Key Takeaways

- Strong AI integration and platform unification are driving customer retention, product differentiation, and expanding long-term revenue opportunities worldwide.

- Operational efficiency and global market expansion are supporting sustained margin and earnings growth across diverse industries and geographies.

- Competitive threats, pricing model changes, product complexity, regulatory pressures, and leadership turnover create risks to innovation, margins, and earnings stability.

Catalysts

About Salesforce- Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

- The rapid adoption of Agentforce and expansion of AI-driven workflows across Salesforce's customer base, with over 3,000 paying customers in the first quarter post-launch and strong ROI metrics, signals a multi-year growth runway as enterprises increasingly shift toward digital labor. This should drive accelerating revenue and higher average contract value over the next several years.

- Demand for unified customer engagement, automation, and advanced analytics continues to surge as organizations accelerate their digital transformation, with Salesforce's tightly integrated Customer 360 platform, Data Cloud, and agentic layer uniquely positioned to meet this need. This integration is expected to increase customer stickiness, boost cross-sell and upsell rates, and extend long-term revenue commitments visible in the record $63.4 billion RPO.

- The explosion of AI and generative technologies in business is leading to persistent enterprise demand for scalable, trusted platforms with embedded intelligence. Salesforce’s early lead in embedding AI agents into its core cloud applications not only enhances product differentiation but is anticipated to grow margins and support premium pricing as customers transition to digital labor at scale.

- Ongoing margin expansion driven by automation, operational efficiency, and partner-led implementation is expected to result in durable net margin growth, as highlighted by the company's guidance for rising non-GAAP operating margins and double-digit free cash flow growth, even as Salesforce invests in AI innovation and international expansion.

- Salesforce’s broadening international and industry vertical penetration, with nearly half of major recent bookings from outside the Americas and significant momentum in sectors like life sciences, public sector, and manufacturing, greatly expands its addressable market. This global and vertical diversification should underpin sustainable double-digit revenue and earnings growth well beyond fiscal year 2026.

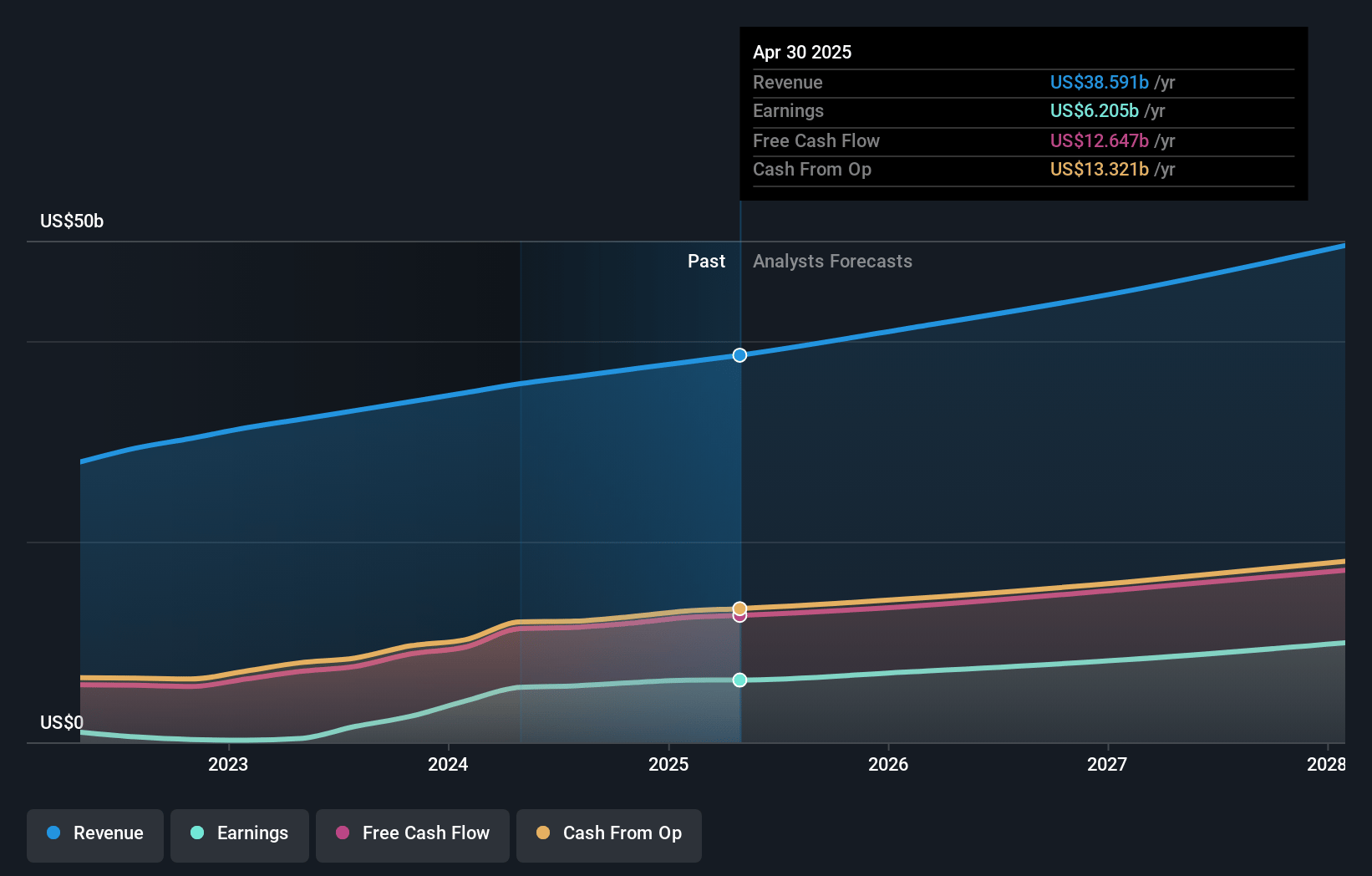

Salesforce Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Salesforce compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Salesforce's revenue will grow by 12.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.4% today to 19.6% in 3 years time.

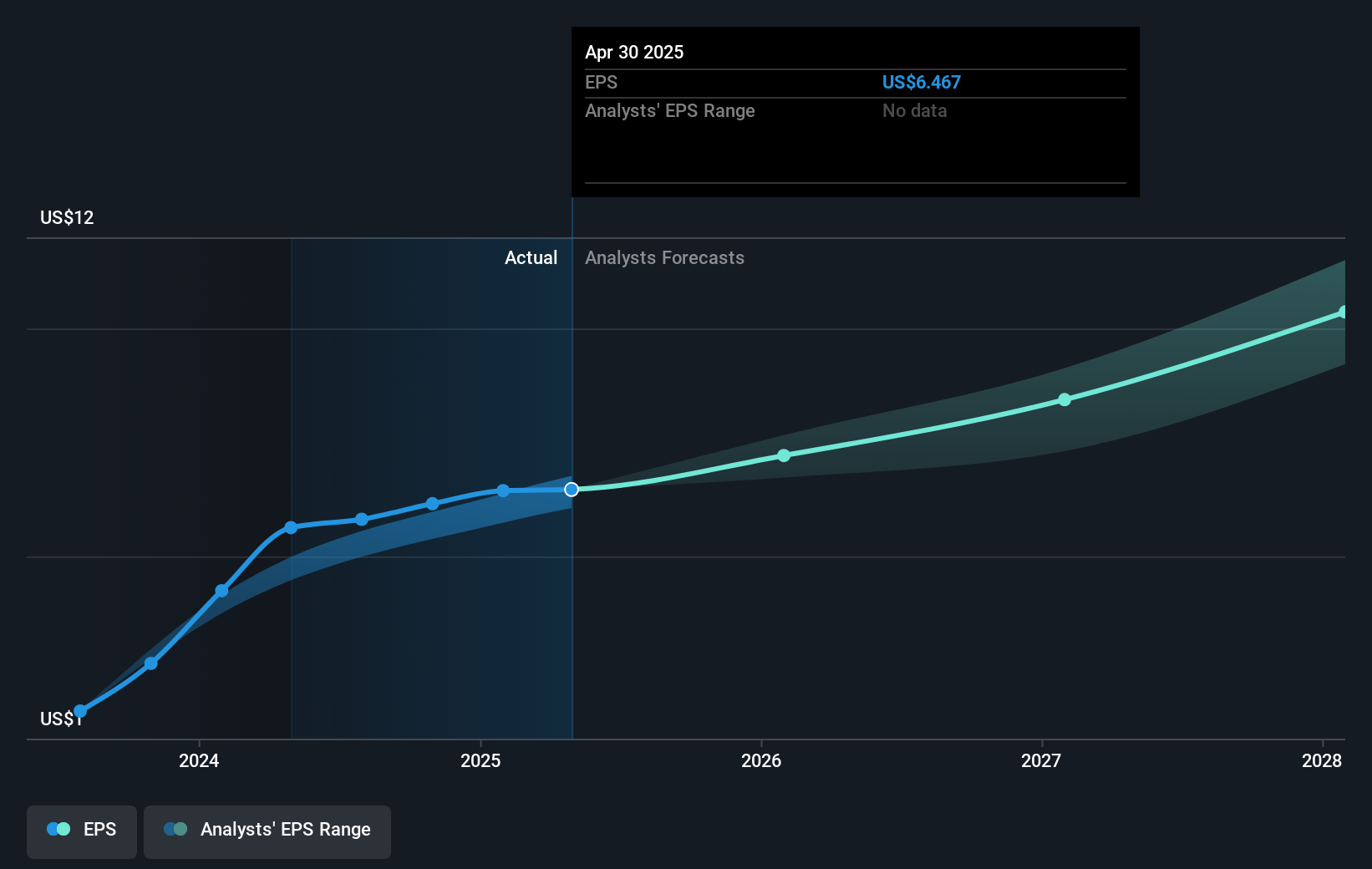

- The bullish analysts expect earnings to reach $10.6 billion (and earnings per share of $11.47) by about April 2028, up from $6.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 48.7x on those 2028 earnings, up from 38.3x today. This future PE is greater than the current PE for the US Software industry at 30.0x.

- Analysts expect the number of shares outstanding to decline by 0.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.72%, as per the Simply Wall St company report.

Salesforce Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shift toward a consumption-based pricing model for new AI and Agentforce offerings introduces uncertainty, as not all customers may scale usage quickly, which could slow revenue growth if large clients delay adoption or do not expand usage as anticipated.

- Intensifying industry competition from hyperscalers and new AI-driven tools, particularly from Microsoft, Google, and Amazon, threatens Salesforce's ability to maintain technical leadership, which could erode pricing power and dampen top-line revenue growth.

- The increased complexity of Salesforce’s expanding product suite, while touted as “deeply unified,” raises operational risks that could limit innovation speed, making integration and future cross-selling more difficult and potentially suppressing both revenue and net margins.

- Rising global data privacy regulations and data sovereignty requirements, especially as Salesforce emphasizes Data Cloud and cross-border deployment, could hinder cloud adoption or raise compliance-associated costs, thereby compressing earnings and margins over time.

- Salesforce’s regular executive turnover—highlighted by the departure of key long-tenured leaders and significant organizational restructuring—may exacerbate cultural integration challenges from years of M&A activity, potentially impacting operational execution and long-term earnings predictability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Salesforce is $442.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Salesforce's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $442.0, and the most bearish reporting a price target of just $243.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $54.1 billion, earnings will come to $10.6 billion, and it would be trading on a PE ratio of 48.7x, assuming you use a discount rate of 7.7%.

- Given the current share price of $247.26, the bullish analyst price target of $442.0 is 44.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:CRM. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.