Key Takeaways

- Heavy dependence on emerging markets and customer concentration exposes Ceragon to earnings risk despite moves toward higher-margin, software-driven revenue streams.

- Competitive pressures, scale disadvantages, and a regional tilt toward lower-margin hardware threaten margin expansion and the capacity for sustained long-term growth.

- Heavy reliance on low-margin markets, limited scale against competitors, and slower innovation threaten Ceragon's growth prospects and ability to sustain higher earnings.

Catalysts

About Ceragon Networks- Provides wireless transport solutions for cellular operators and other wireless service providers in North America, Europe, Africa, the Asia Pacific, the Middle East, India, and Latin America.

- While Ceragon's entry into private wireless networks and software-driven services provides the company with higher-margin, recurring revenue opportunities and aligns well with increasing demand for digital connectivity and automation, the company remains heavily exposed to the volatile emerging markets, particularly India, which is prone to revenue concentration, currency risk, and delayed payments that may limit improvements in overall net margins.

- Although accelerating 5G deployments, the densification of wireless networks, and the global surge in mobile data consumption are driving long-term demand for Ceragon's backhaul and millimeter wave solutions, Ceragon faces increasing competitive pressures from well-capitalized telecom giants, as well as ongoing risk of commoditization and price compression that could cap gross margin expansion.

- Despite the successful integration of recent acquisitions in private networks (such as Siklu and E2E Technologies) and initial signs of cross-selling synergies, Ceragon's smaller scale and limited balance sheet relative to key industry peers restrict its R&D investment capacity, threatening its ability to defend market share as the industry transitions to new technologies such as Open RAN and virtualization, which is critical for sustaining long-term revenue growth.

- While software and managed services adoption is projected to improve operating leverage and drive margin accretion over time, the near-term gross margin remains pressured by a regional shift toward lower-margin hardware business in India, and any delay in materializing higher-value software revenues could sustain thin net margins for longer than anticipated.

- Even though the expansion of digital connectivity and significant addressable markets in both developed and emerging regions provide room for growth, Ceragon's historical challenges with cash flow and reliance on a limited number of large customers increase risk to earnings consistency, especially if macroeconomic or geopolitical disruptions impede infrastructure spending or customer procurement cycles.

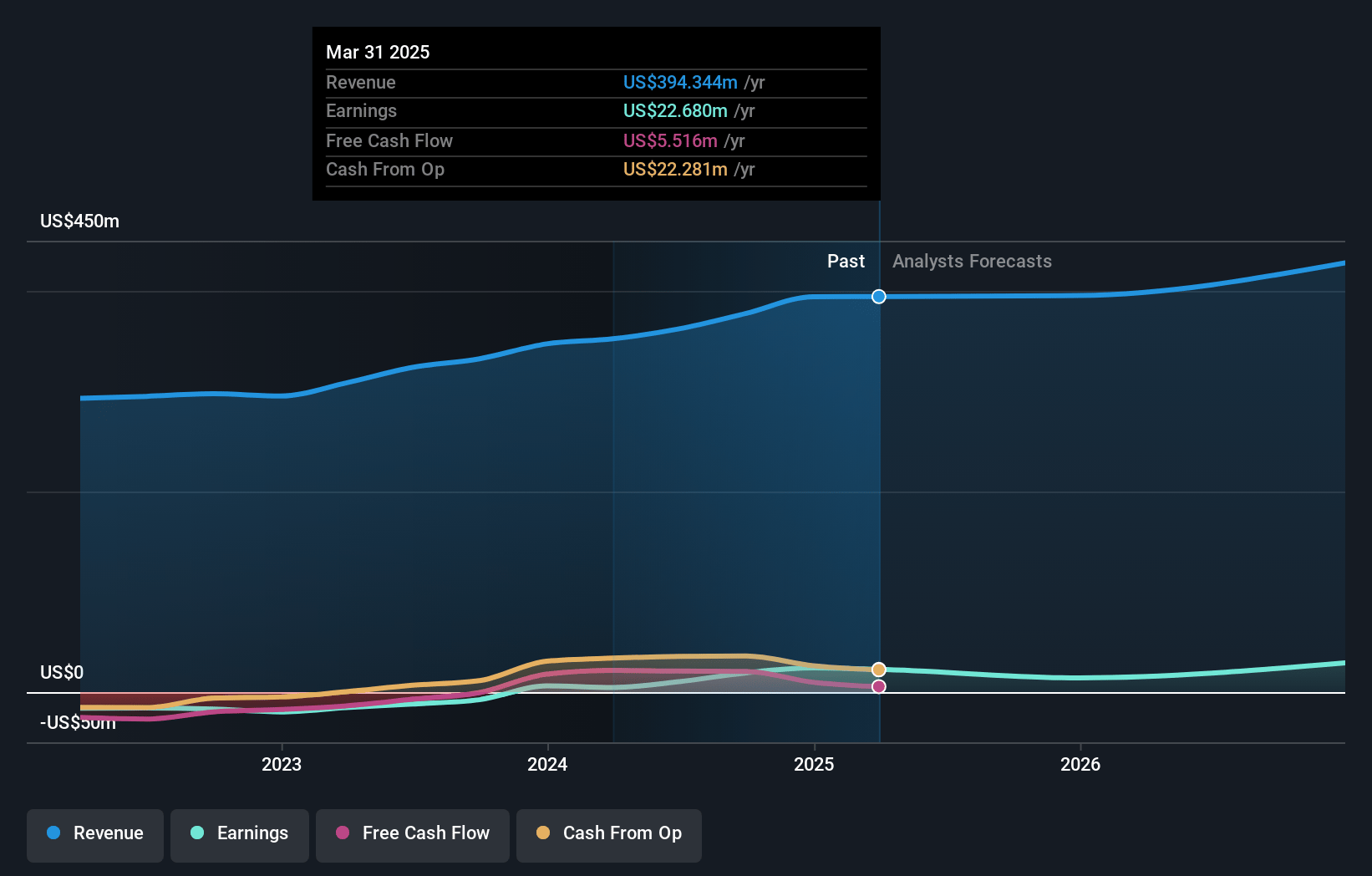

Ceragon Networks Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ceragon Networks compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ceragon Networks's revenue will grow by 5.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.8% today to 7.8% in 3 years time.

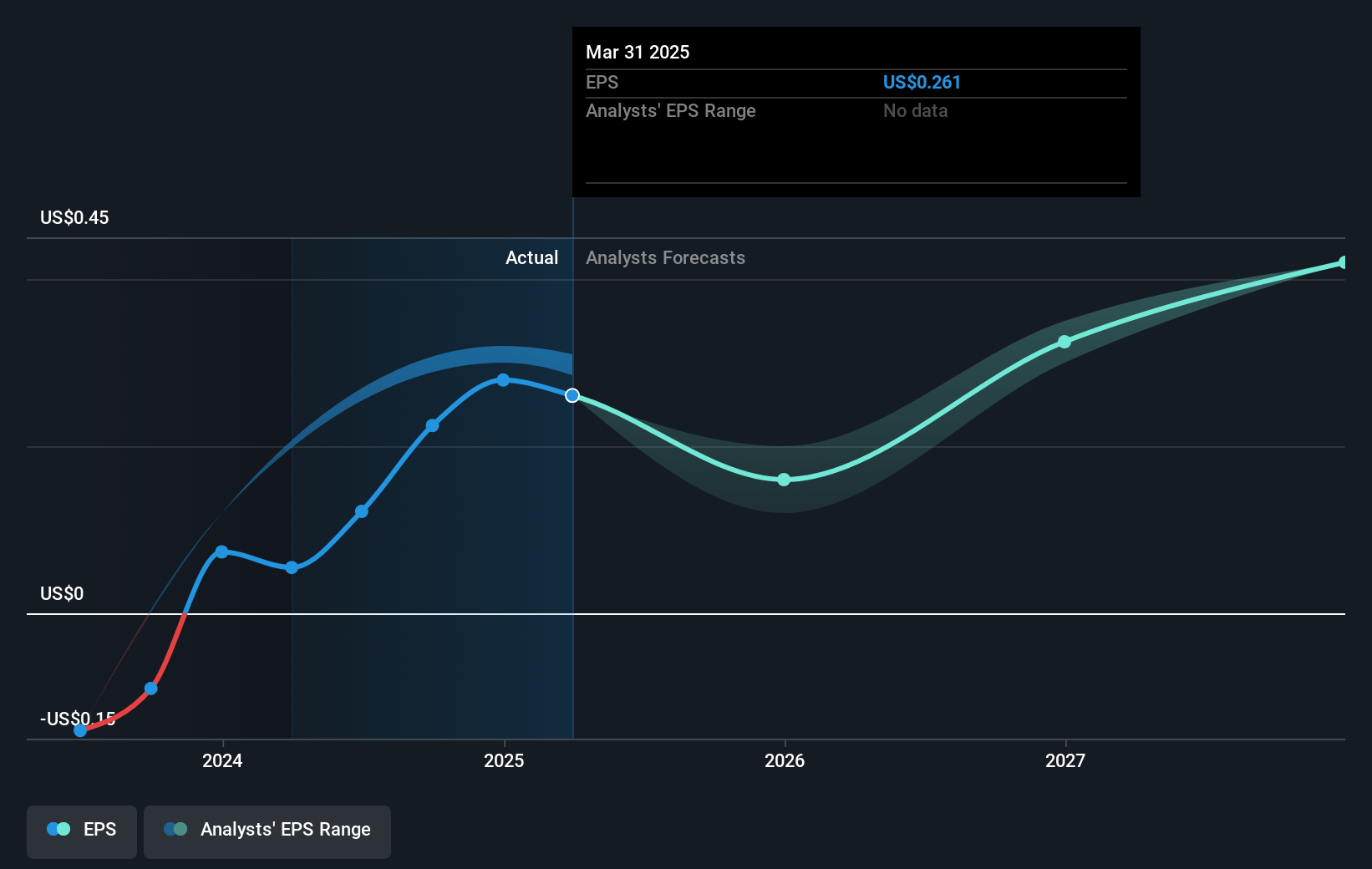

- The bearish analysts expect earnings to reach $36.2 million (and earnings per share of $0.46) by about July 2028, up from $22.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.3x on those 2028 earnings, up from 9.4x today. This future PE is lower than the current PE for the US Communications industry at 28.0x.

- Analysts expect the number of shares outstanding to grow by 3.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.14%, as per the Simply Wall St company report.

Ceragon Networks Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ceragon's heavy reliance on India, where nearly half of revenues now originate and the outlook is driven by major yet concentrated Tier 1 operator projects, exposes the company to market volatility, delayed customer payments, pricing pressure, and unpredictable ordering patterns, all of which increase the risk of revenue swings and margin compression over time.

- The company's gross margin has declined year-on-year from 36.7 percent to 33.5 percent, largely due to regional revenue mix shifts towards lower-margin markets like India, and despite management's expectations of future expansion, the continued dominance of these lower-margin projects could restrict sustainable improvement in net margins.

- While Ceragon's strategy involves expanding recurring revenue and higher-margin software-driven services, the traditional hardware business still dominates and is vulnerable to commoditization and increasing competition from low-cost or larger integrated telecom vendors, potentially leading to further pressure on gross margins and stagnant earnings growth.

- Although key management commentary emphasizes expanded opportunities in North America and Europe, these markets remain much smaller contributors to revenue and are faced with strong incumbent competitors as well as the risk that fiber-optic and alternative backhaul solutions may erode the long-term demand for Ceragon's core wireless products, limiting future revenue growth.

- Ceragon's limited scale versus larger industry players restricts its ability to invest in R&D and new technologies at the pace of the majors, increasing the risk that industry shifts towards virtualized, software-centric, or alternative backhaul (like fiber or satellite) may outpace Ceragon's innovation and thus erode its long-term market share, ultimately limiting its capacity to sustain higher net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ceragon Networks is $4.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ceragon Networks's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $4.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $463.2 million, earnings will come to $36.2 million, and it would be trading on a PE ratio of 16.3x, assuming you use a discount rate of 10.1%.

- Given the current share price of $2.39, the bearish analyst price target of $4.5 is 46.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.