Key Takeaways

- Ceragon is poised for accelerated growth and margin expansion due to market share gains, rapid software transition, and rising demand for wireless backhaul globally.

- Regulatory shifts and operator moves away from Chinese vendors position Ceragon for major contract wins, driving long-term revenue and earnings opportunities.

- Heavy dependence on a few large customers, price competition, supply chain risks, and slow innovation threaten long-term revenue stability and profitability as market dynamics evolve.

Catalysts

About Ceragon Networks- Provides wireless transport solutions for cellular operators and other wireless service providers in North America, Europe, Africa, the Asia Pacific, the Middle East, India, and Latin America.

- Analyst consensus highlights Ceragon's expansion in India and North America as a major growth lever, yet this sharply understates the scale of opportunity: current data shows Ceragon is positioned to capture the majority share of massive, multi-year fixed wireless and E-Band deployments in India, while simultaneously gaining market share from Chinese vendors in Europe, potentially doubling revenue growth expectations beyond current analyst models and driving operating leverage in the next two years.

- While analysts broadly expect software and managed services to lift margins and stabilize earnings over time, Ceragon's rapidly rising private network bookings-combined with a surge in enterprise use cases following the Siklu and E2E acquisitions-indicate that the transition to higher-margin, recurring software revenue may occur faster than expected, setting the stage for gross margins to exceed the 38 percent upper bound previously forecasted, with a sharp positive impact on net margins.

- Rising global urbanization and the exponential explosion in bandwidth demand from applications like AI, IoT, and streaming are causing wireless backhaul deployments to accelerate beyond earlier projections, positioning Ceragon to benefit from a multi-year, non-cyclical demand uptrend that can structurally lift revenues through the end of the decade.

- Ceragon's demonstrated ability to engineer cost-optimized, high-performance solutions for price-sensitive, high-growth markets-like India-gives it a critical long-term advantage as operators worldwide seek to migrate away from energy-intensive legacy infrastructure, ensuring a sustained pipeline of product upgrade cycles that could drive both higher sales volumes and margin expansion.

- Evolving global telecom regulation and geopolitical trends are creating new opportunities for Ceragon to win Tier 1 contracts in Europe and other regions as operators seek to diversify away from Chinese suppliers, unlocking untapped large-scale deals that could significantly increase both top-line growth and earnings power over the next several years.

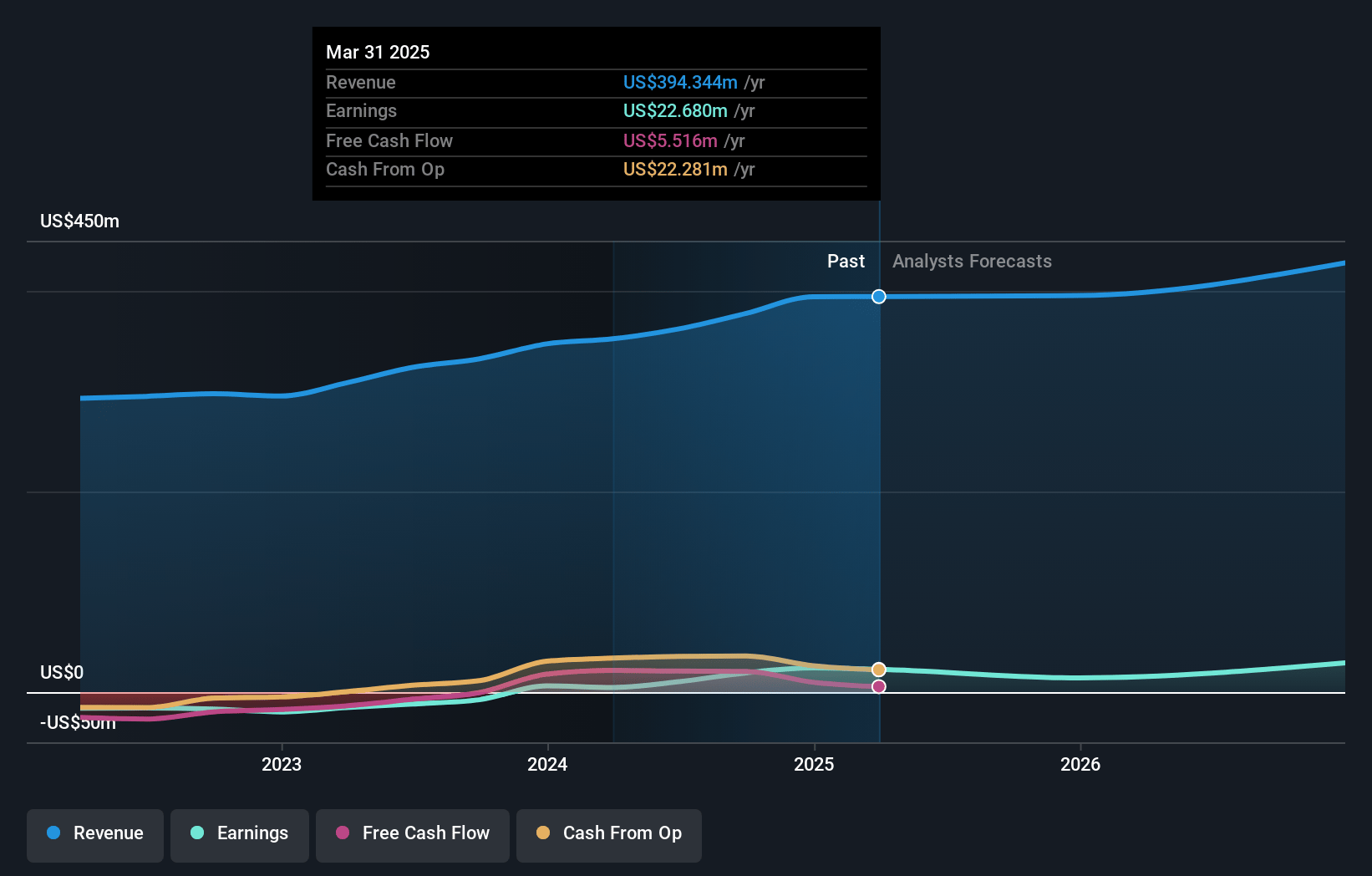

Ceragon Networks Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ceragon Networks compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ceragon Networks's revenue will grow by 5.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.8% today to 9.6% in 3 years time.

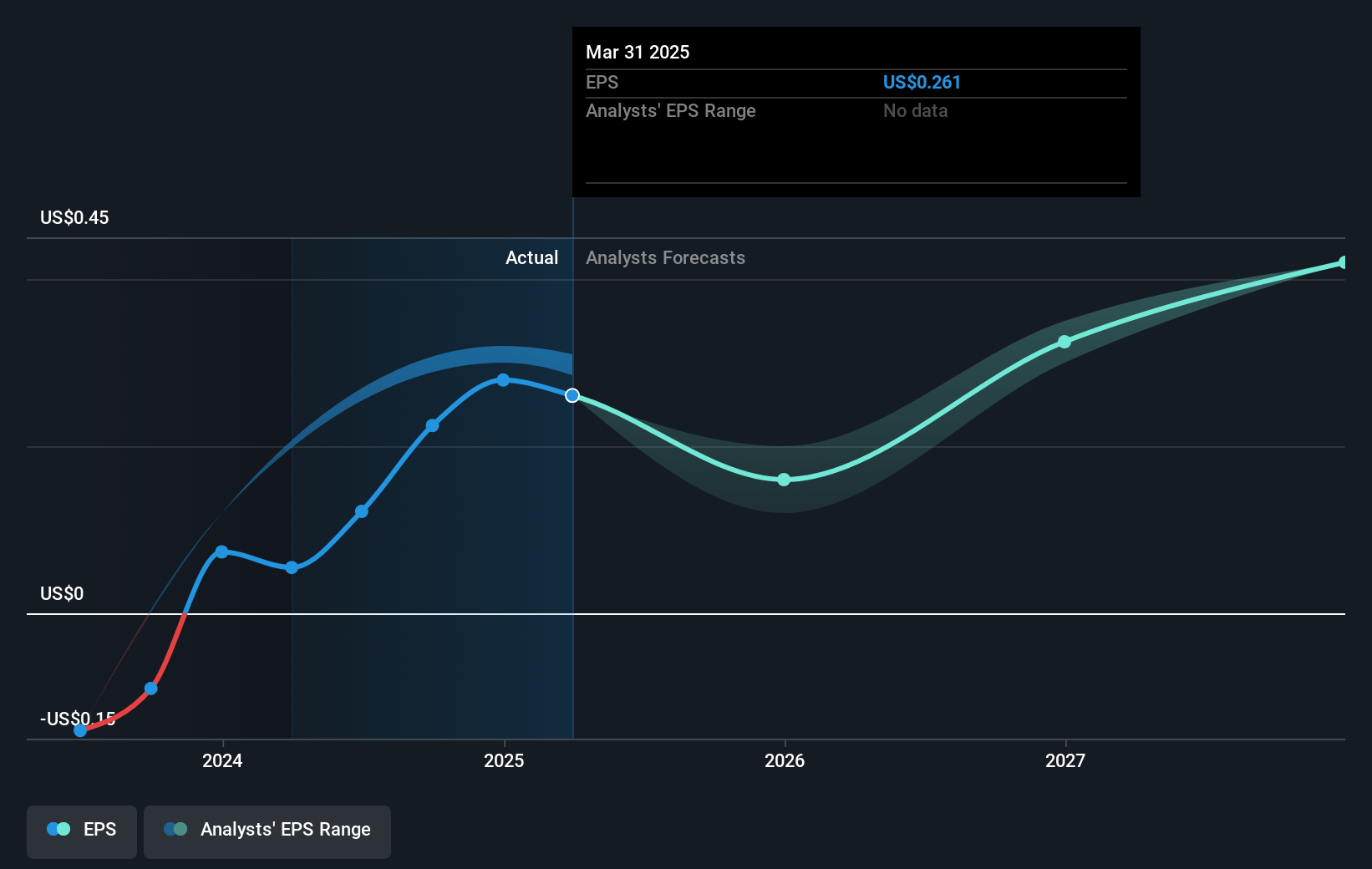

- The bullish analysts expect earnings to reach $44.7 million (and earnings per share of $0.46) by about July 2028, up from $22.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 29.2x on those 2028 earnings, up from 9.6x today. This future PE is greater than the current PE for the US Communications industry at 28.6x.

- Analysts expect the number of shares outstanding to grow by 3.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.11%, as per the Simply Wall St company report.

Ceragon Networks Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Overreliance on the Indian market and a small number of large customers, as evidenced by nearly half of revenues and bookings coming from just two or three major operators in India, creates significant earnings risk if spending patterns change or major projects are delayed, which may drive revenue volatility and hit overall earnings stability.

- Long-term industry shift toward fiber optic backhaul by telecom operators for superior bandwidth and reliability could reduce demand for Ceragon's core wireless backhaul hardware in key markets, shrinking the company's addressable market and impacting long-term revenue growth.

- Intense competition from large Asian vendors and constant pressure from customers in cost-sensitive markets like India are driving down selling prices, as reflected in the declining gross margins from 36.7 percent to 33.5 percent year over year, which may compress net margins and operating profitability further if price wars persist.

- Ongoing global supply chain instability and trade barriers, including persistent tariff dynamics and uncertainty in sourcing components, create risk of delayed deliveries and higher input costs, which could lower gross profit and hurt net margins, especially as Ceragon's manufacturing relies on cost efficiencies in global supply chains.

- Limited growth in R&D spending and the potential for lagging innovation pose a risk that Ceragon's solutions may fall behind in rapidly evolving technological areas such as advanced 5G/6G or Open RAN, which could lead to product obsolescence, loss of market share, and eventually declining revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ceragon Networks is $10.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ceragon Networks's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $4.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $464.5 million, earnings will come to $44.7 million, and it would be trading on a PE ratio of 29.2x, assuming you use a discount rate of 10.1%.

- Given the current share price of $2.46, the bullish analyst price target of $10.0 is 75.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.