Key Takeaways

- AI-powered product innovation and usage-based pricing position Box to accelerate revenue growth, expand margins, and drive greater enterprise customer value.

- Expanded integrations, regulatory-driven demand, and operational discipline deepen market penetration in regulated industries and strengthen recurring revenue streams.

- Consolidation and intensifying competition threaten Box’s differentiation, margins, and revenue growth, while heavy investment requirements challenge its ability to scale earnings over time.

Catalysts

About Box- Provides a cloud content management platform that enables organizations of various sizes to manage and share their content from anywhere on any device in the United States and Japan.

- Box's launch and early momentum of its Enterprise Advanced suite, featuring AI-powered workflow automation, intelligent document processing, and metadata extraction, positions the company to capture the accelerating enterprise shift from legacy systems to next-generation content management. This is expected to drive a step-function increase in average contract value and support faster revenue growth as organizations modernize workflows.

- The broadening adoption of secure, compliant cloud-based content solutions, heightened by increasing regulatory complexity and cybersecurity threats, is expected to expand Box's penetration into regulated industries such as legal, government, and financial services. This expands Box’s addressable market, drives longer customer commitments, and supports continued growth in billings and RPO.

- Deep ecosystem integrations—including with Microsoft 365, Salesforce, and leading system integrators—coupled with a more partner-focused go-to-market strategy, are likely to accelerate customer acquisition and embed Box more deeply in enterprise IT architectures. This supports greater stickiness, rising net retention rates, and recurring revenue expansion over time.

- The introduction of AI consumption-based pricing (AI units) creates a new growth lever; as enterprises increase their use of advanced AI-driven document processing and workflow automation, Box can capture more wallet share on a usage basis. This innovation enables ARPU uplift and provides direct upside to both revenue and margins as AI adoption ramps.

- Ongoing enhancements in operational efficiency, including disciplined cost controls and international workforce expansion, are expected to support continued gross margin and long-term operating margin expansion—even as the company invests for growth—leading to stronger earnings power.

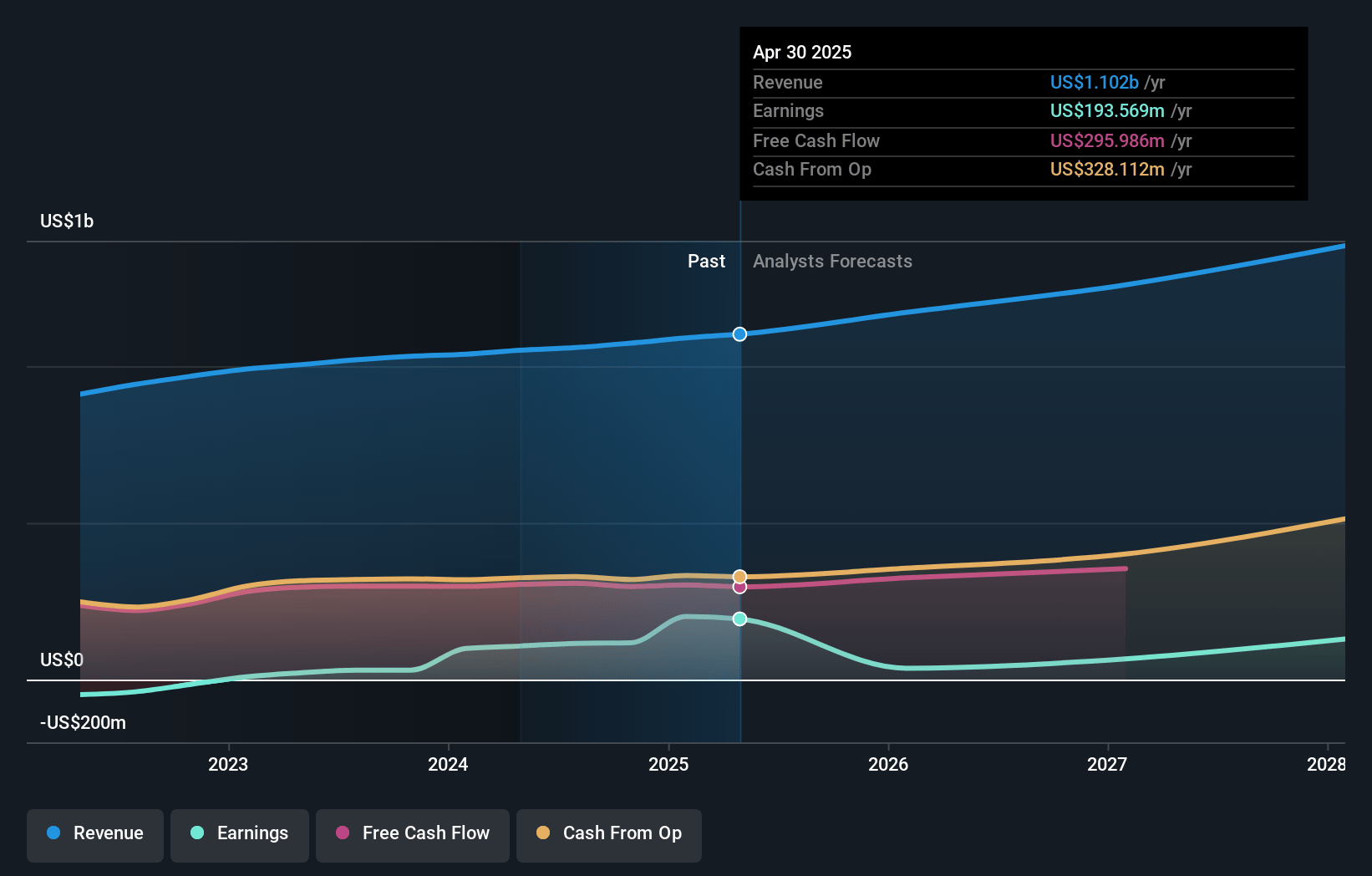

Box Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Box compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Box's revenue will grow by 10.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 17.6% today to 8.1% in 3 years time.

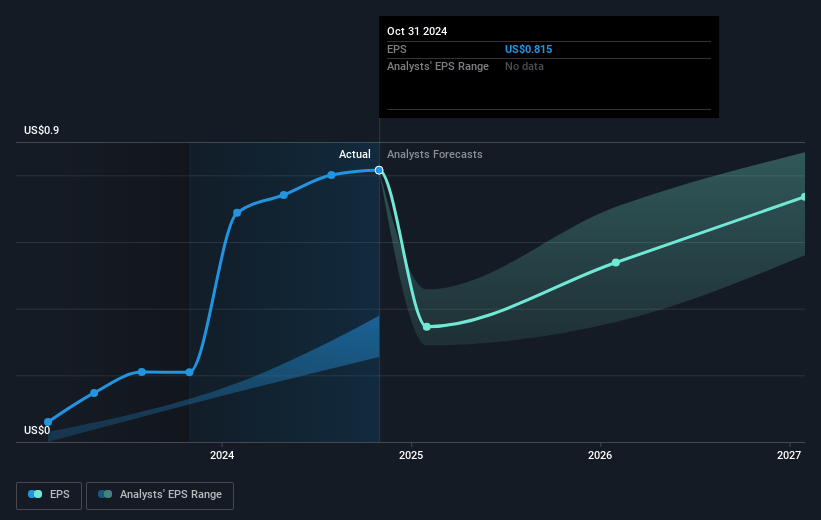

- The bullish analysts expect earnings to reach $121.8 million (and earnings per share of $0.8) by about July 2028, down from $193.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 70.0x on those 2028 earnings, up from 24.8x today. This future PE is greater than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to grow by 1.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.32%, as per the Simply Wall St company report.

Box Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating consolidation of digital workplace platforms and the enterprise push toward all-in-one solutions may threaten Box’s growth, as it remains a point product competing against hyperscale providers like Microsoft and Google. This trend could increase customer churn and intensify pricing pressure, ultimately limiting Box’s long-term revenue potential.

- Persistent competition from hyperscale cloud vendors who bundle storage and collaboration products threatens Box’s market access and pricing power, forcing Box to invest heavily to remain differentiated, which could lead to margin compression and constrain net earnings growth over time.

- Box’s ability to upsell or cross-sell non-storage products is still significantly more limited than diversified competitors, suggesting average contract value growth could stagnate as larger integrated suites become more attractive, which would negatively impact revenue expansion and net retention rates in the long run.

- The commoditization of cloud storage and increasing availability of machine learning and content AI as table-stakes features erode Box’s product differentiation, likely resulting in lower average selling prices and slower top-line growth as well as increased pressure on gross margins.

- Heavy ongoing investment in R&D, industry-specific go-to-market efforts, and partner ecosystem development will remain essential for Box to keep up with rapid innovation and shifting customer demands, yet these costs impede significant net margin improvement and may lead to prolonged periods of flat or limited net income growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Box is $45.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Box's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $23.82.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $121.8 million, and it would be trading on a PE ratio of 70.0x, assuming you use a discount rate of 8.3%.

- Given the current share price of $33.09, the bullish analyst price target of $45.0 is 26.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.