Catalysts

About Roper Technologies

Roper Technologies is a diversified software and technology company that owns a portfolio of vertically focused, application specific businesses across areas such as application software, network software and technology enabled products.

What are the underlying business or industry changes driving this perspective?

- Although Roper is seeing strong AI related product momentum across Deltek, CentralReach, SoftWriters, Subsplash and other platforms, there is a risk that customers adopt these AI SKUs more slowly than management expects. This could limit the uplift in software bookings and recurring revenue growth that is currently anticipated to flow through the income statement.

- While the build out of AI related data center and power generation capacity is positive for businesses like PowerPlan and some TEP assets, utilities and industrial customers may stagger or rephase projects. This would affect the timing of new software deployments and could hold back revenue and margin expansion in those franchises.

- Although DAT is being positioned for end to end freight automation with AI and ML capabilities and has added tuck in assets like Trucker Tools, Outgo and Convoy, a prolonged period of weak freight activity or slower broker adoption of automated workflows could mean the expected higher value per load shows up later than planned. This could mute revenue growth and delay operating leverage.

- Despite Roper’s active M&A program focused on faster growth platforms and bolt ons, including recent deals such as Subsplash, Orchard and multiple tuck ins, the integration of less profitable assets like Convoy and any delay in scaling new acquisitions could weigh on consolidated EBITDA margins and free cash flow per share. This may be particularly relevant while acquisition related dilution is being absorbed.

- While the company is investing heavily to become AI native across internal functions to improve productivity, there is a risk that efficiency gains take longer to materialize or are offset by higher talent and R&D spending. This would limit the contribution of AI enabled cost savings to future net margins and earnings growth.

Assumptions

This narrative explores a more pessimistic perspective on Roper Technologies compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

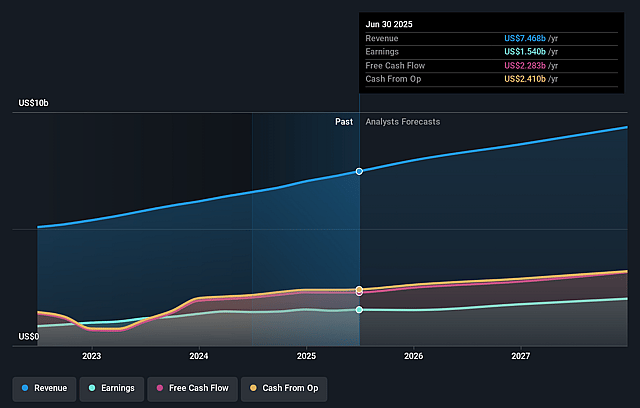

- The bearish analysts are assuming Roper Technologies's revenue will grow by 11.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 20.3% today to 22.2% in 3 years time.

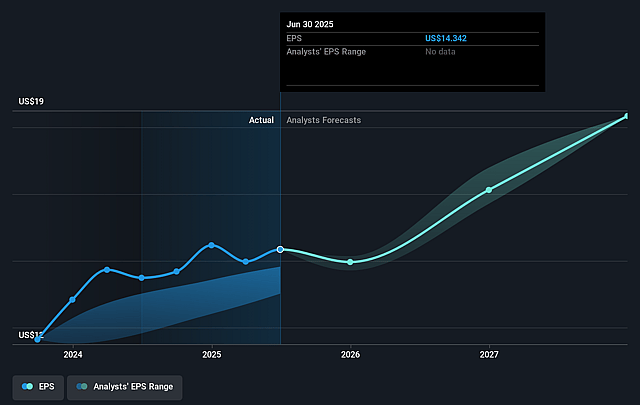

- The bearish analysts expect earnings to reach $2.4 billion (and earnings per share of $21.34) by about January 2029, up from $1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 25.1x on those 2029 earnings, down from 27.7x today. This future PE is lower than the current PE for the US Software industry at 30.9x.

- The bearish analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.03%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- AI is described by management as a powerful and durable growth driver, with CentralReach already seeing roughly 75% of bookings from AI enabled products and multiple platforms rolling out AI SKUs and features. This could support higher software bookings, recurring revenue and earnings over time than a flat share price assumption implies, impacting revenue and net margins.

- The company has over US$5b of capital deployment capacity over the next 12 months and a history of acquiring higher growth platforms and tuck in deals, including US$1.3b deployed in the quarter and a pipeline supported by private equity portfolio exits. This could add to cash flow, EBITDA and earnings per share if acquired assets track well, impacting revenue and free cash flow.

- DAT is building an end to end AI based freight automation workflow, targeting US$100 to US$200 in savings per automated load and supported by tuck ins such as Trucker Tools, Outgo and Convoy. If adoption scales, this could materially increase value per load and monetization across the network, impacting revenue growth and EBITDA margins.

- AI enabled productivity tools used internally across functions, including code assistants and shared best practices across more than 20 software businesses, may allow Roper to do more with a similar R&D envelope. This could support margin resilience or expansion as products and go to market activity scale, impacting operating margins and earnings.

- The authorization of a US$3b share repurchase program on top of an established mid teens cash flow compounding goal and TTM free cash flow of over US$2.4b, alongside modest historical share count growth of about 0.5% annually, means that buybacks, if executed, could support earnings per share growth relative to a flat share price view, impacting earnings per share and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Roper Technologies is $419.0, which represents up to two standard deviations below the consensus price target of $548.12. This valuation is based on what can be assumed as the expectations of Roper Technologies's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $656.0, and the most bearish reporting a price target of just $419.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2029, revenues will be $10.6 billion, earnings will come to $2.4 billion, and it would be trading on a PE ratio of 25.1x, assuming you use a discount rate of 9.0%.

- Given the current share price of $403.76, the analyst price target of $419.0 is 3.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Roper Technologies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.