Key Takeaways

- Transition to consumption-based pricing with Agentforce may cause revenue volatility and uncertainty in future contract sizes.

- Partner ecosystem reliance may challenge service delivery and affect future service revenue and customer satisfaction.

- Transitioning to a consumptive pricing model and slow Agentforce adoption could create revenue predictability issues and uneven global earnings growth.

Catalysts

About Salesforce- Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

- The transition from traditional seat-based pricing to a more consumption-based model with Agentforce could create uncertainty in future revenue forecasts, potentially leading to lower-than-expected contract sizes and revenue volatility as clients adjust to the new pricing dynamics.

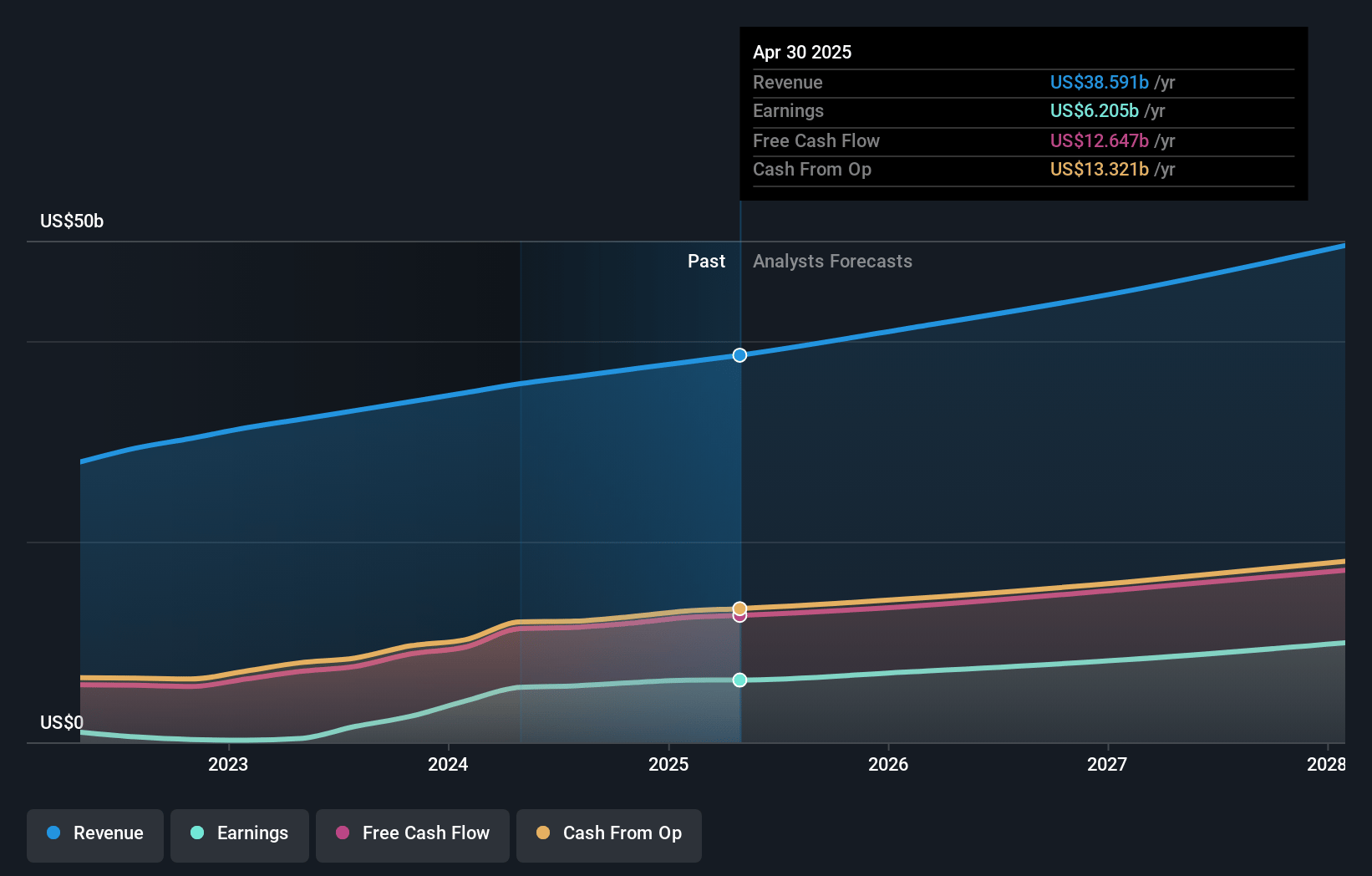

- While the Data Cloud and Agentforce show strong growth potential with a 120% year-over-year increase in annual recurring revenue, the contribution to revenue in fiscal year 2026 is expected to be modest, delaying significant revenue boosts to fiscal year 2027, impacting short-term revenue growth expectations.

- The continued transition to relying more on the partner ecosystem for implementation rather than Salesforce’s own professional services may create challenges in service delivery, potentially affecting future service revenue and maintaining customer satisfaction.

- Economic headwinds, such as the stronger U.S. dollar, contribute to a foreign exchange headwind, reducing nominal growth figures by approximately half a percentage point, which could impact the financial results and offset some growth achieved in other areas.

- Despite strong performance in Data Cloud and AI, revenue attrition remains slightly above 8%, indicating that maintaining existing customer revenue levels could be challenging and may lead to lower revenue retention rates, affecting the stability of future earnings.

Salesforce Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Salesforce compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Salesforce's revenue will grow by 7.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 16.4% today to 19.0% in 3 years time.

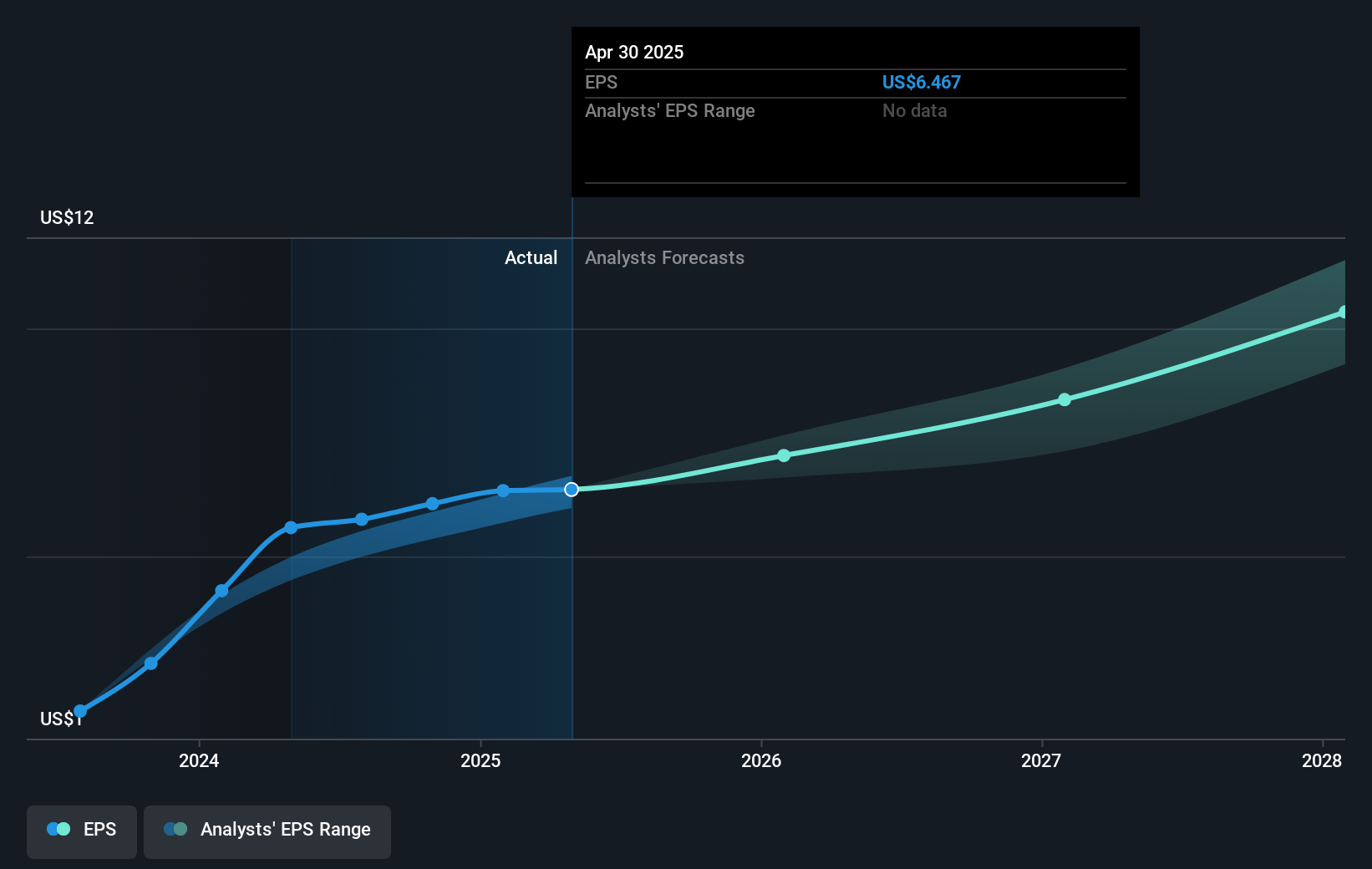

- The bearish analysts expect earnings to reach $8.9 billion (and earnings per share of $9.04) by about April 2028, up from $6.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 42.1x on those 2028 earnings, up from 38.3x today. This future PE is greater than the current PE for the US Software industry at 30.0x.

- Analysts expect the number of shares outstanding to decline by 0.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.72%, as per the Simply Wall St company report.

Salesforce Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The evolving shift from a seat-based pricing model to one that includes consumptive elements brings uncertainty, potentially affecting both revenue predictability and contract negotiations.

- Slow adoption cycles for Agentforce may limit its revenue contribution in fiscal year '26, posing a risk of delayed earnings growth.

- The current strengths and constraints in various geographic regions, such as parts of EMEA, could lead to uneven revenue growth globally, impacting overall earnings.

- Expected headwinds in the professional services business could suppress overall revenue growth, particularly as the focus shifts to leveraging partner ecosystems for implementations.

- The early stage of Agentforce's contribution means potential overestimation of its impact on revenue and margins, which might disappoint investor expectations if growth does not accelerate as anticipated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Salesforce is $321.29, which represents one standard deviation below the consensus price target of $368.75. This valuation is based on what can be assumed as the expectations of Salesforce's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $442.0, and the most bearish reporting a price target of just $243.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $47.0 billion, earnings will come to $8.9 billion, and it would be trading on a PE ratio of 42.1x, assuming you use a discount rate of 7.7%.

- Given the current share price of $247.26, the bearish analyst price target of $321.29 is 23.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:CRM. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.