Last Update08 May 25Fair value Decreased 5.45%

Key Takeaways

- Intensifying global price competition, technological commoditization, and customer in-sourcing threaten IPG Photonics’ pricing power, gross margins, and sustainable growth prospects.

- Trade tensions, shifting capital investments, and market access disruptions are likely to increase costs and structurally limit demand for IPG's core laser products.

- Diversifying into emerging applications and new products, supported by strategic acquisitions and manufacturing agility, is expected to drive sustained growth and margin improvement despite mature market challenges.

Catalysts

About IPG Photonics- Develops, manufactures, and sells various high-performance fiber lasers, fiber amplifiers, and diode lasers used in materials processing, medical, and advanced applications worldwide.

- The continued expansion of manufacturing automation in emerging markets is likely to intensify global price competition for laser-based products, eroding IPG Photonics’ ability to grow revenues and exert pricing power, which will in turn lower both top-line growth and gross margins in the coming years.

- Geopolitical tensions and increasing trade protectionism, such as the recent imposition of tariffs that delayed $15 million in shipments, are expected to disrupt IPG’s access to key markets, force costly supply chain adjustments, and drive up input costs, directly compressing future net margins and making sustained earnings growth increasingly difficult.

- The ongoing transition of capital investments away from traditional heavy manufacturing toward alternative, lower-emission processes as global decarbonization accelerates is likely to shrink the demand for IPG’s core fiber laser systems, structurally limiting the company’s long-term total addressable market and capping sustainable revenue growth.

- Intensifying technological competition from low-cost manufacturers, particularly in China, along with the looming commoditization of fiber laser technology as patents expire, is set to drive down average selling prices, erode market share in core applications, and permanently compress gross margins as competitors close the technology gap.

- Increasing vertical integration by major industrial and automotive customers, who are developing in-house laser solutions, will reduce the necessity for best-of-breed third-party lasers, leading to long-term customer attrition and a structural decline in recurring revenues and overall earnings visibility.

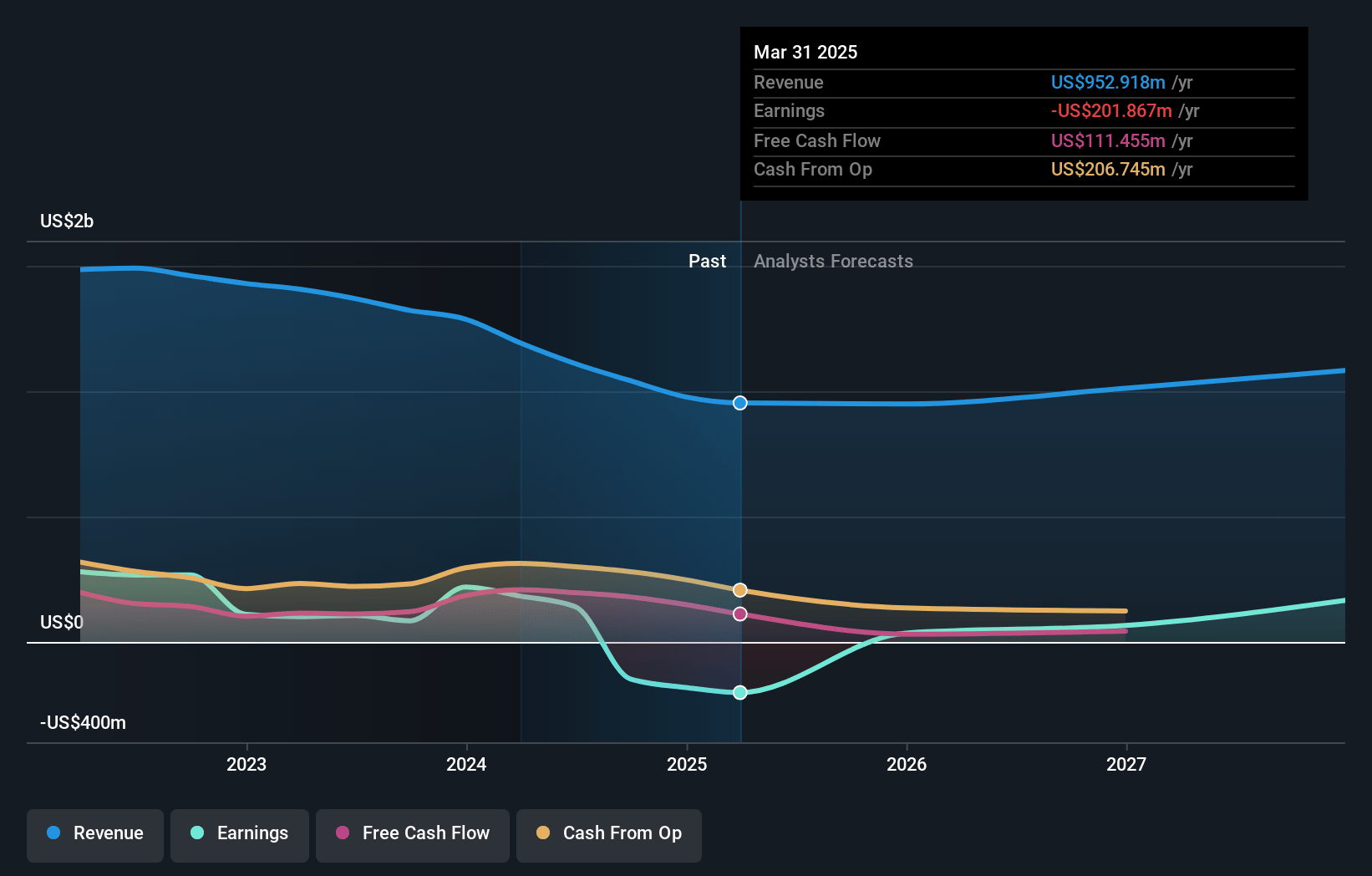

IPG Photonics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on IPG Photonics compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming IPG Photonics's revenue will grow by 4.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -21.2% today to 15.5% in 3 years time.

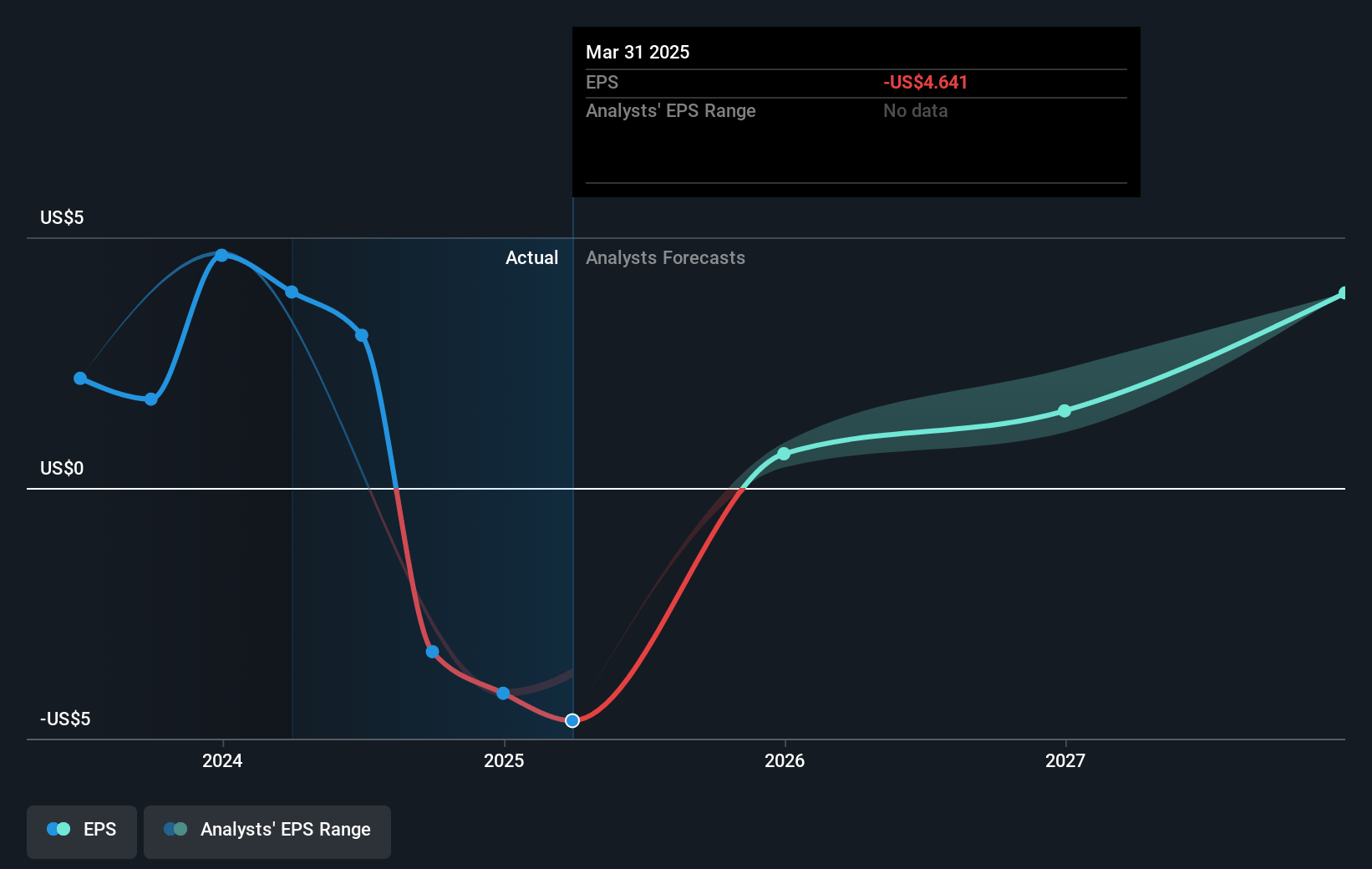

- The bearish analysts expect earnings to reach $165.7 million (and earnings per share of $3.89) by about May 2028, up from $-201.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.5x on those 2028 earnings, up from -11.6x today. This future PE is lower than the current PE for the US Electronic industry at 20.0x.

- Analysts expect the number of shares outstanding to decline by 6.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.22%, as per the Simply Wall St company report.

IPG Photonics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- IPG Photonics is seeing strong revenue growth and momentum in emerging applications such as medical, micromachining, additive manufacturing, and advanced solutions, which are beginning to offset headwinds in mature markets and are expected to contribute increasingly to revenue and earnings in the coming years.

- The company’s investments in new product development, such as next-generation medical lasers for the large and growing urology market, as well as the successful acquisition of cleanLASER, position it to diversify and grow revenue streams, likely supporting long-term revenue and net margin improvement.

- Robust manufacturing flexibility and supply chain agility allow IPG to rapidly adapt to tariff-related disruptions; the business is already moving production and sourcing to minimize costs, suggesting that gross margin pressures from tariffs may be transitory and margins could recover.

- IPG’s strong balance sheet, with over $900 million in cash and no debt, provides significant strategic flexibility to invest in R&D, pursue value-creating acquisitions, and weather industry downturns, supporting sustained earnings and long-term growth.

- Bookings trends and the book-to-bill ratio being solidly above one, particularly in strategic growth areas, indicate stabilizing or accelerating demand that may translate to future revenue growth and improved operating leverage, thereby positively impacting earnings over several years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for IPG Photonics is $52.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of IPG Photonics's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $52.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $165.7 million, and it would be trading on a PE ratio of 13.5x, assuming you use a discount rate of 7.2%.

- Given the current share price of $54.91, the bearish analyst price target of $52.0 is 5.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.