Narratives are currently in beta

Key Takeaways

- Expectation of rapid revenue growth from AI deployment might overestimate sustained high growth rates, risking stock overvaluation if market adoption lags.

- Significant investments in AI and partnerships could inflate earnings forecasts, facing challenges from market slowdowns or competitive pressures.

- Palantir's growth in U.S. markets and strategic partnerships indicate strong revenue streams and long-term financial stability through differentiated offerings and market credibility.

Catalysts

About Palantir Technologies- Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

- Palantir's rapid growth expectations due to the AI revolution, with a significant focus on deploying AI models in production, suggest expectations for revenue growth, but may lead to an overestimation of sustained high growth rates.

- The push to leverage AI models and the commoditization of cognition is seen as a catalyst for differentiation, which might inflate expectations for net margins and earnings, assuming successful implementation in enterprise contexts.

- The continued investment in AIP and technical talent amidst macroeconomic uncertainties may imply pressures on operating margins and profitability if the anticipated demand does not materialize as expected.

- The narrative of a winner-takes-all AI economy and aggressive expansion strategies might lead investors to anticipate outsized financial performance, potentially driving stock overvaluation if market adoption lags.

- Increasing investment and partnerships in defense and commercial segments to capitalize on AI adoption, while expanding profitability expectations, might lead to inflated earnings forecasts not fully capturing potential market slowdowns or competitive challenges.

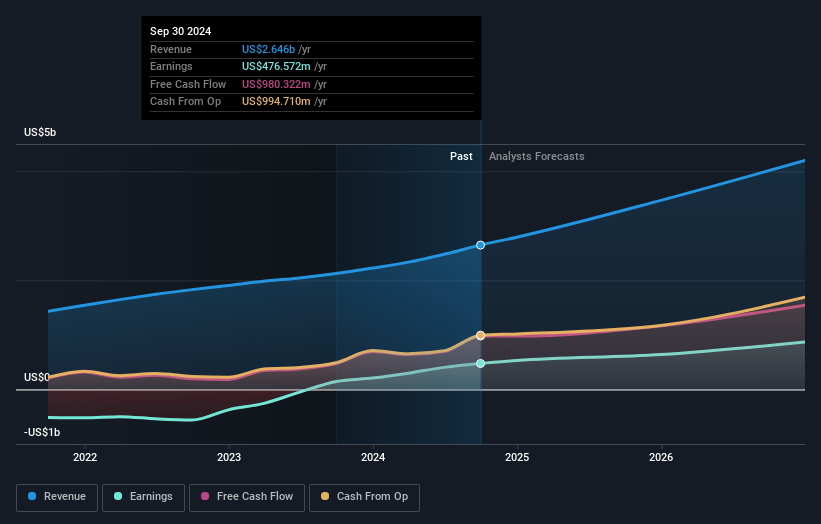

Palantir Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Palantir Technologies's revenue will grow by 23.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 18.0% today to 23.0% in 3 years time.

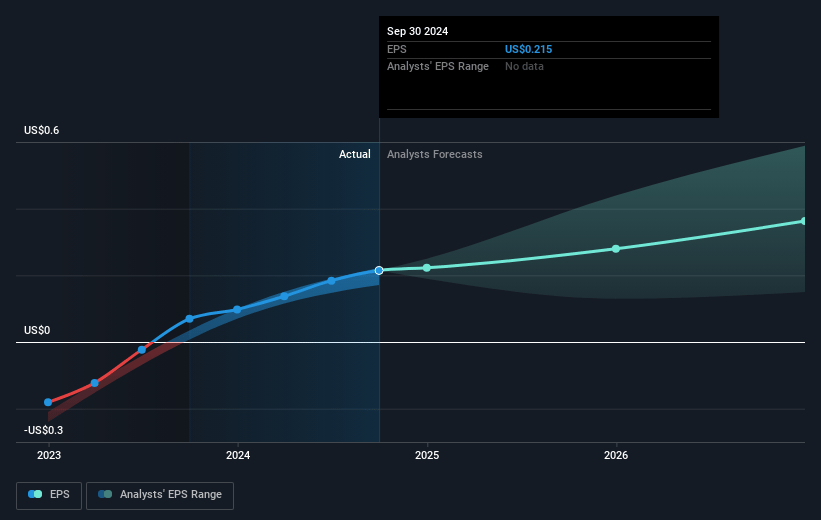

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $0.48) by about November 2027, up from $476.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 82.7x on those 2027 earnings, down from 240.3x today. This future PE is greater than the current PE for the US Software industry at 35.5x.

- Analysts expect the number of shares outstanding to grow by 1.87% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 6.66%, as per the Simply Wall St company report.

Palantir Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Palantir's strong revenue growth, including a 30% year-over-year increase and exceptional growth in the U.S. market, suggests robust demand for its products and potential for continued revenue expansion.

- The company's inclusion in the S&P 500 and sustained profitability underscore its market credibility and potential for long-term financial stability and earnings growth.

- Palantir's focus on leveraging AI models in production and its ability to demonstrate quantifiable improvements for clients could result in differentiated offerings that support revenue growth and improving net margins.

- The expansion of contracts with the U.S. government and commercial clients indicates both a strong current revenue stream and future growth opportunities, potentially leading to improved earnings.

- The development of partnerships with defense tech firms, alongside increasing deal values and customer count, suggests a positive trajectory for revenue growth and strategic market positioning.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $32.72 for Palantir Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $55.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $4.9 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 82.7x, assuming you use a discount rate of 6.7%.

- Given the current share price of $51.13, the analyst's price target of $32.72 is 56.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

US$20.60

FV

169.6% overvalued intrinsic discount29.00%

Revenue growth p.a.

21users have liked this narrative

0users have commented on this narrative

11users have followed this narrative

4 months ago author updated this narrative