Key Takeaways

- While government contracts were historically Palantir's primary revenue source, commercial adoption driven by AIP workshops is set to overtake revenue growth and become the largest segment.

- Palantir’s value-based pricing model allows the company to generate high margins and reinvest in product development.

- The introduction of the AI-powered "AIP" module is driving sales through workshops. This will create network effects, and change Palantir’s status as a “nice to have” to a “critical” product.

- Palantir’s Ontology will keep differentiating from competitors and become a class of its own which can’t be easily replicated.

- Palantir has a “too much cash problem” which limits immediate innovation, but will be allocated to growth via acquisitions and possibly buybacks

Catalysts

Product Superiority Will Overpower Direct And Service Competitors

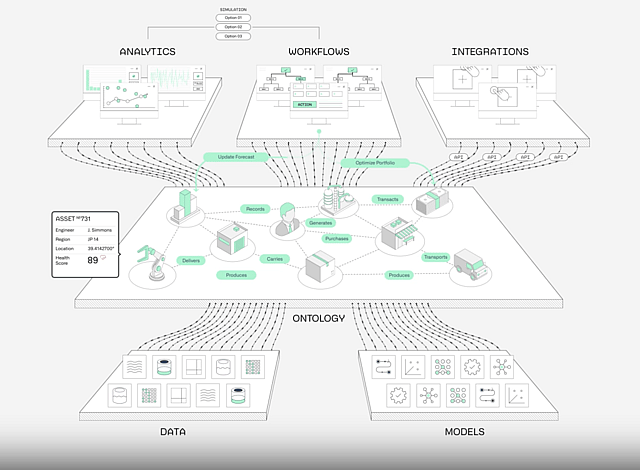

The core product of Palantir is their Ontology, which is a digital twin built upon existing enterprise data streams. This effectively results in producing a command center for executives and military operatives. The product features are then split for use in the commercial sector (Foundry), and governments (Gotham).

Customers can use Ontology to gain an integrated birds-eye perspective of their organization. This allows them to analyze relationships, discover potential optimizations, and create agents that can directly steer operations.

Palantir: Ontology example model

The key feature is the well integrated platform that synergises with multiple data streams, producing insights and operational levers that wouldn’t be possible with individual analytics products such as BI’s and dashboards. While many platforms produce analytics from their own data stream (SAP, Snowflake, Databricks, Salesforce, Hyperion, external APIs), Palantir integrates these streams in a meaningful platform and enables insights that wouldn’t be available with individual products.

Palantir’s product design is influenced by Peter Thiel’s approach that in order for a product to be valuable it needs to be orders of magnitude better than the competition – by this approach, building incremental improvements over peers is not enough, the difference has to be both obvious and drastic. This is why Palantir’s CEO Mr. Karp frequently emphasizes that Palantir has no real competitors given the vast difference of value that their products produce compared to peers.

In my view, this approach allows Palantir to create a high-value product that specializes in maximizing the value of multiple data streams for organizations, and will result in a best-in-class software since competitors are focused on delivering and structuring data instead of directly impacting the decision making process.

The implication for me here is that Palantir will have a lasting product that will differentiate from the competition over time and can thus be valued as a going concern. Note, that if I got this assumption wrong, the whole narrative falls apart - which makes Palantir a highly-speculative company.

Palantir’s Main Revenue Source Will Shift To Commercial Customers

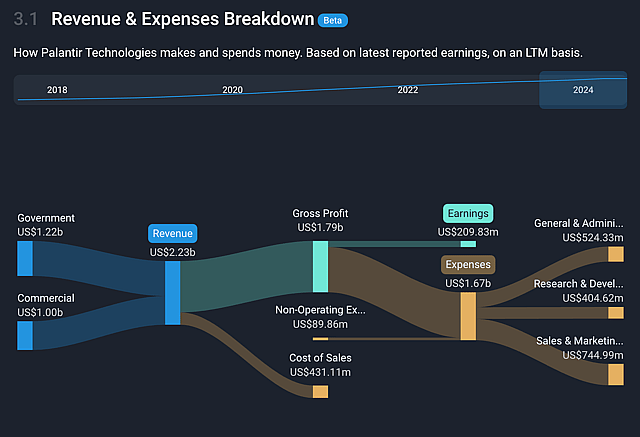

Of the $2.2B in revenue that they generated in 2023, 55% came from customers in the government segment, and 45% came from customers in the commercial segment. On a geo-segment basis, 62% of Palantir’s revenue comes from customers in the United States, and 38% from those abroad.

Simply Wall St: Palantir’s Revenue Structure

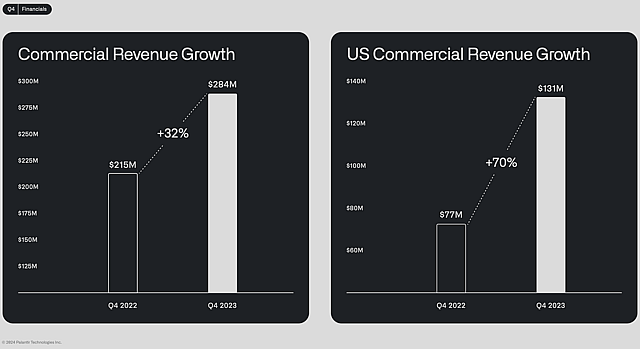

Palantir boasted about a 70% growth year-over-year in their U.S. commercial customer count, indicating that it's driven by AIP and workshops. The number of total customers is also increasing, reaching 497 in 2023.

We can see that Palantir has two main revenue sources, government and commercial. While the former was their primary customer, we will analyze how the commercial segment has the potential to outgrow customers from governments.

Government contracts tend to be longer-term and less volatile than commercial, providing a stable revenue stream. They have long conversion cycles but are easier to maintain once all the upfront hurdles are met. I assume that once Palantir signs-up a government customer, they will have an easier time retaining them. Budgets for government programs are also known to keep inflating, which means that future spending programs may increase and Palantir will be well positioned to capture more defense spending.

On the commercial side, spending is driven by industry growth or cost-cutting initiatives. We are currently witnessing Palantir’s foot in the door due to demonstrating valuable cost cutting capabilities for companies, and establishing a presence in the space will increase their chances to upsell growth services leading to a higher net revenue retention. The downside of commercial sales is that a product must provide consistent value or the customer will quickly cut the program. Palantir is in the initial stage of validation, and we need to wait and see how satisfied are commercial customers before getting a sense of how far their product can spread.

Value-Based Pricing Is A Success KPI For Palantir

Palantir is using a value-based pricing model that can be sustainable when at least two conditions are met. First, the company must be selling to the highest bidders – in this case, enterprise level customers. Small and medium sized businesses are typically avoided in order to keep a high pricing ROI. This allows Palantir to allocate high quality support engineers whose service can be justified based on the high pricing.

Second, is ensuring resilience in pricing power. Palantir needs to be the only game in town that produces a high-level of value for customers with its technological edge. Specifically, while competitors are building ways to add analytics and logistics on top of their data products, Palantir needs to continue being the only company able to provide a data integration product that creates much more value than separate tools.

Currently, Palantir is likely entering a phase of higher product recognition, where it is able to negotiate pricing terms based on a percentage of the value it creates for customers. The company combines this with a minimum contract value based on the size of a customer and uses the tailored approach to capture value for shareholders.

This is starting to impact the bottom line as Palantir is now in a position to produce a high cash from operating activities margin of 32%. Palantir also has a 2023 pipeline in remaining deal value of $3.9B up 5% from $3.7B in 2022, representing an indicator of future revenue that may be realized over a few years. Both of these factors show that the company is on a profitable growth trajectory.

Palantir’s Commercial Products Are Experiencing Network Effects In Sales

Palantir’s commercial platform is witnessing a strong acceleration driven by its AIP module. In the past, Foundry (the commercial product) customers had to have high technical capabilities to configure and operate the platform. However, with the introduction of AI, these barriers have significantly decreased, and now operatives can use natural language prompts to interact and direct Foundry. This is great because C-suite executives and operatives can instantly see the effects of adopting foundry on top of their data, where previously they had to wait for a programmer to complete a lengthy integration process.

The company has taken the advantages of this improvement and started running quick (10-hour to 3-day) bootcamps, where they demonstrate the practical application of foundry to customer’s platforms. The positive effect of the bootcamps has been noticeable, as customers are able to see the results of adopting foundry for their use case in a few hours. As opposed to a general demo or a presentation pitch, these boot camps have proven to be a much better sales channel because they solve a customer’s problem directly, without presenting optimized hypothetical scenarios.

This is great from a management point of view, since their incentives tend to revolve around hitting quarterly targets, and by solving large enterprise problems, management is put in a position to get credit for exceeding their targets at a fraction of the cost. This increases the incentive to adopt Palantir, especially now – in an environment where companies are looking to optimize processes and cut down expenses.

Palantir: Quarterly Commercial Revenue Growth

I believe that this trend will continue and produce adoption network effects, where the C-suite is starting to communicate the benefits of Foundry to their industry peers, which will drive other companies to adopt the product in order to keep up with the competition. This network effect will transform Foundry from a “nice to have” category to a “must have” for many companies.

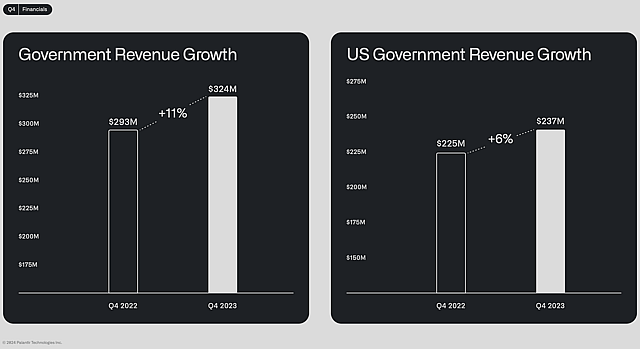

Gotham Will Experience Lower Growth But Has High Optionality

Palantir’s defense platform – Gotham is already deployed on the Ukrainian and Middle-Eastern fronts. While reliable details are hard to come by due to their classified nature, the CEO of Palantir claims that the software has been successful on the battlefield thus far, and that Western rivals are now aware of the importance of the product, forcing them to initiate their own versions.

Palantir: Quarterly Government Revenue Growth

Government is known to be slow to react to developing technology, and while it has been an initial core customer of Palantir, its contract growth is now subsiding. The CEO of Palantir argues that the DoD (Department of Defense) should allocate at least 1% of their budgets to software spending that delivers high returns on the field. While it is obvious that this call is self-serving and that Palantir will largely benefit from an increase of software budget allocation in defense, it is also a likely scenario as new generations replace older doctrines and given the containment failure of two hotspots in the world thus far – Ukraine and Israel.

The Asian Theater Creates Optionality Value For Palantir

While I expect relatively low revenue growth from governments, it also has a large optionality value due to the possible opening up of the Asian theater. In a scenario where the relations between China and Taiwan convert to military action, Palantir is primed to increase collaboration with Western allies in this region including Taiwan, Japan, South Korea, and Australia.

Palantir may also be considered as a high-value asset for western defense, and large private investors may decide to extend their support for the company regardless of the fundamentals, this may keep the company’s market value elevated for an extended period of time and is a point that should be factored-in when reviewing the company.

AIP Reduces Palantir’s Consulting Aspect

In the past, people argued that Palantir is akin to a consulting company, where a number of employees were tasked to manually connect the customer’s data to Palantir, manually create digital twins (ontologies) and run operations.

While this may have been true, there are some tailwinds working in Palantirs favor. For one, data lakes and streams have become easier to work with, and second, the technology to connect multiple streams is also advancing, leading to simplified operations and allowing engineers to focus on the product.

Palantir’s latest major development – AIP, allows for a much faster integration of customer’s data and provides automated service “agents” (software with the ability to directly operate processes) that can be directed via natural language. This will reduce the need for prolonged set-up processes for Palantir and reduce the consulting burden, allowing for simpler deployments for customers and higher margins for Palantir.

I believe that this positive trend will continue and serve as a competitive edge moat against other products in the industry.

Palantir’s Top Use Cases Are Starting To Show

Palantir is tailored to solve complex problems of large organizations, where it has to analyze a network of data and their relationships. For this reason, we can see that Palantir is a good use case for companies with many moving parts such as hospitals, logistics, airlines, etc. I would even argue that a company that is as optimized as Amazon (AWS offers Palantir) may benefit if it piloted the product, given that small optimizations in their processes may yield billions in excess value for the company.

The CEO of Palantir notes that while in the past, they had barely any sales in the commercial sector, Palantir now powers between 15% to 30% of hospital bed allocation in the US.

Palantir also entered the Aerospace business and partnered with Surf Air Mobility to optimize air travel logistics for companies. With Palantir, Airlines using the services of Surf Air can make cost-effective routing decisions, impacting their bottom-line. Entering this market may also pose increased competition to companies like Frequentis AG who have used automation and AI for years in air-traffic control. Palantir now owns a cumulative 9.7% in Surf Air, and while an acquisition move may seem counterintuitive for a growth company, Palantir is likely making good use of their large $3.67B cash balance by investing into potential long-term customers.

I expect companies to use AIP in the future and discover even more use cases for Palantir that lead to tangible cost savings via optimizations and process automation. At the same time, I expect Palantir to use its capex and start growing via acquiring companies whose business and customers can benefit from Palantir – These expenses will be a key part of the company’s reinvestment, directly impacting free cash flows.

Assumptions

Revenue: I assume an acceleration of revenue growth driven by sales network effects and hands-on AIP workshops that demonstrate immediate value to customers. The government segment is showing stagnating growth, but has positive optionality characteristics. I expect that in FY 2028 Palantir converges on revenues of about $8B, starting with a 25% growth next year, then accelerating to 30% revenue growth in the remaining 4.

Profitability: Current profit margins are suppressed because Palantir needs to deploy engineers in order to effectively integrate existing data streams with the platform. As integration tools get optimized, data streams become easier to work with, and AIP allows for easier integration, I expect that the need for these engineers will decrease, allowing the company to capture more value with higher-margin contracts. For this reason, my free cash flow margin target is 35% for 2029.

Net Income: At a free cash flow margin of 35% with $8B revenues in FY 2028, I estimate that Palantir produces free cash flows of $2.8B. I expect that the net income will become 40% of free cash flows, resulting in a net income of $1.12B.

Valuation Multiple: I believe the primary multiple used to value Palantir will be the price to free cash flows. By 2028 Palantir will have captured all of the possible high-value customers, and will have to invest in a larger salesforce to penetrate additional market share. Additionally, they will need to continue innovating above their core products to stimulate further growth. For these reasons, I think that the market will re-rate Palantir’s multiple lower, but still leave room for growth from continued innovation. I expect a P/FCF multiple of 22x, which translated to a PE comes up to 55x – close to some of its older software peers.

Share count: I believe that palantir will initiate buybacks in the future by allocating a portion of their future cash balance, and reduce its total share count around 3% by 2028. This results in 2.14B shares, from the current 2.21B.

Risks

- High Expectations: Palantir is a highly speculative young growth company with a high performance expectation already baked-into the stock. Investors should be aware of the high downside risk that can come even from what they consider to be high performance i.e. even if Palantir performs, the stock may drop.

- Technological Advancements: The rapid advancement of technology lifts all boats, and competitors may quickly find ways to innovate, posing a substantial risk to Palantir’s pricing, and consequently profitability margins.

- Customers Bringing Expense In-House: Customers may uncover repeatable patterns from Palantir’s ontologies which they may be able to replicate in-house, diminishing their usefulness in the future, leading to lower contract renewals/value.

- Currently Only Suitable To Huge Customers: Palantir may be most effective with large corporations, and have difficulties producing appealing value propositions for relatively smaller companies. This will impact future growth expectations and shrink valuation multiples.

- Volatility: Palantir is a highly-priced stock and investors may need to be prepared for multiple years of volatility before the company starts delivering significant returns.

Have other thoughts on Palantir Technologies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Goran_Damchevski holds no position in NasdaqGS:PLTR. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.