Key Takeaways

- Intense competition from integrated productivity suites and commoditized storage pressures Box's pricing power, margins, and customer retention.

- Regulatory barriers and lack of clear product differentiation hinder Box's global growth and make revenue increasingly volatile and unpredictable.

- Box's AI-driven platform, ecosystem integrations, and regulatory alignment position it for revenue growth, margin expansion, and leadership in enterprise content management.

Catalysts

About Box- Provides a cloud content management platform that enables organizations of various sizes to manage and share their content from anywhere on any device in the United States and Japan.

- Box faces increasing headwinds from the proliferation of bundled productivity suites offered by Microsoft 365 and Google Workspace, which integrate storage, collaboration, and workflow at a lower cost, undermining Box's ability to command premium pricing and leading to growing customer attrition and revenue pressure.

- The long-term commoditization of cloud storage has intensified price competition, shrinking industry-wide gross margins and making it harder for Box to offset declining per-seat growth with pricing increases, which threatens Box's earnings and operating margin outlook.

- The international growth potential for Box is constrained by escalating global data sovereignty and privacy regulations such as GDPR and regional data localization mandates, which limit the scalability of Box's cloud-based service outside core markets, capping future addressable market and long-term top-line growth.

- Despite significant investment and product momentum in AI-powered features and agent integrations, Box has failed to materially differentiate itself from much larger, integrated competitors; this has limited net new seat growth and raises the risk of slowing net retention rates and atrophying revenue going forward.

- Box's dependence on large enterprise contracts, which increasingly renew early or demand higher discounts, exposes the business to volatile swings in billings and revenues as key customers switch to alternative platforms or negotiate downsized renewals, increasing revenue unpredictability and earnings risk over the long haul.

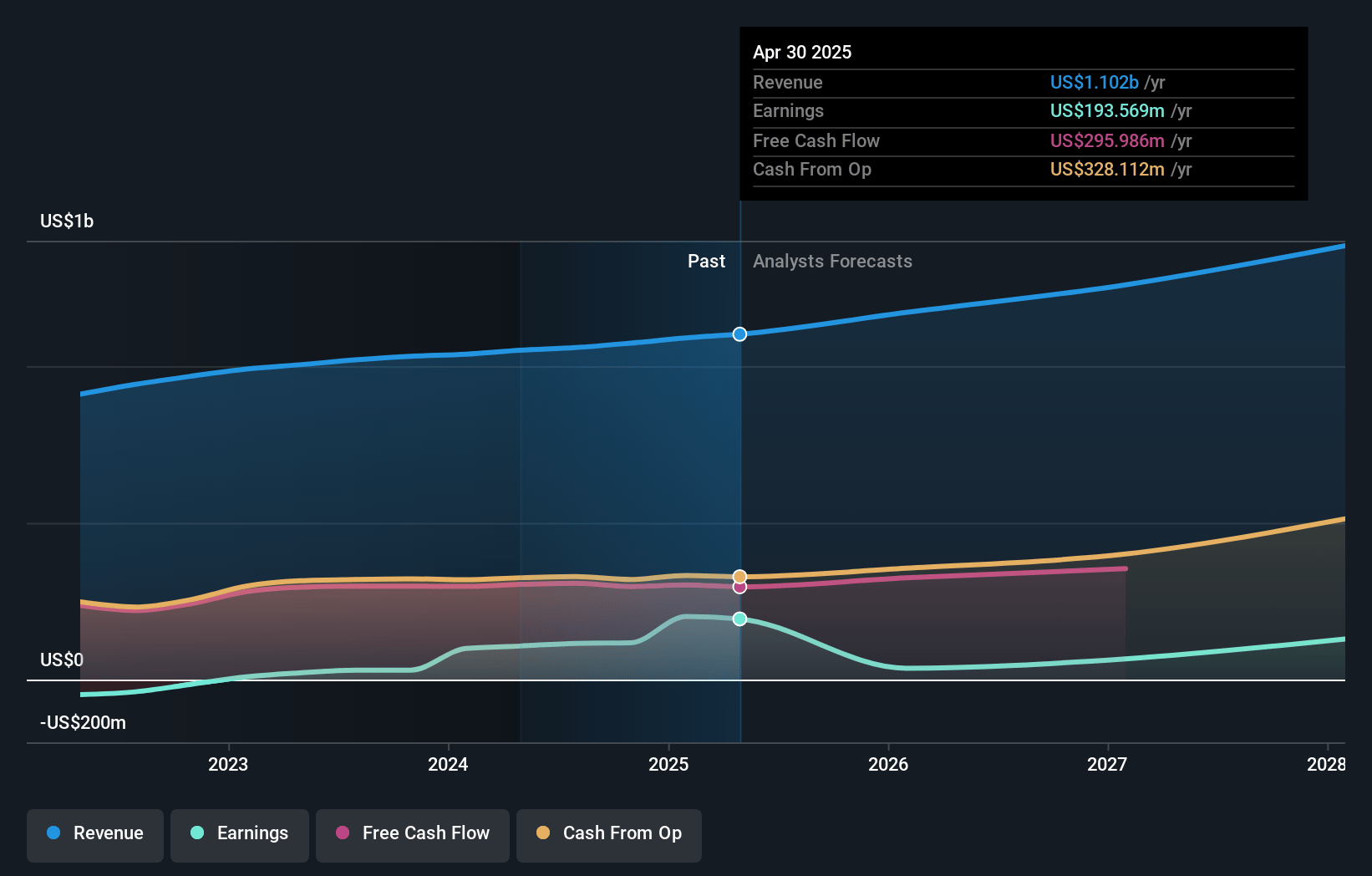

Box Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Box compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Box's revenue will grow by 8.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 17.6% today to 8.7% in 3 years time.

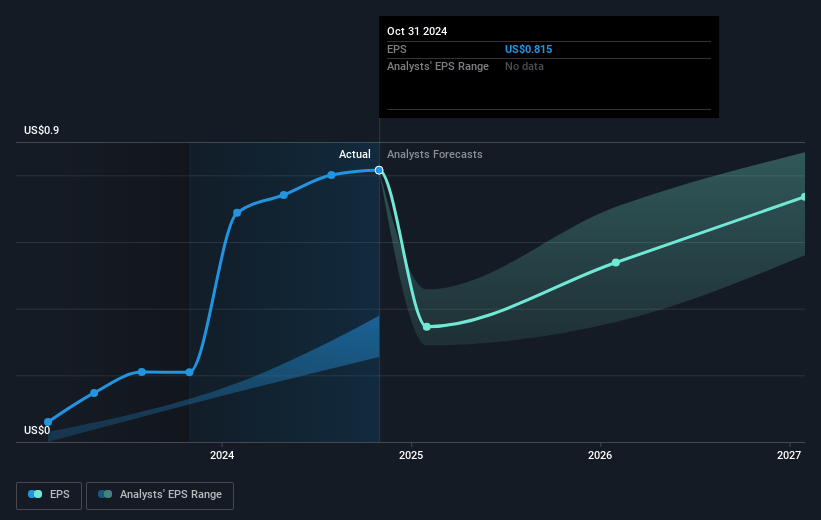

- The bearish analysts expect earnings to reach $121.6 million (and earnings per share of $0.76) by about July 2028, down from $193.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 37.1x on those 2028 earnings, up from 24.7x today. This future PE is lower than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to grow by 1.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.31%, as per the Simply Wall St company report.

Box Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Box's rapid innovation and leadership in AI-powered content management, including strong early demand for its Box AI and Enterprise Advanced offerings, positions it to capture a growing share of enterprise digital transformation budgets, likely supporting revenue growth and margin expansion in the long term.

- Deep ecosystem integration and partnerships-with leading platforms such as Microsoft 365 Copilot, Google Agentspace, Salesforce Agentforce, IBM watsonx Orchestrate, OpenAI, NVIDIA, and Meta-enable Box to serve as a central, interoperable data hub, which should sustain customer retention and drive both higher net retention rates and recurring revenue.

- The secular shift from on-premises and legacy enterprise content management systems toward cloud-native, AI-driven platforms plays to Box's strengths, as evidenced by increased migrations from legacy providers, and supports the company's ability to command premium pricing and boost contract values, positively impacting top-line growth.

- Increasing regulatory requirements for data security and privacy in sectors like financial services, healthcare, and the public sector enhance Box's value proposition as a secure and compliant cloud platform, driving market share gains in highly regulated verticals and supporting stable earnings and high gross margins.

- Declining costs of AI inference and scalable platform economics are enabling Box to roll out new capabilities to customers while maintaining margin neutrality, which, when coupled with product bundle upsells and the company's active focus on operational leverage, points to potential sustained improvement in net margins and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Box is $23.82, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Box's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $23.82.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $121.6 million, and it would be trading on a PE ratio of 37.1x, assuming you use a discount rate of 8.3%.

- Given the current share price of $33.02, the bearish analyst price target of $23.82 is 38.6% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.