Key Takeaways

- Opera's growth is challenged by regulatory risks and dominant browser ecosystems, threatening both advertising revenue and market share expansion.

- Dependence on emerging markets and third-party browsing exposes Opera to macroeconomic shocks and competition, limiting consistent revenue and user growth.

- Declining user growth, reliance on volatile e-commerce advertising, currency headwinds, and dependence on partner deals and regulation threaten Opera’s long-term revenue and margin stability.

Catalysts

About Opera- Provides mobile and PC web browsers and related products and services in Norway and internationally.

- Although Opera continues to benefit from rapidly rising internet connectivity and digital advertising expansion in emerging and global markets—driving record 40 percent year-over-year revenue growth in the first quarter and strong e-commerce segment performance—the company remains highly exposed to intensifying global privacy regulations and shifting data consent frameworks, which could limit future data-driven advertising revenue and slow top-line growth.

- While Opera's emphasis on AI-powered features and agentic browsing tools positions it to capture new user segments and premium subscriptions over the long term, the ongoing consolidation of consumer attention within dominant browser ecosystems, such as those built by Google and Apple, creates formidable barriers to expanding Opera’s long-term market share, potentially restricting user base growth and putting downward pressure on premium ARPU expansion.

- The strong operating leverage demonstrated by decreasing OpEx as a percentage of revenues and stable EBITDA margins could support improved net margins as Opera scales. However, heavy reliance on volatile, performance-based advertising—especially in lower-ARPU emerging markets subject to currency fluctuations and local economic shocks—leaves Opera’s earnings and cash flows vulnerable to macro disruptions outside its direct control.

- Despite industry trends shifting toward browser diversification and regulatory actions that might favor smaller players like Opera, the rise of integrated web services and the increasing embedding of browsing functionalities into operating systems threaten to reduce consumer reliance on third-party browsers, potentially shrinking Opera’s addressable user base and limiting long-term revenue opportunities.

- While Opera boasts a track record of innovation and diversification across geographies and verticals—including early traction with Opera Air in Western markets—the company is still in the early stages of monetizing significant opportunities such as U.S. e-commerce. Future growth in these markets may face delays or heightened competition from better-capitalized rivals, which could restrict Opera’s ability to consistently expand its top-line and compress operating margins.

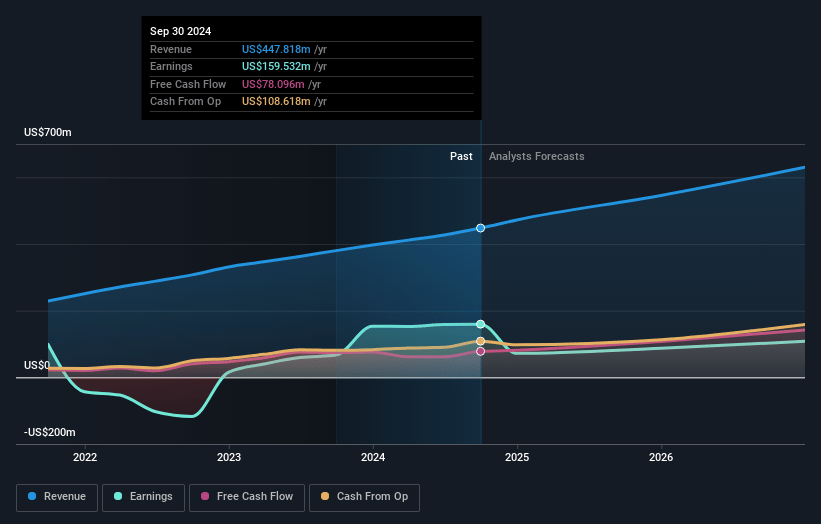

Opera Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Opera compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Opera's revenue will grow by 15.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 16.1% today to 17.7% in 3 years time.

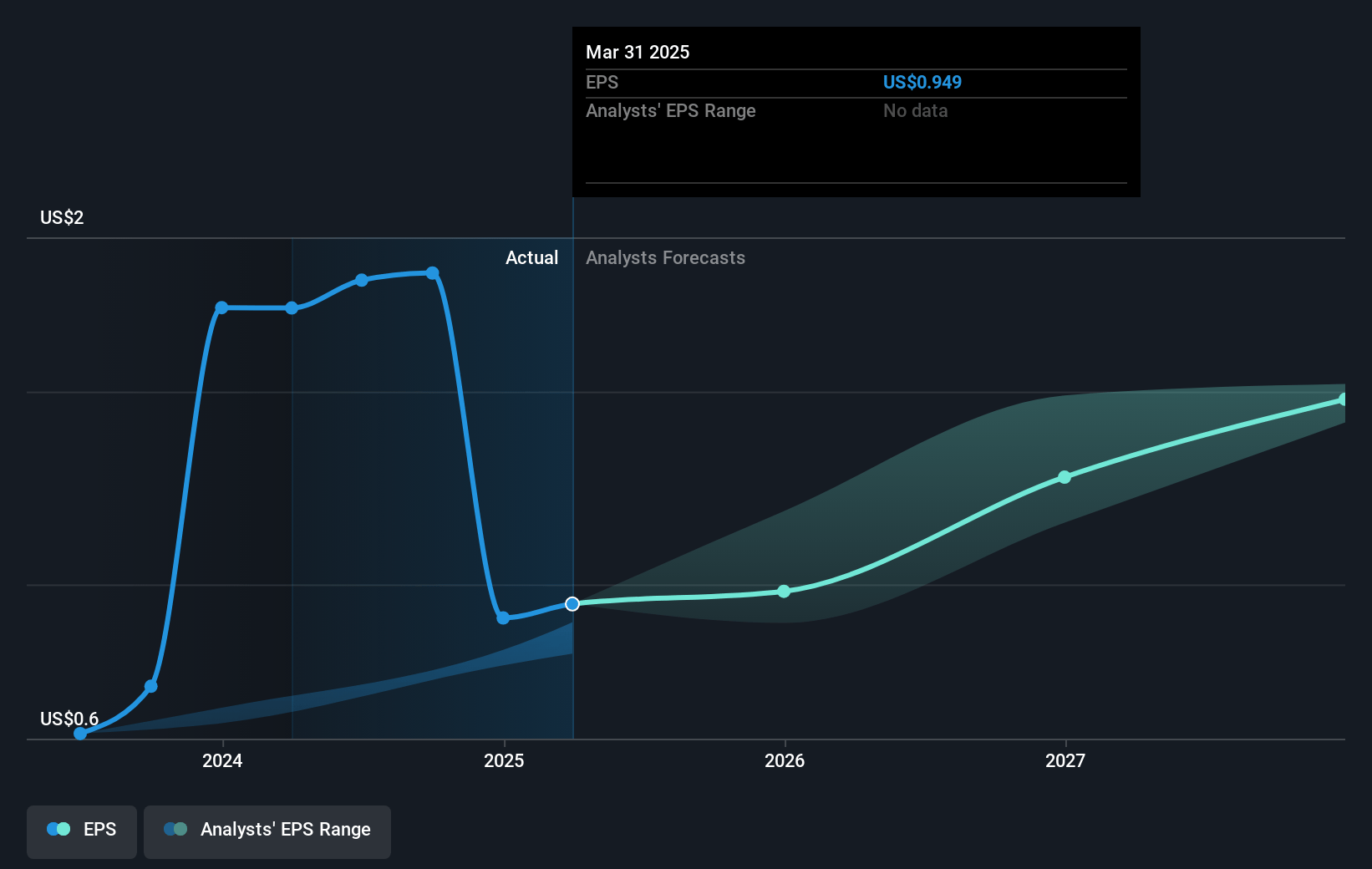

- The bearish analysts expect earnings to reach $142.9 million (and earnings per share of $1.54) by about July 2028, up from $84.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, down from 18.7x today. This future PE is lower than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to grow by 1.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.89%, as per the Simply Wall St company report.

Opera Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Opera’s user base is drifting lower, with the company prioritizing higher-value users over overall Monthly Active User growth; long-term declines in total users could eventually cap revenue expansion and dampen future earnings potential.

- Search revenue growth is slowing significantly, falling to 8 percent year-over-year versus previous double-digit rates, as the advertising mix shifts toward e-commerce; if this trend continues, reliance on e-commerce for outperformance may create volatility in Opera’s revenue mix and overall top-line growth.

- Opera’s fastest-growing revenue vertical is performance-based e-commerce advertising, which is still in early stages in major markets like the U.S.; the rapid expansion currently masks underlying seasonality, but as this segment matures and faces cyclical macroeconomic pressures, future revenue and margin stability may be at risk.

- Currency fluctuations, particularly a strong U.S. dollar, have been a headwind to Opera’s reported results, with growth impacted by 5 to 6 percentage points; ongoing exposure to exchange rate volatility can erode net margins and earnings, especially given Opera’s global revenue base.

- The industry’s structural reliance on distribution deals, default search placements, and integration with larger platforms could become a risk, as Opera acknowledges that performance and search revenues depend on partner relationships and emerging regulatory/antitrust changes, threatening both revenue retention and margin consistency over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Opera is $23.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Opera's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $23.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $805.8 million, earnings will come to $142.9 million, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 7.9%.

- Given the current share price of $17.63, the bearish analyst price target of $23.0 is 23.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.