Key Takeaways

- Increasing automation, EV expansion, and regionalized supply chains are driving stronger bookings, sales opportunities, and premium pricing for IPG’s differentiated laser solutions.

- Diversification into medical, micromachining, and additive manufacturing, coupled with vertical integration, supports margin resilience and long-term profitable growth.

- Shrinking demand, rising trade barriers, intense low-cost competition, and high investment needs are threatening profitability and long-term growth in IPG’s core business segments.

Catalysts

About IPG Photonics- Develops, manufactures, and sells various high-performance fiber lasers, fiber amplifiers, and diode lasers used in materials processing, medical, and advanced applications worldwide.

- Rapidly growing demand for advanced automation and precision manufacturing systems is driving early signs of stabilization and sequential improvements in bookings, positioning IPG to capture accelerating revenues as global manufacturing recovers and customers invest in next-generation laser-based solutions.

- The expansion of electric vehicle and battery markets is resulting in share gains for IPG in e-mobility applications, particularly in China, where proprietary technologies such as adjustable mode beam lasers and laser depth dynamics are addressing highly technical welding requirements, supporting higher revenue growth, improved customer stickiness, and stronger margins as EV and stationary energy storage capacity investments rise.

- The company is benefiting from significant onshoring and regionalization of supply chains, notably in North America and Europe, leading to increased capital expenditures by manufacturing customers on automated, laser-based production lines—a trend that enhances IPG’s sales opportunities, supports premium pricing for differentiated solutions, and provides a durable tailwind for revenue.

- Continued investment in research and development is fueling traction in new verticals such as medical (with new urology customers and upcoming product launches), micromachining, and additive manufacturing; this pipeline of new products and applications is already driving growth in emerging categories and is expected to generate hundreds of millions in incremental revenue over the next several years while diversifying margins away from more cyclical segments.

- IPG’s vertically integrated global manufacturing footprint and supply chain flexibility not only mitigate tariff and geopolitical risks, but also allow the company to serve customers more cost-effectively, quickly recover gross margin lost to near-term shocks, and maintain industry-leading profitability as revenues scale and operating leverage improves.

IPG Photonics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on IPG Photonics compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming IPG Photonics's revenue will grow by 5.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -21.2% today to 19.3% in 3 years time.

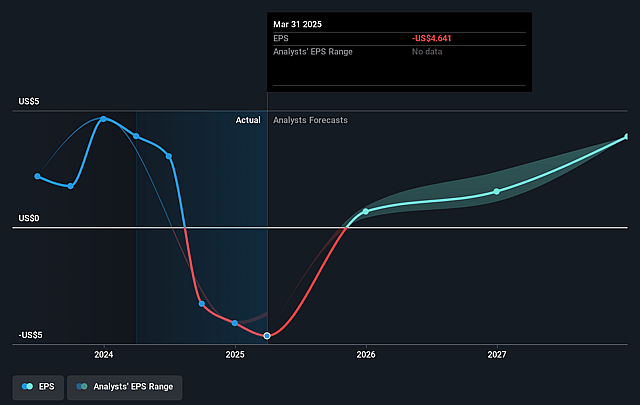

- The bullish analysts expect earnings to reach $216.8 million (and earnings per share of $5.11) by about July 2028, up from $-201.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.0x on those 2028 earnings, up from -15.9x today. This future PE is lower than the current PE for the US Electronic industry at 23.8x.

- Analysts expect the number of shares outstanding to decline by 3.82% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.61%, as per the Simply Wall St company report.

IPG Photonics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Global manufacturing is experiencing long-term slowing growth, especially in developed markets, as indicated by IPG’s 10% year-over-year revenue decline and management’s acknowledgment of ongoing uncertainty in general industrial demand, which poses a sustained threat to topline revenue growth.

- Rising deglobalization and protectionist trade policies—such as escalating tariffs on critical inputs and finished products—have already led to $15 million in delayed shipments and are pressuring gross margins and increasing operating costs, which is likely to continue to negatively affect profitability and may pose further risks to earnings.

- The accelerating global shift to green technologies and away from manufacturing-intensive sectors, such as automotive and heavy industry, challenges IPG’s core materials processing business, which saw a 14% year-over-year decline and ongoing weakness in key applications like cutting and welding, harming long-term revenue streams.

- Intense competition from low-cost providers, particularly Chinese laser manufacturers, is heightening price pressure and eroding margins in core product segments, while IPG’s reliance on high-power fiber lasers and slow diversification means gross margins and earnings remain highly vulnerable to competitive and technological disruption.

- Sustained high R&D and capital expenditure requirements to support innovation and maintain manufacturing flexibility are pushing up operating expenses and compressing net margins, putting additional strain on free cash flow in an environment where stable or declining revenue limits the ability to leverage these investments for earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for IPG Photonics is $75.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of IPG Photonics's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $55.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $216.8 million, and it would be trading on a PE ratio of 16.0x, assuming you use a discount rate of 7.6%.

- Given the current share price of $75.46, the bullish analyst price target of $75.0 is 0.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.