Last Update10 Oct 25Fair value Increased 1.77%

TeraWulf's consensus price target has been raised to approximately $13.09 from $12.86. Analysts cite improved growth and profitability outlooks, driven by recent contract wins and industry momentum in AI and HPC infrastructure.

Analyst Commentary

Recent analyst updates highlight a strong and growing consensus around TeraWulf's improved outlook. Target price increases reflect broad optimism about the company's operational execution, new contracts, and the strategic value of its partnerships within the AI and high-performance computing sectors.

Bullish Takeaways

- Bullish analysts raise price targets in response to successful contract executions and the rapid expansion of capacity, supported by long-term agreements with major partners.

- The company's strategic alliances, including those with prominent technology players, are seen as significantly enhancing its credit profile and market credibility.

- Analysts cite increased critical IT load capacity and newly signed leases as signs of leadership within the industry, supporting an upgraded valuation methodology.

- Momentum in AI and HPC infrastructure, combined with a pipeline of potential incremental opportunities, bolsters expectations for continued growth and profitability.

Bearish Takeaways

- Bearish analysts express caution regarding execution risks, particularly the need for flawless delivery and integration of recently announced deals.

- The long-term nature of hyperscale infrastructure agreements introduces uncertainties around funding and future cash flows.

- Visibility on growth and profitability is improved, yet some analysts note that market expectations may not fully account for potential challenges in scaling operations or integrating new tenants.

What's in the News

- White House order expands access to crypto and alternative assets in 401(k) plans, raising new risks and opportunities for retirement portfolios that include companies like TeraWulf (Reuters).

- Bipartisan crypto regulation bills clear a record-setting House vote after prolonged opposition. This signals potential shifts in the legislative landscape for digital assets (CNBC).

- President Trump aims to open U.S. retirement markets further to crypto, gold, and private equity, with an executive order that could impact publicly traded crypto companies (Financial Times).

- Justice Department ends investigations into Polymarket, a major crypto betting platform, removing a regulatory overhang for the sector (Bloomberg).

- Bitcoin surpasses $120,000, driven by institutional investment and optimism surrounding upcoming 'Crypto Week,' benefiting major crypto-exposed firms including TeraWulf (CNBC).

Valuation Changes

- Consensus Analyst Price Target has risen slightly, increasing from $12.86 to $13.09.

- Discount Rate has decreased marginally, moving from 8.77 percent to 8.73 percent.

- Revenue Growth expectations have increased slightly, from 85.05 percent to 85.63 percent.

- Net Profit Margin estimate has improved, rising from 15.95 percent to 17.70 percent.

- Future P/E has declined modestly, moving from 46.60x to 42.28x, reflecting higher expected profitability.

Key Takeaways

- Transition to diversified digital infrastructure with major institutional backing reduces reliance on bitcoin price, boosting revenue stability and supporting margin growth.

- Expansion of sustainable, regulatory-compliant infrastructure positions the company to meet rising enterprise demand, drive new revenue streams, and achieve operational efficiency.

- Aggressive diversification into AI and HPC hosting exposes TeraWulf to rising costs, tenant risks, and operational challenges that threaten margin stability and long-term financial health.

Catalysts

About TeraWulf- Operates as a digital asset technology company in the United States.

- TeraWulf's recent multi-billion-dollar, multi-year hyperscale hosting agreements (e.g., with Fluidstack and Google), mark a significant shift from a pure bitcoin mining model toward diversified, contracted revenue streams in high-demand digital infrastructure-this underpins higher revenue visibility and insulates earnings from bitcoin price volatility.

- Long-term partnerships and investments from marquee players (Google's $1.8B lease backstop and equity stake) signal institutional validation, enhance creditworthiness, and are likely to lower WULF's future cost of capital, directly supporting margin expansion and accelerated infrastructure growth.

- Rapid expansion of zero-carbon, high-capacity digital infrastructure (Lake Mariner and Cayuga) positions TeraWulf to capture rising enterprise demand for sustainable, regulatory-compliant compute, supporting long-term revenue and improved net margins as regulatory and ESG pressures rise globally.

- Proven operational track record (on-time, on-budget delivery, experienced team, long-standing contractor relationships) de-risks future capacity scale-up and enables disciplined cost management, supporting sustained margin improvement and higher EBITDA.

- Growing momentum for institutional and enterprise digital asset adoption, coupled with TeraWulf's expansion into grid-interactive, renewable-powered data centers, positions the company to benefit from both higher transaction volumes and new ancillary revenue streams, enhancing long-term earnings stability and upside.

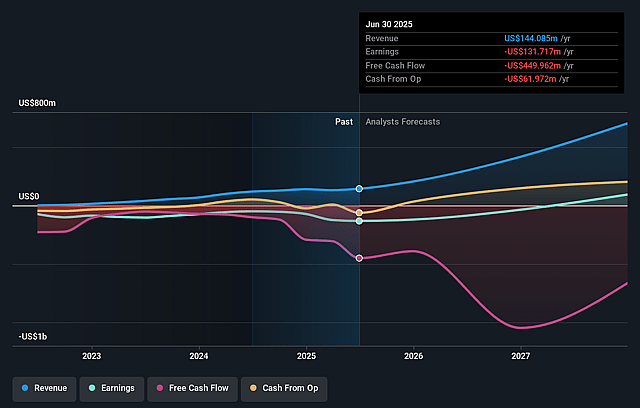

TeraWulf Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TeraWulf's revenue will grow by 85.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -91.4% today to 17.1% in 3 years time.

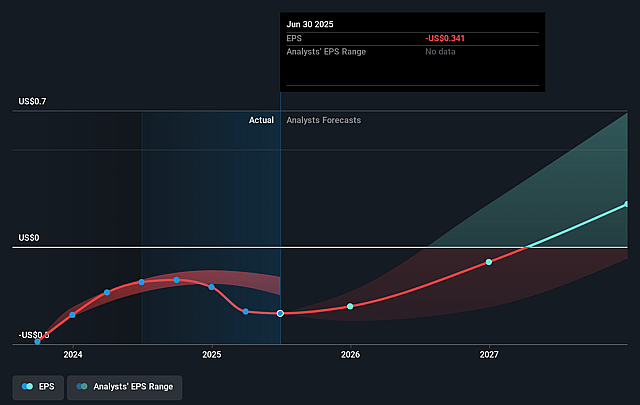

- Analysts expect earnings to reach $157.9 million (and earnings per share of $0.33) by about September 2028, up from $-131.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $405.2 million in earnings, and the most bearish expecting $-45.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.4x on those 2028 earnings, up from -27.8x today. This future PE is greater than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 1.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.78%, as per the Simply Wall St company report.

TeraWulf Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- TeraWulf's aggressive expansion into High Performance Computing (HPC) and AI data center hosting (e.g., the Fluidstack deal and Cayuga site development) requires substantial capital expenditures and increases debt exposure, introducing long-term risks to free cash flow, net margins, and balance sheet stability-especially if demand or execution timelines falter.

- The company's revenue stream is rapidly diversifying away from its legacy crypto mining business, but longer-term returns are highly dependent on maintaining "transformative" leases with newer tenants (e.g., Fluidstack) whose own financial stability, customer base, and AI sector demand are not fully transparent, creating potential risks to recurring revenue and earnings should counterparties struggle or market conditions shift.

- Although Google's backstop reduces near-term counterparty risk, its credit support for the Fluidstack lease declines over time and is tied to equity dilution, potentially impacting future shareholder value and exposing TeraWulf to ongoing concentration risks if similar structures are used in future expansions.

- TeraWulf faces escalating operational costs (e.g., labor, custom buildouts, supply chain constraints) as evidenced by higher CapEx on Fluidstack versus Core42 and increasing SG&A guidance, posing a risk to gross and net margins unless efficiencies scale materially or future contracts continue to deliver very high site-level net operating income.

- The company's long-term growth relies on sustained strong demand in both the AI infrastructure and crypto mining sectors, both of which could be adversely affected by regulatory changes (e.g., U.S. energy/environmental policy, digital asset legislation) or technology disruptions, leading to potential declines in revenue, EBITDA, or asset utilization if sectoral sentiment or policy support weakens.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.182 for TeraWulf based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $6.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $920.8 million, earnings will come to $157.9 million, and it would be trading on a PE ratio of 42.4x, assuming you use a discount rate of 8.8%.

- Given the current share price of $8.98, the analyst price target of $12.18 is 26.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.