Design, manufacture, supply chain

Catalysts

- Are there any industry tailwinds this stock is benefitting or hindered from?

- Robotics

- EV

- IoT

- Cloud computing

- Smart home

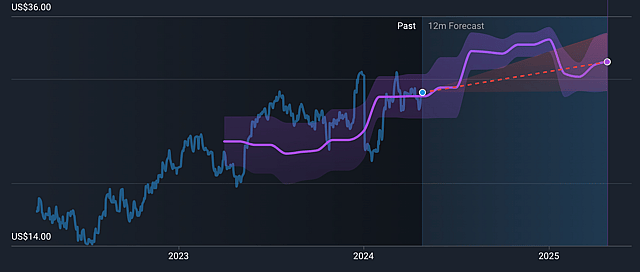

Analysts projections trending upwards

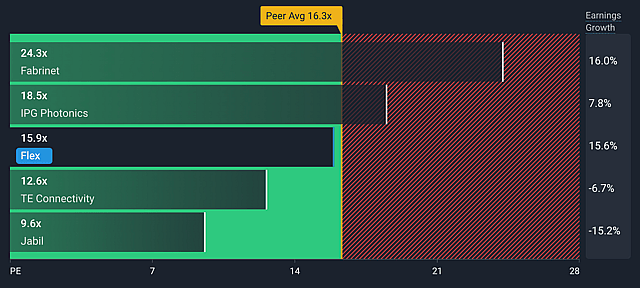

Excellent PE against industry Peers

Assumptions

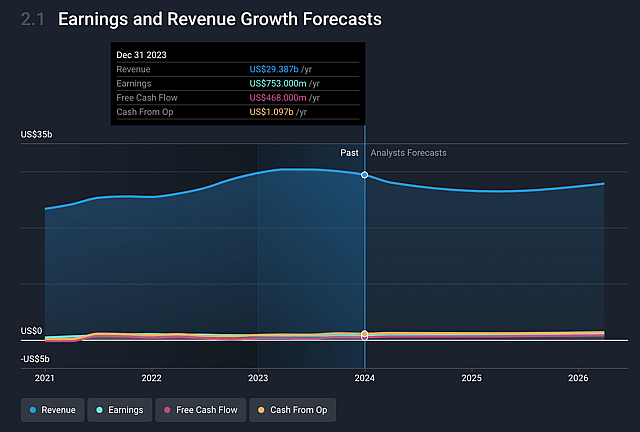

- Where do you think revenue will be in 5 years time? and why?

- Despite analysts not predicting a massive growth, I believe that market demand in Robotics and EV especially will eventually drive the revenue upwards.

- Where do you think earnings will be in 5 years time? and why?

- There is a slight but steady growth in free cash flow and cash flow from operations. I believe as they start leveraging technology for automation they have invested in, it will increase their productivity and profit margins.

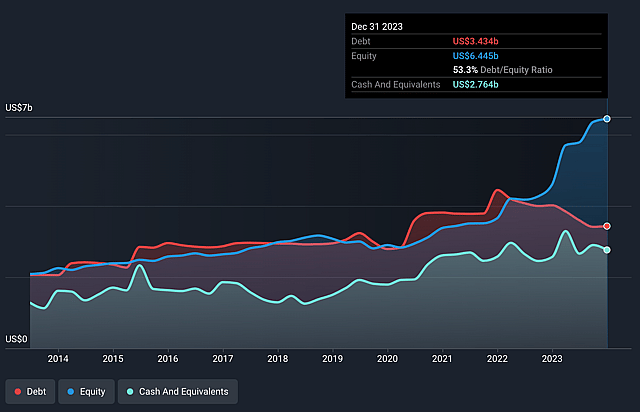

Reduction in debt

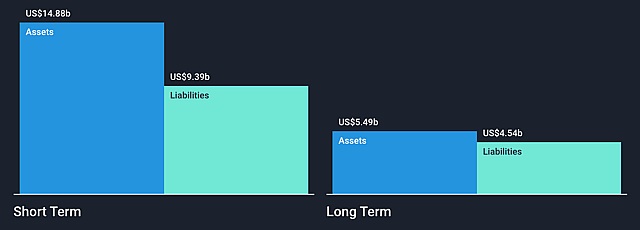

Liabilities are well covered by assets

Risks

- The risks for this company are fairly low as they are already distributed in many regions which mitigates regulatory challenges and also being outpriced by potentially cheaper markets.

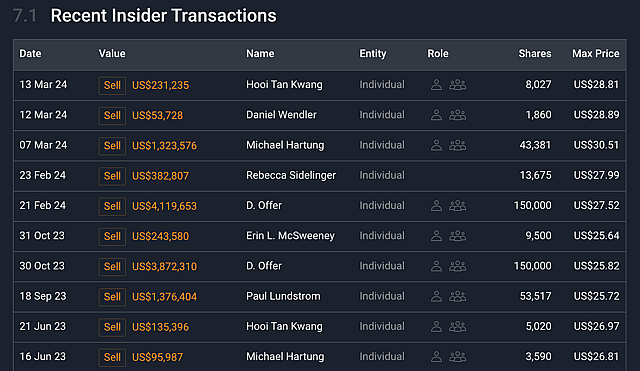

Look out for insider selling

Valuation

- See the valuator

- Revenue - 1% p.a.

- Profit Margin - 3 % p.a.

- Future PE - 25x

- Discount rate - 10%

- Fair Value - $44 - currently 35% undervalued

Have other thoughts on Flex?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

Zdend is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. Zdend holds no position in NasdaqGS:FLEX. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.