Key Takeaways

- Expanding AI and analytics drive growth among large clients, but rising privacy rules, platform shifts, and competition threaten data collection, pricing power, and feature relevance.

- Heavy reliance on SMBs and traditional SEO faces risk from market stagnation and evolving consumer search habits, challenging user growth and long-term product differentiation.

- Shifting digital search trends, regulatory and data challenges, increased competition, and foreign exchange exposure threaten Semrush’s core offerings, pricing power, and long-term revenue growth.

Catalysts

About Semrush Holdings- Develops an online visibility management software-as-a-service platform in the United States, the United Kingdom, and internationally.

- While Semrush's rapid expansion in AI-driven solutions and its strong data platform support further ARPU growth and customer retention, the ongoing deprecation of third-party cookies and rising global privacy regulations could reduce data collection capability over time, undermining the long-term sustainability of revenue growth.

- Despite robust enterprise momentum and a growing portion of high-value clients fueling improvements in net margins, further reliance on AI-powered tools may accelerate the commoditization of search and digital marketing functions, potentially eroding the differentiated value that justifies Semrush’s premium pricing and limiting future top-line expansion.

- Although global customer growth, especially among large enterprises, remains strong and feeds a solid dollar-based net revenue retention rate, prolonged stagnation or contraction in small business creation in core markets could shrink the company’s primary SMB customer base, restraining total user expansion and long-term revenue mix diversity.

- While ongoing investment in expanding and integrating new analytics tools increases wallet share and ARPU among higher-value segments, intensifying competitive pressure from bundled martech tools offered by larger tech firms could force Semrush to lower pricing or increase spend, compressing net margins even as revenue scales.

- Even with the surge in demand for AI optimization products and the promise of higher-value enterprise sales, evolving consumer search behavior toward voice, social media, and app-based discovery risks diminishing the centrality of traditional SEO and keyword analytics, jeopardizing the relevance of Semrush’s core offerings and putting future ARR growth at risk.

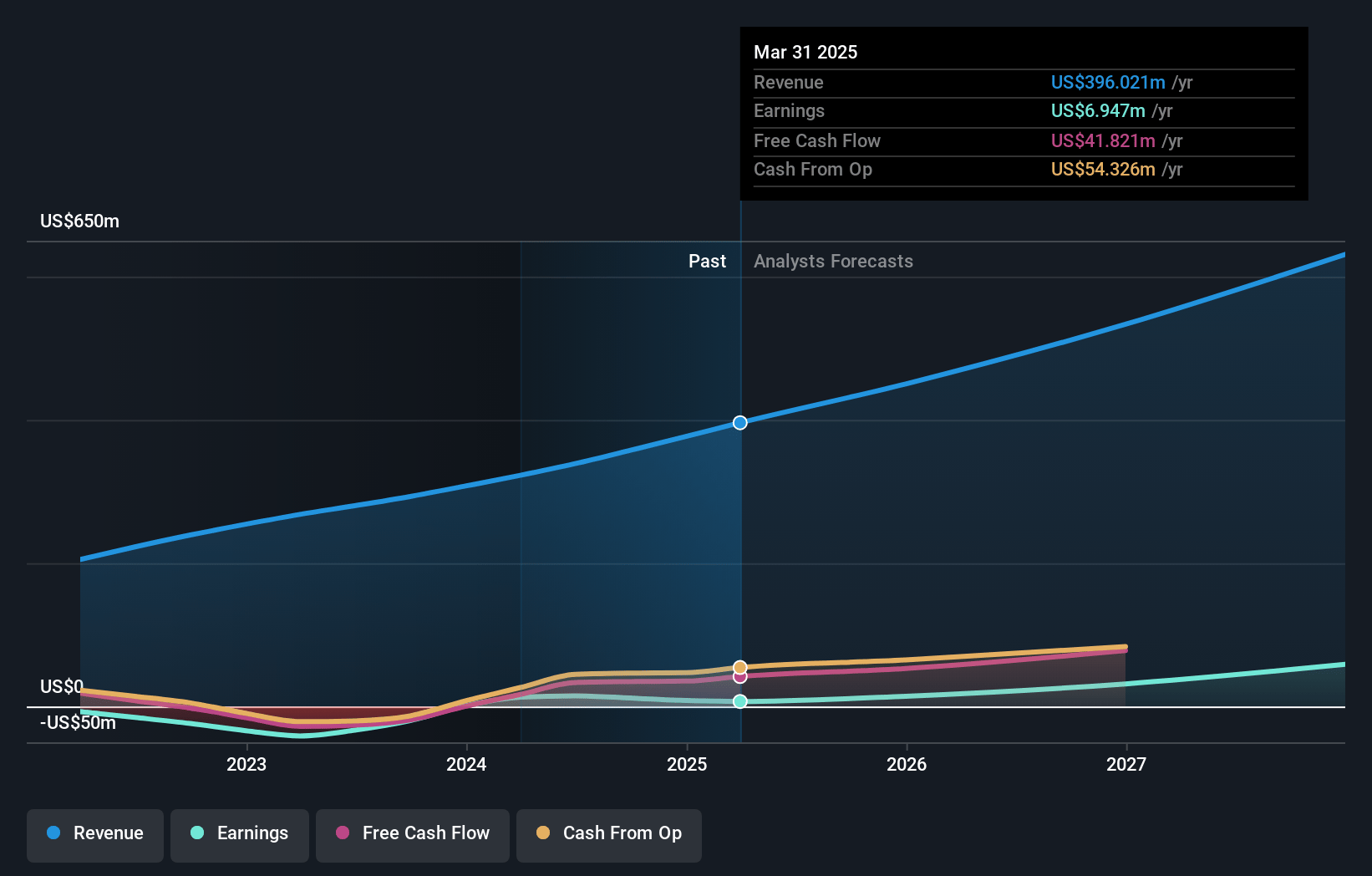

Semrush Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Semrush Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Semrush Holdings's revenue will grow by 19.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.8% today to 11.3% in 3 years time.

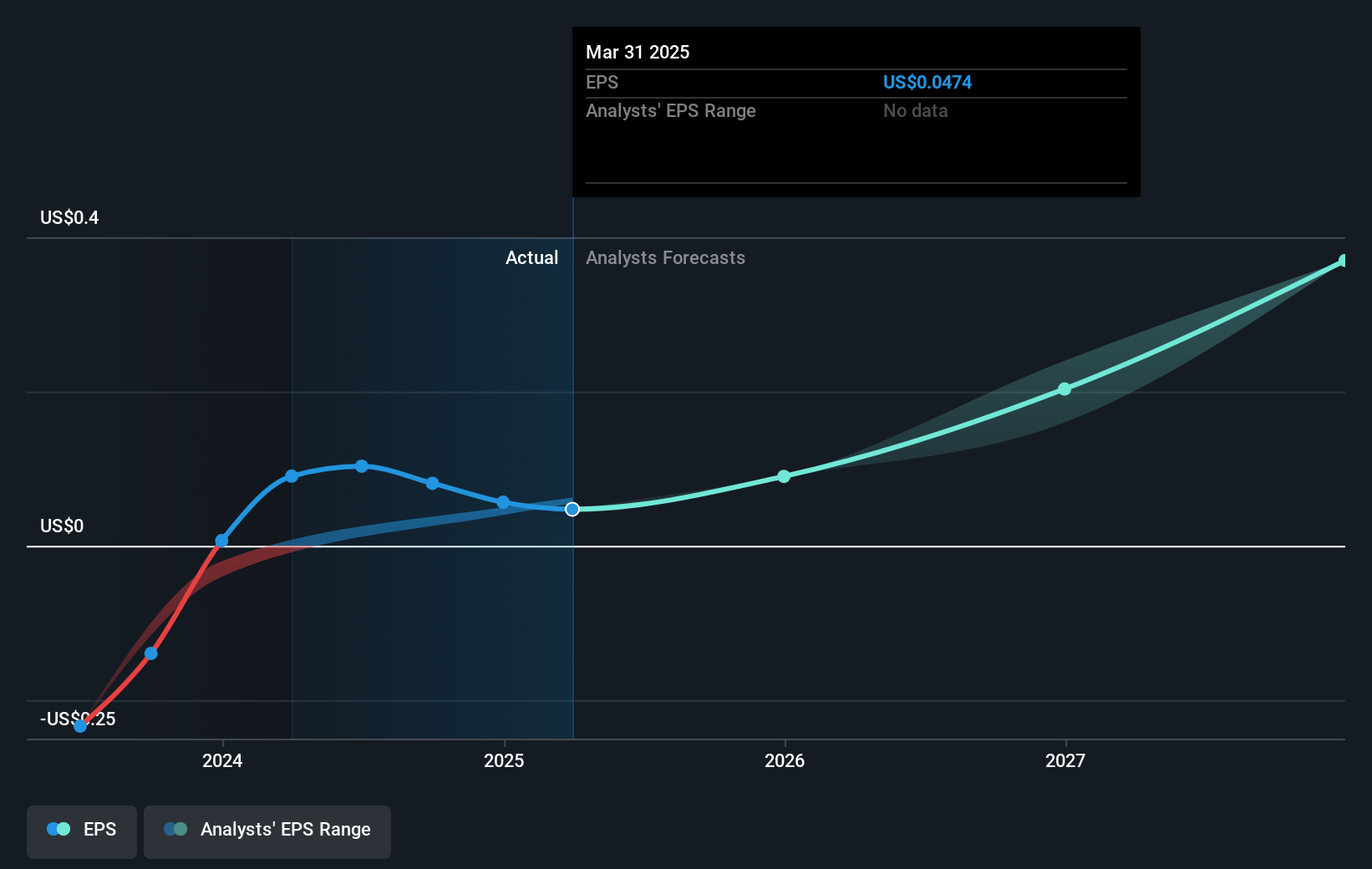

- The bearish analysts expect earnings to reach $75.7 million (and earnings per share of $0.48) by about July 2028, up from $6.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 30.5x on those 2028 earnings, down from 213.3x today. This future PE is lower than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to grow by 1.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.9%, as per the Simply Wall St company report.

Semrush Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing shift of digital search behavior toward AI-driven answer engines, and away from traditional search—including large technology players integrating generative AI such as ChatGPT, Perplexity, and Claude into consumer search experiences—could decrease the relevance of traditional SEO analytics and core keyword research platform products, which may shrink Semrush’s core market and impact its long-term revenues.

- Semrush’s growth strategy is increasingly reliant on upselling to and expanding within the enterprise segment, yet elongated enterprise sales cycles and the relatively early-stage adoption of its new enterprise solutions create execution risk; failure to maintain this pace or convert pipeline could result in lower than expected enterprise customer growth, suppressing average revenue per user and delaying anticipated improvements in margins and earnings.

- Rising privacy regulations globally and recent changes in data collection policies threaten the depth and quality of marketing data available to analytics providers; any significant tightening in data access could restrict Semrush’s ability to deliver high-value insights, diminishing the effectiveness of its solutions and putting downward pressure on subscription growth and recurring revenue.

- Intense competition from larger SaaS platforms able to bundle similar features at lower cost, as well as in-house analytics development among large enterprise customers, risks undermining Semrush’s pricing power and market share, which may compress net margins and reduce the sustainability of revenue growth.

- The company’s cost structure is exposed to foreign exchange fluctuations—with 30 percent of expenses in euros and revenue denominated entirely in US dollars—leaving operating margins and earnings vulnerable to currency swings, as highlighted by the recent $8 million exchange rate headwind absorbed in 2025 guidance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Semrush Holdings is $12.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Semrush Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $672.3 million, earnings will come to $75.7 million, and it would be trading on a PE ratio of 30.5x, assuming you use a discount rate of 7.9%.

- Given the current share price of $10.0, the bearish analyst price target of $12.0 is 16.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.