadening its sales structure is generating new design wins and customer penetration-particularly in high-growth areas like data centers and green hydrogen-that should drive greater revenue stability, improved visibility, and reduced cyclicality going forward.

- A solid balance sheet, robust free cash flow, and a disciplined capital allocation strategy (including ongoing buybacks and selective acquisitions) provide Littelfuse with the flexibility to invest in high-growth/innovative product areas and maintain or enhance shareholder returns, supporting long-term EPS growth.

Littelfuse Future Earnings and Revenue Growth

Assumptions

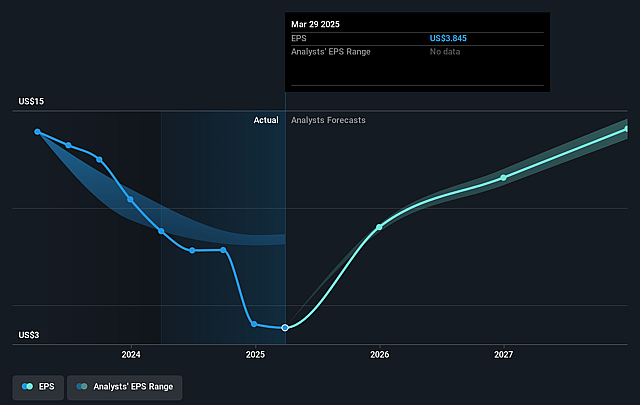

How have these above catalysts been quantified?- Analysts are assuming Littelfuse's revenue will grow by 8.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.7% today to 13.8% in 3 years time.

- Analysts expect earnings to reach $400.8 million (and earnings per share of $16.46) by about September 2028, up from $107.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.0x on those 2028 earnings, down from 60.4x today. This future PE is lower than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to decline by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.53%, as per the Simply Wall St company report.

Littelfuse Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing softness and execution challenges in the power semiconductor business, combined with shifting technology trends toward integrated and solid-state circuit protection, risk undercutting Littelfuse's core revenue streams and profit margins if the turnaround is slower than anticipated or demand shifts more rapidly than the company can adapt.

- Littelfuse's exposure remains heavily tilted toward cyclical industries like automotive (both ICE and EV) and industrial sectors; overdependence on these sectors exposes the company to economic downturns or sector-specific slowdowns leading to increased revenue volatility and less predictable earnings.

- While the company is investing in growth opportunities and portfolio expansion, successful acquisition integration (e.g., Dortmund) and expansion into adjacent markets is critical-failure to execute or realize synergies could result in lower returns on invested capital and potential EPS dilution over the long term.

- The electronics segment's margin performance is currently being partially offset by weakness in power semiconductor volumes and impacts from stock-based and variable compensation; a prolonged period of margin pressure or inability to consistently drive operating leverage could negatively affect long-term net margins and earnings growth.

- Increased competition-especially from lower-cost Asian manufacturers and technology shifts that may outpace Littelfuse's R&D cycles-could pressure pricing and gross margins, risking market share erosion and directly impacting long-term revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $300.0 for Littelfuse based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.9 billion, earnings will come to $400.8 million, and it would be trading on a PE ratio of 23.0x, assuming you use a discount rate of 8.5%.

- Given the current share price of $261.12, the analyst price target of $300.0 is 13.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.