Key Takeaways

- Embedding AI and cloud solutions across insurance platforms is boosting deal sizes, recurring revenue, and margins through modernization and SaaS transitions.

- Global expansion, innovation investment, and strategic M&A are diversifying revenue streams, reducing risk, and supporting sustainable long-term growth.

- Sapiens faces margin and revenue growth pressures due to industry consolidation, increased competition, limited diversification, lengthy sales cycles, and costly adaptation to modern insurance software trends.

Catalysts

About Sapiens International- Provides software solutions for the insurance industry in North America, the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

- Demand for AI-driven automation and advanced data analytics in insurance is accelerating, and Sapiens is embedding these capabilities across its insurance platform, which is expected to significantly increase average deal sizes and promote sustained multi-year revenue growth as insurers modernize.

- The rapid shift by global insurers toward cloud and SaaS-based core systems, paired with Sapiens’ targeted transition of existing customers to the cloud and new SaaS deals, is set to boost recurring revenue mix, improve gross margins, and drive a more stable and expanding earnings base over the next several years.

- The company’s expansion into underpenetrated regions like North America, Asia-Pacific, and new countries within Europe, using highly localized offerings and system integrator partnerships, has the potential to materially enlarge Sapiens’ revenue base and diversify customer risk, fueling top-line growth.

- Ongoing investments in product innovation—including the AI-based insurance platform, new releases, and integration with major partners like Microsoft Azure—are differentiating Sapiens’ solutions, elevating win rates, reducing customer churn, and supporting improved net margins through higher-value solution sales.

- Active pursuit of strategic M&A, enabled by strong cash flow and a robust balance sheet, offers the prospect of faster inorganic growth, potential cost synergies, and further portfolio expansion, which can lift both revenue and long-term earnings power.

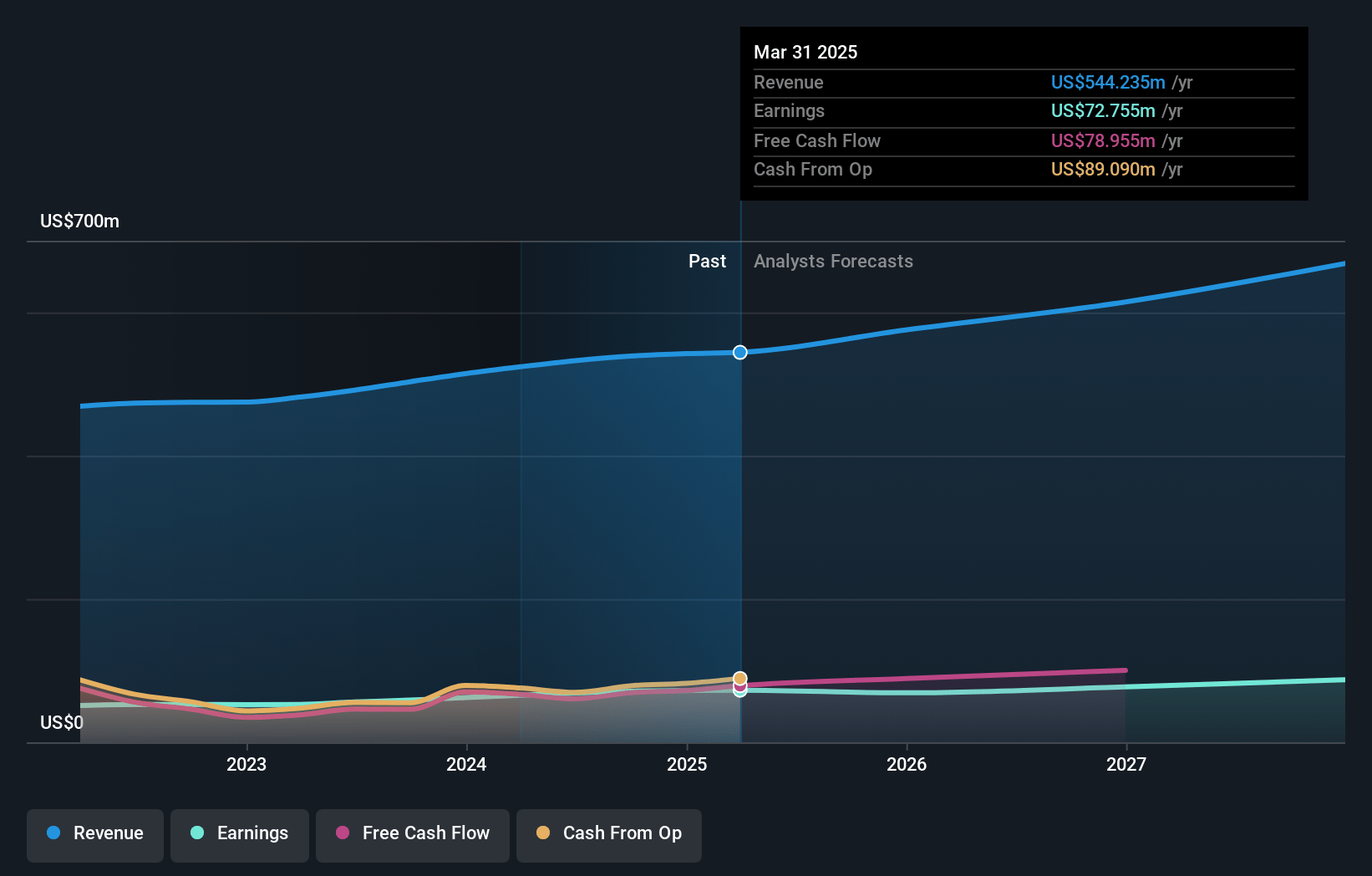

Sapiens International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Sapiens International compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Sapiens International's revenue will grow by 5.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 13.3% today to 13.5% in 3 years time.

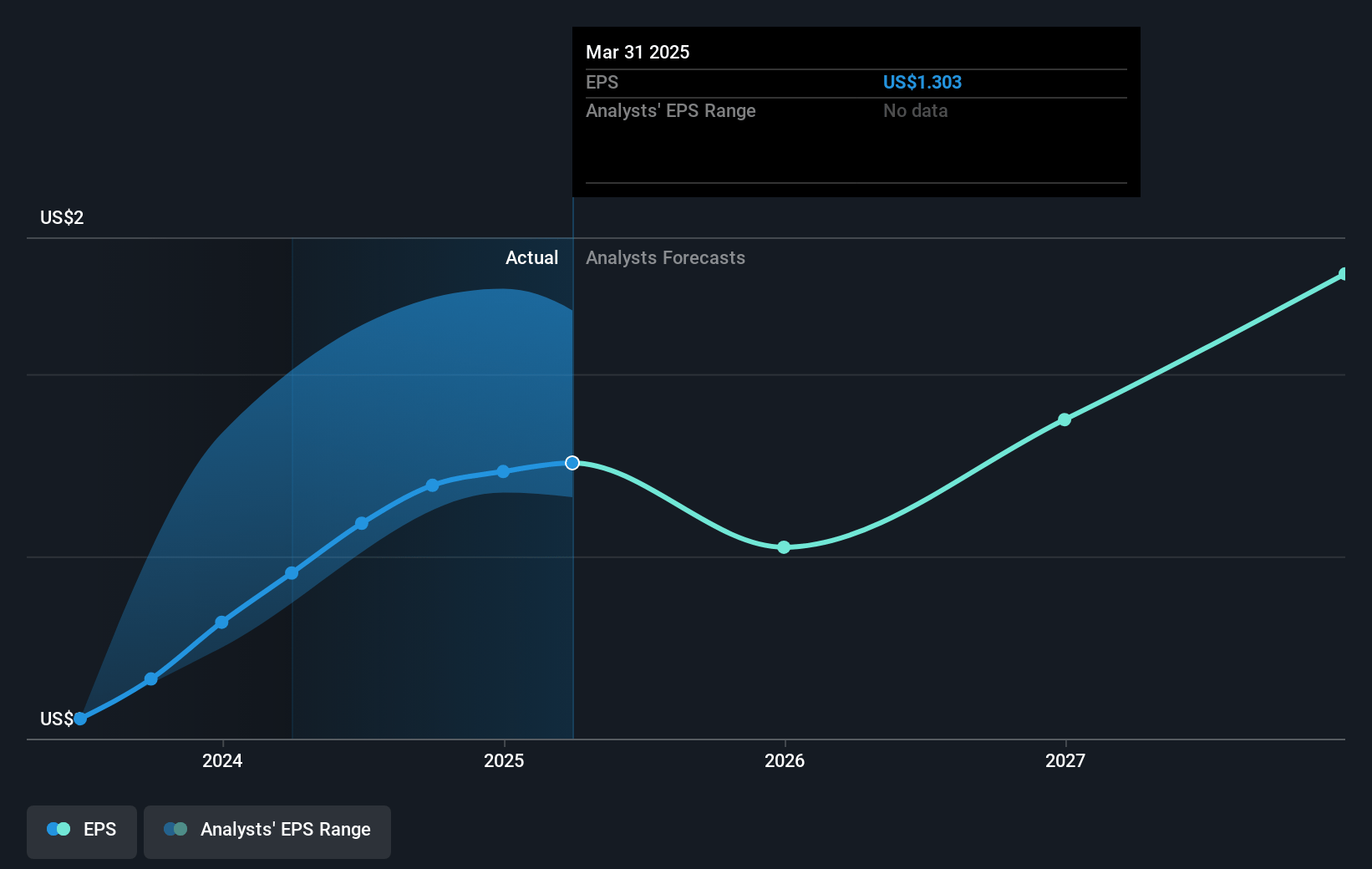

- The bullish analysts expect earnings to reach $85.0 million (and earnings per share of $1.47) by about May 2028, up from $72.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 30.8x on those 2028 earnings, up from 21.8x today. This future PE is lower than the current PE for the US Software industry at 33.5x.

- Analysts expect the number of shares outstanding to grow by 0.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.17%, as per the Simply Wall St company report.

Sapiens International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing dominance of large AI-powered insurance platforms may commoditize core insurance software offerings, making it difficult for Sapiens to maintain differentiation or pricing power, which could pressure long-term profit margins and limit earnings growth.

- Ongoing consolidation in the insurance industry may favor larger, end-to-end platform vendors over mid-sized providers like Sapiens, potentially shrinking their addressable market and impacting revenue growth prospects.

- Heavy dependence on the insurance sector, combined with a concentration in established regions such as EMEA and North America, exposes Sapiens to sectoral downturns and limits diversification, increasing the volatility of both revenues and earnings as these markets mature or face cyclicality.

- Extended or unpredictable sales cycles, particularly in the Life and P&C segments, coupled with macroeconomic uncertainty and delayed deal signings, may result in slower-than-expected top-line revenue growth, as evidenced by recent guidance for low single-digit organic revenue increases.

- Ongoing need for significant R&D and product upgrades to keep legacy software competitive in a shifting landscape toward flexible, modular, cloud-native solutions and stricter regulatory requirements could inflate operating costs and pressure net margins if revenue growth does not accelerate accordingly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Sapiens International is $35.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sapiens International's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $629.1 million, earnings will come to $85.0 million, and it would be trading on a PE ratio of 30.8x, assuming you use a discount rate of 10.2%.

- Given the current share price of $28.2, the bullish analyst price target of $35.0 is 19.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.