Last Update07 May 25Fair value Increased 1.77%

Key Takeaways

- Expansion of digital commerce and the creator economy strengthens demand for GoDaddy’s core and value-added products, supporting sustained customer growth and increased revenue per user.

- Strategic investments in AI, product bundling, and international reach enhance customer engagement, improve retention, and contribute to ongoing top-line and profitability growth.

- Cloud-based builders, integrated SaaS ecosystems, commoditization, and platform consolidation threaten GoDaddy’s traditional business model, margins, and customer retention.

Catalysts

About GoDaddy- Engages in the design and development of cloud-based products in the United States and internationally.

- GoDaddy is positioned to capitalize on the global increase in digital commerce and demand for online presence, as millions of small businesses, entrepreneurs, and creators continue to seek tools for establishing a digital footprint. This expanding market increases demand for core domain registration, web hosting, and value-added solutions, supporting sustained revenue and ARR growth for years to come.

- The acceleration of the freelance and creator economy is expanding the need for personal branding, e-commerce enablement, and digital portfolios—all areas where GoDaddy’s suite of products is directly aligned—positioning the company to capture higher customer lifetime value and drive a compounded increase in average revenue per user.

- GoDaddy’s long-term investment in AI-powered products, particularly through Airo and the forthcoming Agentic AI, is driving higher product attach rates, deeper customer engagement, and increased second and third product sales, which collectively enhance net margins and lay the groundwork for meaningful earnings expansion as the AI platform matures and automates more customer-facing tasks.

- Strategic execution on pricing and bundling initiatives, along with the platform's enhanced ability to rapidly integrate both proprietary and third-party products into tailored bundles, is already resulting in higher average order size and improved retention. These factors boost both top-line revenue and profitability, and the multiyear nature of these initiatives points to persistent uplift in future financials.

- GoDaddy’s international expansion, supported by strengthening internet access and mobile penetration in emerging markets, is yielding double-digit international revenue growth while broadening the addressable market. This trend is expected to be a durable driver of revenue growth as the company continues to localize offerings and tap into new customer segments globally.

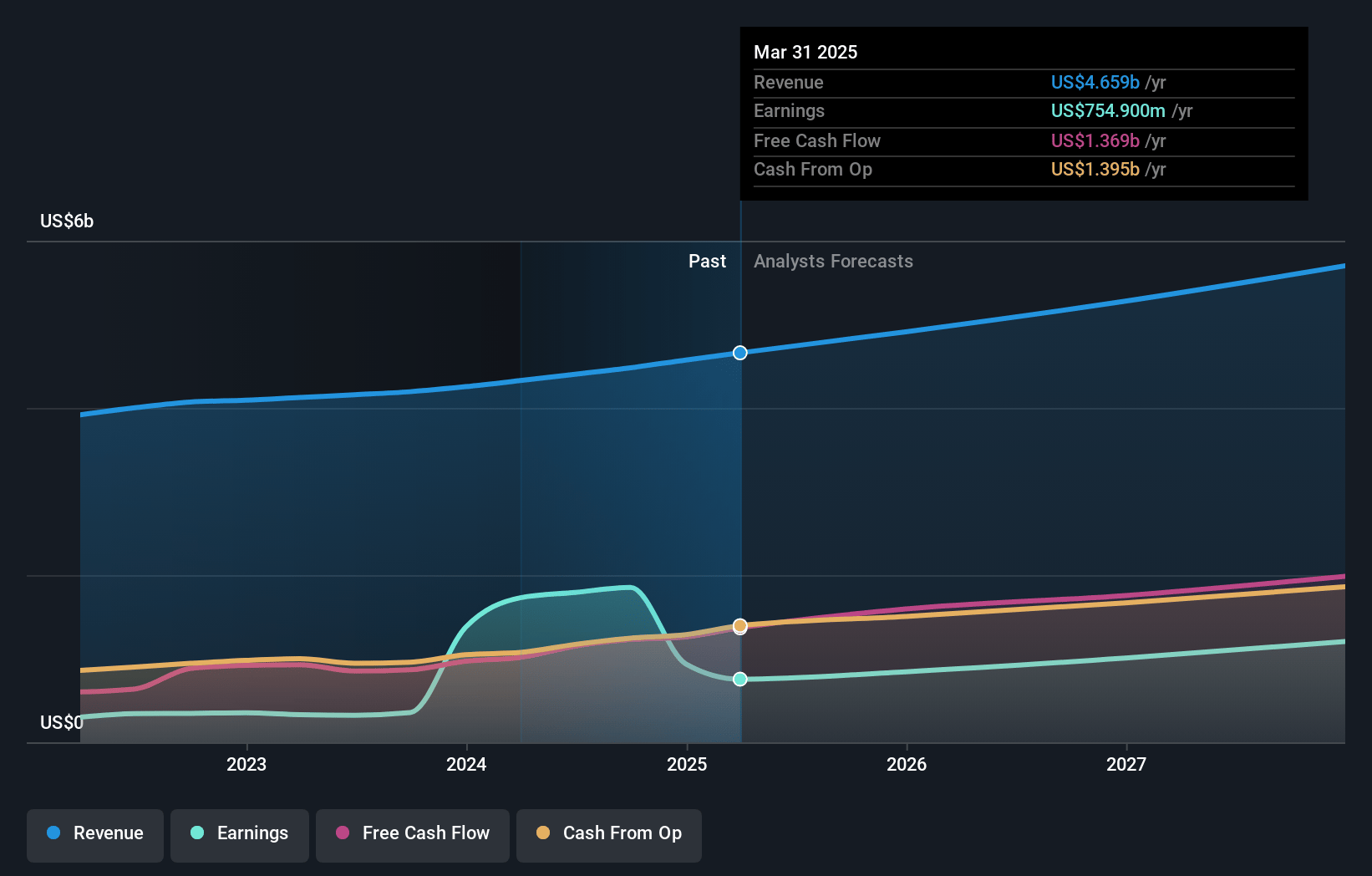

GoDaddy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on GoDaddy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming GoDaddy's revenue will grow by 8.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.2% today to 22.6% in 3 years time.

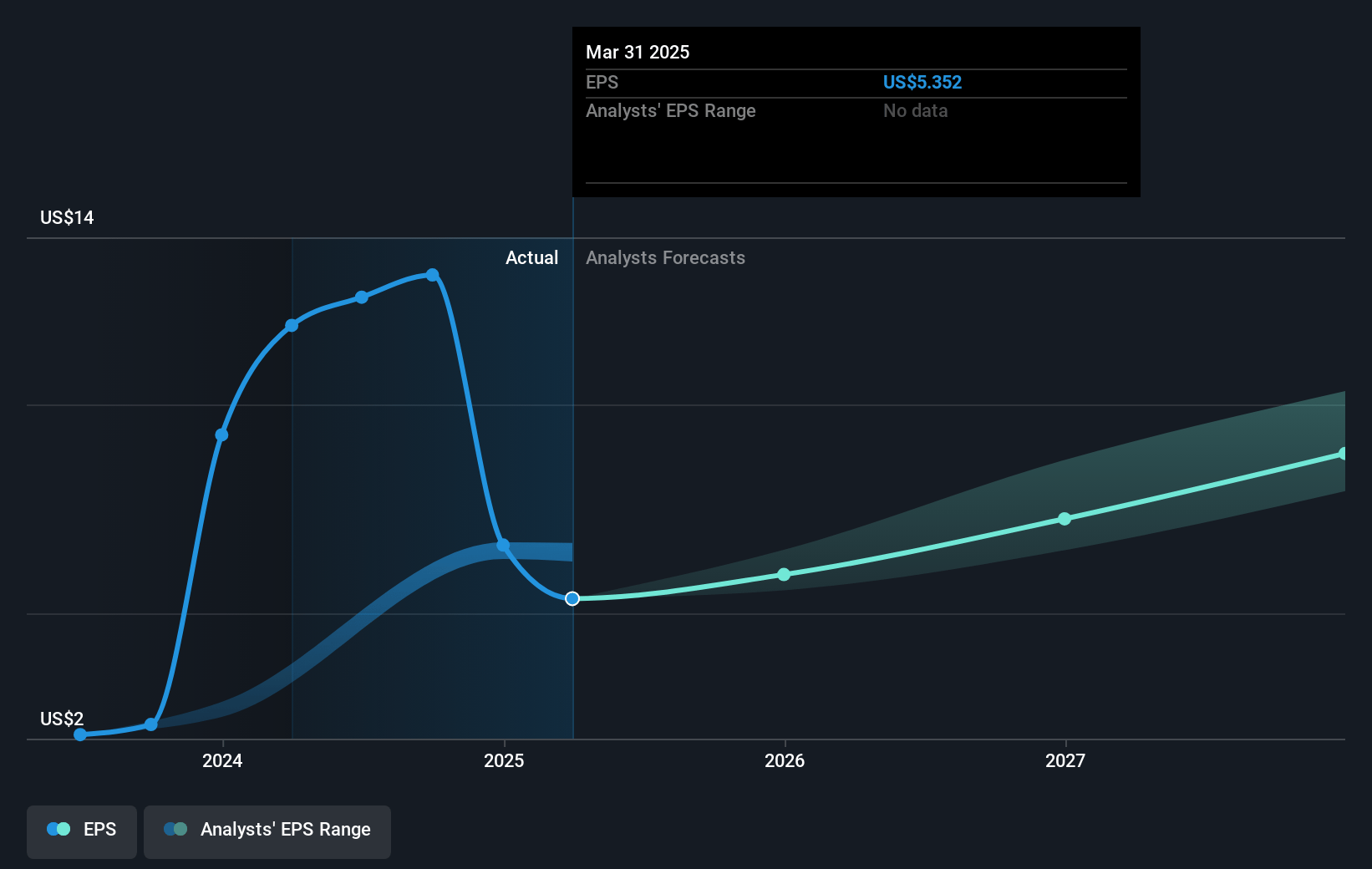

- The bullish analysts expect earnings to reach $1.3 billion (and earnings per share of $10.27) by about May 2028, up from $754.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 34.6x on those 2028 earnings, up from 34.5x today. This future PE is greater than the current PE for the US IT industry at 31.8x.

- Analysts expect the number of shares outstanding to grow by 1.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.2%, as per the Simply Wall St company report.

GoDaddy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rising adoption of cloud-based and no-code website builders could sharply reduce demand for GoDaddy’s legacy domain registration and web hosting services, which may erode their addressable market and put severe pressure on long-term revenue growth.

- Increased customer expectations for integrated, end-to-end SaaS ecosystems offered by competitors such as Shopify, Wix, and Squarespace may accelerate customer churn if GoDaddy cannot develop compelling, innovative solutions beyond domain registration and basic hosting, threatening future earnings growth.

- Ongoing commoditization in core products like domains and web hosting, combined with GoDaddy’s heavy reliance on upselling legacy solutions, could lead to sustained margin erosion and limit GoDaddy’s ability to maintain or grow net margins over time.

- Intensifying cybersecurity risks and privacy regulatory requirements may drive customers toward specialized providers with more advanced security offerings while also increasing GoDaddy’s operational complexity and compliance costs, thereby negatively affecting profitability.

- The consolidation and dominance of large digital platforms — such as social networks and online marketplaces — reduces the necessity for small businesses to operate independent websites, directly undermining GoDaddy’s customer acquisition and retention rates and putting downward pressure on recurring revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for GoDaddy is $250.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of GoDaddy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $250.0, and the most bearish reporting a price target of just $150.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.9 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 34.6x, assuming you use a discount rate of 8.2%.

- Given the current share price of $182.54, the bullish analyst price target of $250.0 is 27.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.