Catalysts

About Roper Technologies

Roper Technologies is a diversified technology company that owns a portfolio of vertically focused software and tech-enabled businesses serving niche end markets.

What are the underlying business or industry changes driving this perspective?

- Broad adoption of AI across more than 20 vertical software platforms is expanding what Roper can sell into existing customers, as AI-enabled SKUs and features are layered on top of core systems of record. This supports potential uplift in recurring revenue and software margins over time.

- Deeply embedded vertical market software with proprietary workflow data, from legal and construction to health care and freight, gives Roper what management describes as a very high right to win in AI applications. This can support pricing power, high customer retention and resilient earnings.

- The buildout of AI driven freight automation at DAT, including carrier vetting, matching, automated rate negotiation and payments, targets meaningful per load labor savings for brokers. This can increase Roper’s monetization per transaction and support revenue growth and profitability in the Network Software segment.

- AI led automation in health care and public sector focused businesses such as CentralReach, Strata, CliniSys and others is already tied to strong bookings traction and higher value workflows. This can support growth in high margin recurring revenue and free cash flow.

- Rising digital and data needs at utilities, health care OEMs and other TEP customers, including ultrasonic metering and guidance enabled devices, are increasing software and data content per customer. This can help support revenue growth and, over time, mixed improvement in segment net margins.

Assumptions

This narrative explores a more optimistic perspective on Roper Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

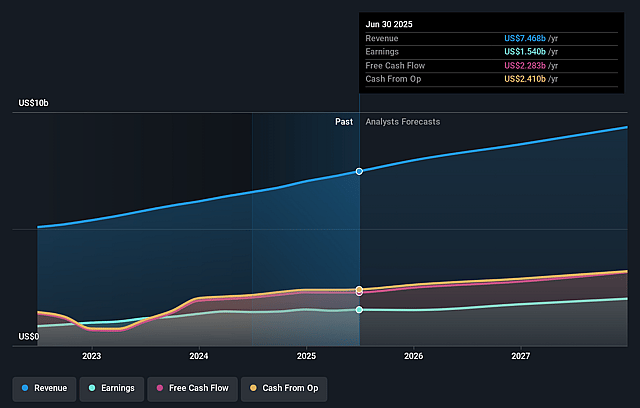

- The bullish analysts are assuming Roper Technologies's revenue will grow by 14.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 20.3% today to 20.2% in 3 years time.

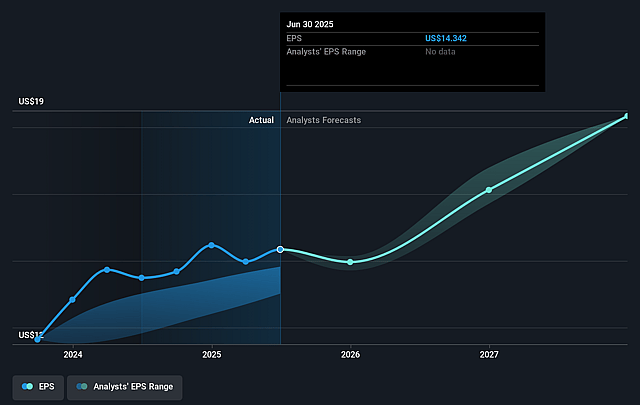

- The bullish analysts expect earnings to reach $2.3 billion (and earnings per share of $21.3) by about January 2029, up from $1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 41.5x on those 2029 earnings, up from 29.9x today. This future PE is greater than the current PE for the US Software industry at 32.7x.

- The bullish analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.0%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Prolonged weakness or repeated disruptions in key end markets such as government contracting and freight, including further government shutdowns or an extended freight downturn, could keep Deltek and DAT below their potential, which would pressure organic revenue growth and limit earnings expansion.

- Execution risk around AI commercialisation, where Roper successfully builds many AI features and SKUs but customers adopt them more slowly than expected or are unwilling to pay premium pricing, could mute the uplift in high margin recurring revenue and free cash flow that investors may be counting on.

- Higher input costs and tariff related actions similar to the Neptune copper surcharge, especially if utilities or other TEP customers resist or delay orders in response, could lead to ongoing timing issues and pricing friction that weigh on segment revenue and compress segment net margins.

- Roper’s heavy reliance on acquisitions and tuck ins to support growth, combined with moves like the unprofitable Convoy purchase, could expose shareholders to integration risk and earnings dilution if acquired businesses do not track to internal expectations, which would weigh on earnings and limit free cash flow per share growth.

- If competitive pressure in vertical software and freight automation intensifies, particularly as other vendors pursue AI based offerings and try to undercut on pricing, Roper’s “right to win” could be weaker than anticipated, which would affect pricing power, customer retention and ultimately revenue and EBITDA margins.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Roper Technologies is $694.0, which represents up to two standard deviations above the consensus price target of $560.69. This valuation is based on what can be assumed as the expectations of Roper Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $694.0, and the most bearish reporting a price target of just $419.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2029, revenues will be $11.6 billion, earnings will come to $2.3 billion, and it would be trading on a PE ratio of 41.5x, assuming you use a discount rate of 9.0%.

- Given the current share price of $436.54, the analyst price target of $694.0 is 37.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Roper Technologies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.