Key Takeaways

- Growing demand for digital marketing analytics and AI-powered solutions is fueling increased customer acquisition, retention, and recurring revenue for Semrush.

- Expansion into enterprise markets and innovative product offerings position the company for higher margins, pricing power, and sustained profit growth.

- Industry shifts toward AI, data privacy challenges, platform consolidation, competitive pressure, and reliance on small businesses threaten Semrush’s growth, differentiation, and financial stability.

Catalysts

About Semrush Holdings- Develops an online visibility management software-as-a-service platform in the United States, the United Kingdom, and internationally.

- The ongoing shift of business activity and marketing to digital channels is fueling demand for analytics and online visibility solutions, which directly expands Semrush’s addressable market and underpins expectations for durable double-digit revenue growth in the coming years.

- Rapid adoption of e-commerce globally is forcing businesses to compete on search visibility, leading to higher reliance on Semrush’s SEO and AI-driven tools, and boosting customer acquisition, retention, and the company’s recurring revenue base.

- The launch and expansion of AI-powered products, including the AI Toolkit and new AI Optimization solution, is expected to drive significant incremental growth through higher-value enterprise deals, increased average contract values, and further differentiation, ultimately supporting both top-line revenue and margin expansion.

- Accelerated penetration in the enterprise segment, with an expanding pipeline and recent success in acquiring enterprise customers with much higher annual contract values, is poised to improve overall ARPU (average revenue per user), raise revenue retention rates, and generate outsized contribution to net income and free cash flow growth.

- As companies face growing complexity in digital marketing and data-driven decision making, Semrush’s integrated, data-rich platform is uniquely positioned to become the essential analytics partner for modern businesses, leading to higher pricing power and the potential for sustained improvements in operating margins and net earnings.

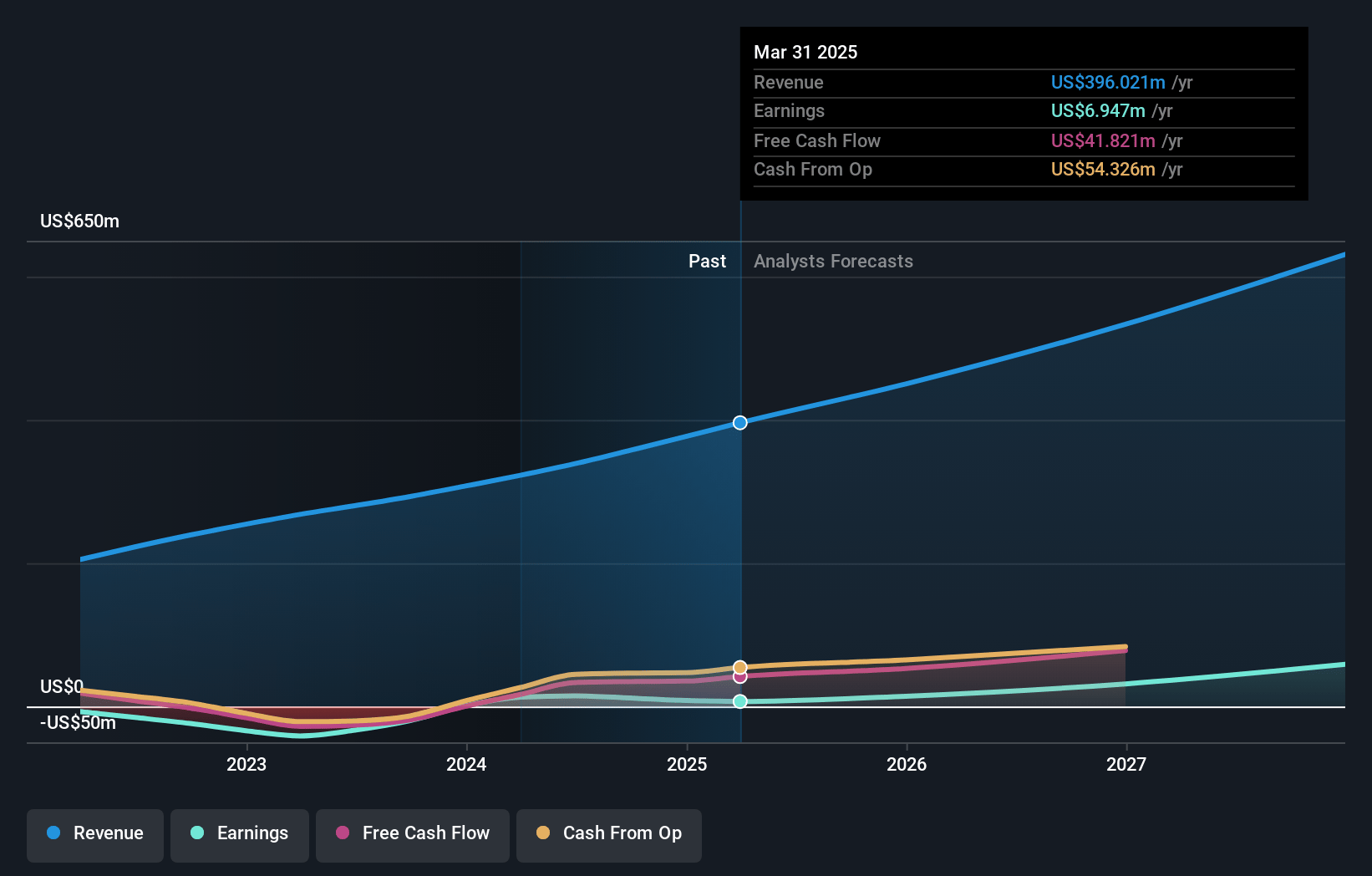

Semrush Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Semrush Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Semrush Holdings's revenue will grow by 21.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.8% today to 10.7% in 3 years time.

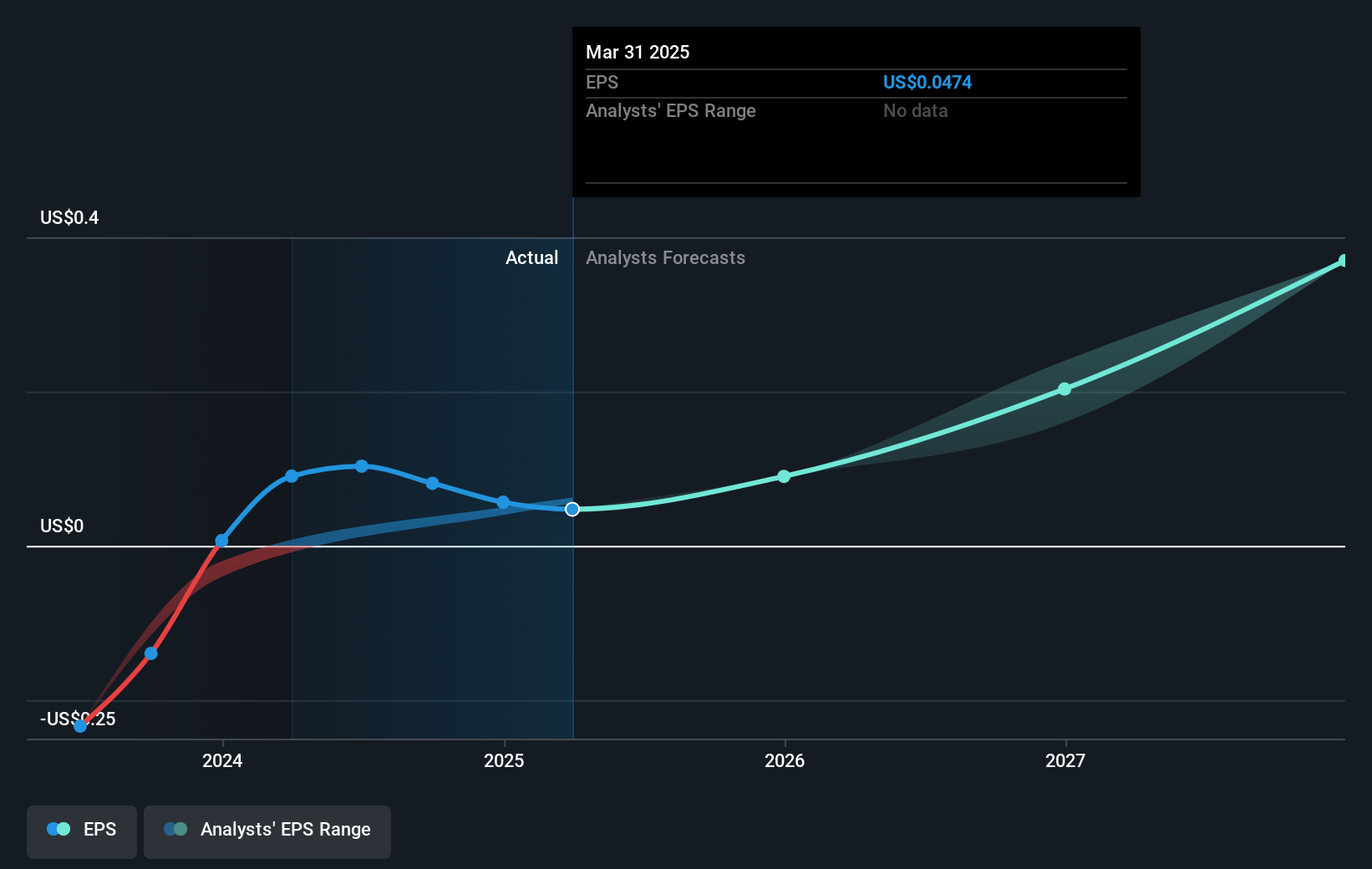

- The bullish analysts expect earnings to reach $75.7 million (and earnings per share of $0.48) by about July 2028, up from $6.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 45.7x on those 2028 earnings, down from 209.0x today. This future PE is greater than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to grow by 1.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.91%, as per the Simply Wall St company report.

Semrush Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid shift toward AI-generated content, answer engines, and voice search threatens to undermine the long-term relevance of traditional SEO tools, which still form the base of Semrush’s product set, putting future customer demand and recurring revenues at risk as the industry evolves.

- New and tightening privacy regulations and global data rules could further limit the amount and quality of third-party data available, weakening Semrush’s data platform differentiation and impairing its ability to deliver core analytical functions, with possible negative consequences for sales growth and margin expansion.

- The ongoing concentration of web traffic and digital ad budgets within closed ecosystems like Google, Facebook, and emerging platforms may reduce SEO’s share of digital marketing spending and decrease the overall market opportunity for Semrush, impacting top-line revenue growth as well as net revenue retention.

- Increasing competition from integrated marketing suites offered by large CRM and cloud vendors threatens Semrush’s appeal as a standalone product, potentially forcing the company to invest heavily in R&D and marketing to maintain market share, which would compress operating margins and reduce free cash flow even as revenue grows.

- High exposure to SMB customers leaves Semrush vulnerable to macroeconomic slowdowns and digital advertising pullbacks, increasing churn risk and adding unpredictability to revenues and net earnings, especially as customer retention metrics have begun to show signs of stabilization rather than improvement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Semrush Holdings is $18.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Semrush Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $707.9 million, earnings will come to $75.7 million, and it would be trading on a PE ratio of 45.7x, assuming you use a discount rate of 7.9%.

- Given the current share price of $9.8, the bullish analyst price target of $18.0 is 45.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.