Narratives are currently in beta

Key Takeaways

- AI-driven initiatives and strategic partnerships enhance revenue and net margins, with Copilot and OpenAI as key contributors to growth.

- Expansion in international cloud markets drives increased revenue, complemented by targeted industry-specific AI solutions for high-growth opportunities.

- Increased CapEx for AI and cloud infrastructure may strain resources amidst demand uncertainties, while competition and supply chain issues could pressure revenue and market position.

Catalysts

About Microsoft- Develops and supports software, services, devices and solutions worldwide.

- Microsoft's AI-driven transformation is expected to significantly impact revenue growth, with Microsoft's AI business on track to surpass a $10 billion annual revenue run rate, driven by accelerated adoption of AI capabilities like Copilot and Azure OpenAI. This increased demand for AI services and products stands to drive top-line growth.

- The expansion of Azure's cloud and AI infrastructure, including new data center investments and partnerships, suggests potential for increased revenue from cloud services as they capture more market share, particularly in international regions. Enhanced infrastructure efficiency may also improve net margins.

- Microsoft's strategic partnership with OpenAI continues to yield positive financial outcomes, driving differentiated IP and revenue momentum, which could improve both revenue growth and net margins over time as AI applications scale.

- GitHub Copilot's growing user base signals strong future earnings potential through increased productivity tools demand, contributing to revenue growth from both new subscriptions and upsell opportunities within existing customer bases.

- The addition of industry-specific AI models, particularly in sectors like healthcare with projects like DAX Copilot, could open new high-growth vertical markets for Microsoft, potentially increasing both revenue and net margins by offering specialized, high-value AI solutions.

Microsoft Future Earnings and Revenue Growth

Assumptions

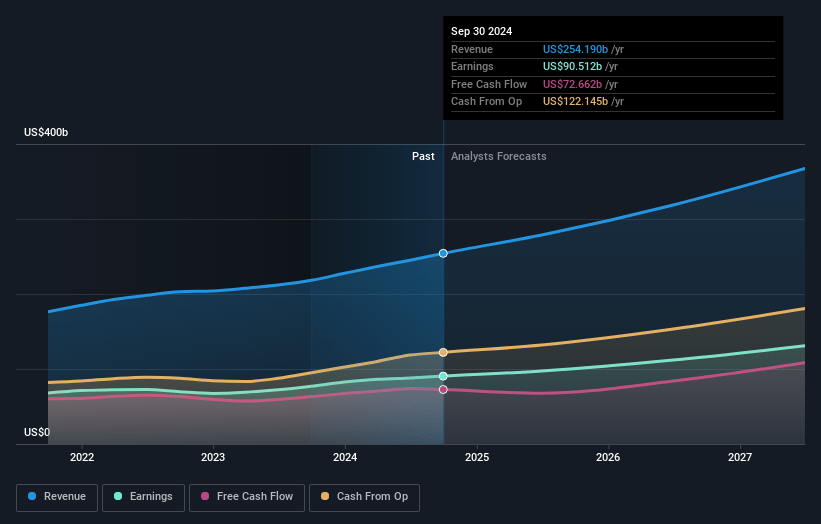

How have these above catalysts been quantified?- Analysts are assuming Microsoft's revenue will grow by 14.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 35.6% today to 35.8% in 3 years time.

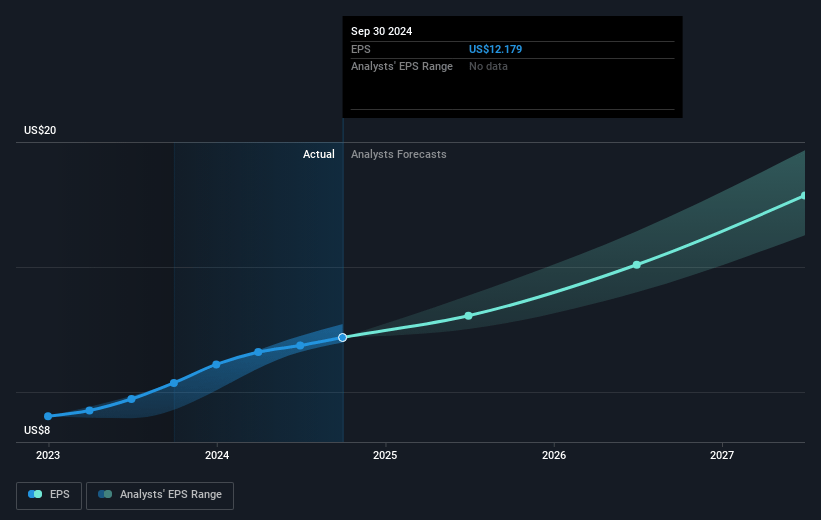

- Analysts expect earnings to reach $136.1 billion (and earnings per share of $18.53) by about December 2027, up from $90.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $116.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.5x on those 2027 earnings, down from 37.3x today. This future PE is lower than the current PE for the US Software industry at 42.0x.

- Analysts expect the number of shares outstanding to decline by 0.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.02%, as per the Simply Wall St company report.

Microsoft Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The heavy investment demands for building out AI and cloud infrastructure may impact Microsoft's CapEx and could potentially strain financial resources if demand doesn't materialize as anticipated, affecting net margins.

- Microsoft faces external constraints, such as delays in data center capacity expansion and power supply, which could limit its ability to meet AI demand, affecting Azure growth and future revenue generation.

- Growing competition in AI and cloud services markets presents a risk of pricing pressure and market share loss, which could impact Microsoft's revenue and earnings growth.

- Dependence on third-party supply chains for AI infrastructure components could result in delays or cost increases, potentially impacting revenue recognition and profitability.

- Any significant disruptions or changes in strategic partnerships, such as with OpenAI, might influence Microsoft's ability to maintain its competitive edge in AI, possibly affecting long-term earnings and market position.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $506.98 for Microsoft based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $650.0, and the most bearish reporting a price target of just $420.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $379.7 billion, earnings will come to $136.1 billion, and it would be trading on a PE ratio of 33.5x, assuming you use a discount rate of 7.0%.

- Given the current share price of $454.46, the analyst's price target of $506.98 is 10.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

GO

Equity Analyst

Productivity Suite, Cloud and AI to Continue Growing, Pushing Up Net Margins

Key Takeaways I'm bullish on Microsoft as a business, its most profitable days ahead Growth avenue: revamp current products with AI, increase offers on Azure cloud Not leader in cloud infrastructure, but dominant in SaaS productivity suite Highest potential growth industries: CRM & ERP, gaming, healthcare Teams: Microsoft's true super app, pushing to make it as prevalent as Office 365 Catalysts Business Catalysts Enhancing the family of apps with AI. By now, most of the investing world regards Microsoft as a leader in AI.

View narrativeUS$333.48

FV

30.9% overvalued intrinsic discount9.50%

Revenue growth p.a.

63users have liked this narrative

0users have commented on this narrative

20users have followed this narrative

about 1 month ago author updated this narrative

BA

Equity Analyst

Declining Notebook Sales And A Shift Away From Console Gaming Will Hurt Earnings Growth Potential

Key Takeaways Competition from free Office Productivity software will likely cause seat growth to decline for home and commercial customers Increased smartphone compute power and diminishing compute needs will see Notebook sales decline A shift towards PC and mobile gaming will be detrimental to Xbox console sales and services Catalysts Stagnating Growth in Microsoft Office Revenue Microsoft’s Office suite has been a staple in workplaces and home offices for years, but competition from free cloud-based alternatives like Google Docs and other vendors like Apple, Cisco Systems, Meta, IBM, Okta, Proofpoint, Slack, Symantec, Zoom, and numerous web-based and mobile application competitors are jeopardising this key revenue stream. The issue for Microsoft here is simple; what matters most to customers is convenience, cost and simplicity, and with Office providing a similar product at an elevated price for consumers means that plenty of users which switch to alternatives like Google Moreover, there was a significant price hike in Microsoft 365 and Office 365 business prices by as much as 20 percent in March 2022.

View narrativeUS$335.64

FV

30.1% overvalued intrinsic discount3.80%

Revenue growth p.a.

51users have liked this narrative

0users have commented on this narrative

7users have followed this narrative

3 months ago author updated this narrative

WA

WallStreetWontons

Community Contributor

MSFT: Staying Headstrong in AI and Infrastructure is Priced in

Catalysts Revenue : MSFT’s revenue reached $61.9 billion, representing a 17% year-over-year increase. Earnings Per Share (EPS) : The EPS rose to $2.94, up by 20% year-over-year.

View narrativeUS$384.79

FV

13.5% overvalued intrinsic discount10.00%

Revenue growth p.a.

3users have liked this narrative

0users have commented on this narrative

12users have followed this narrative

5 months ago author updated this narrative