Key Takeaways

- Geopolitical tensions, regulatory barriers, and rapid technological change threaten GDS Holdings' growth, profitability, and access to essential hardware and markets.

- High leverage, capital demands, and risk of overcapacity in key cities raise financial risk and limit margin and earnings expansion.

- Strong AI-driven demand and international expansion, coupled with flexible financing and asset-light strategies, position the company for sustainable growth, margin resilience, and reduced financial risk.

Catalysts

About GDS Holdings- Develops and operates data centers in the People's Republic of China.

- Ongoing US-China geopolitical tension and stricter controls on advanced technology exports are expected to restrict GDS Holdings' access to critical AI chips and other key hardware. This will slow the rollout of next-generation data center offerings, diminishing the company's ability to capture AI-driven revenue growth and ultimately weakening long-term revenue prospects.

- Rising regulatory barriers and tightening data localization mandates in China and Southeast Asia are increasing compliance costs and operational complexity. As these rules intensify, GDS may face limitations on the expansion and use of its large pipeline of capacity, undermining future margin expansion and the pace of topline growth.

- Heavy capital expenditure requirements, continued asset monetization, and the need to fund large-scale expansion projects have kept leverage high, which could force GDS to dilute shareholders or accept worse financing terms. These pressures are likely to constrain net earnings growth and increase financial risk, particularly if expected AI demand fails to materialize fully and consistently.

- The risk of overcapacity in Tier 1 cities, where GDS has concentrated its future development, is increasing as government controls on new AI data center projects tighten and state-owned enterprises are prioritized for future expansion. This will likely erode pricing power, leading to stagnating revenues and compressing EBITDA margins as utilization rates plateau or decline.

- Rapid advances in data center architecture, cooling, and energy efficiency are expected to obsolete older facilities faster, requiring elevated and continuous reinvestment. This will reduce returns on invested capital and further compress profitability, making it difficult for GDS to sustain EBITDA margin growth over the long term.

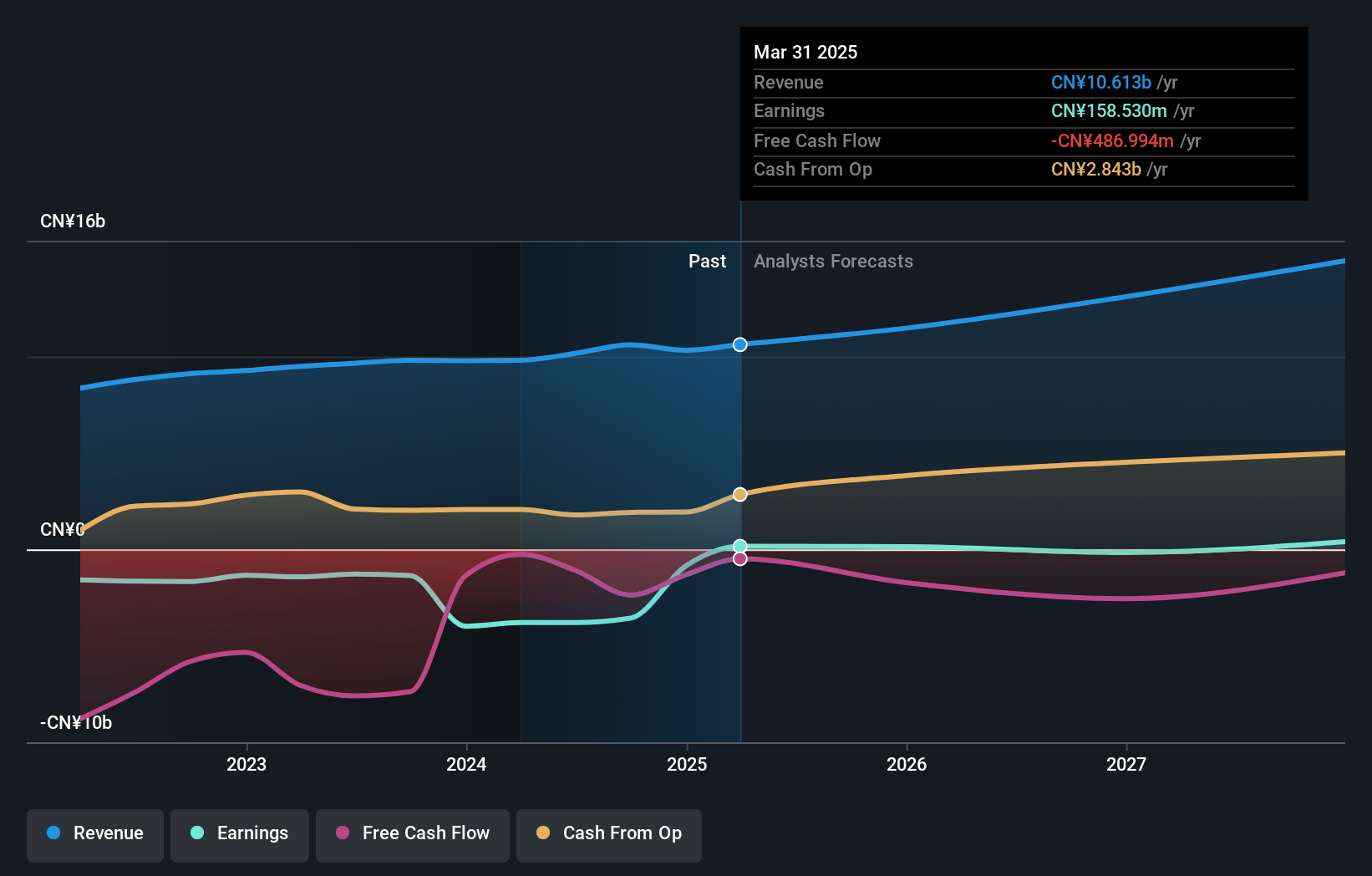

GDS Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on GDS Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming GDS Holdings's revenue will grow by 12.7% annually over the next 3 years.

- The bearish analysts are not forecasting that GDS Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate GDS Holdings's profit margin will increase from 1.5% to the average US IT industry of 6.3% in 3 years.

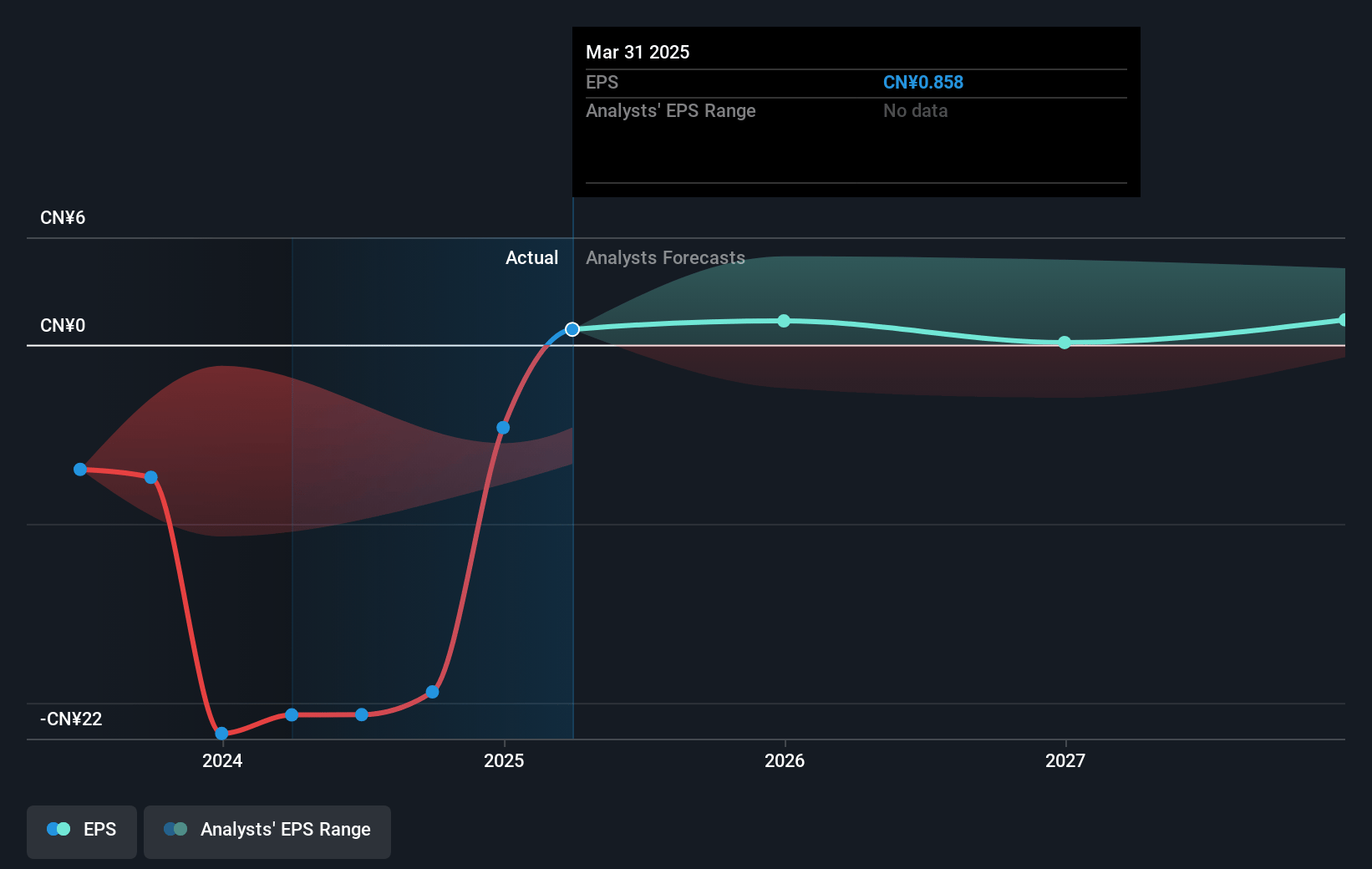

- If GDS Holdings's profit margin were to converge on the industry average, you could expect earnings to reach CN¥958.8 million (and earnings per share of CN¥4.05) by about July 2028, up from CN¥158.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 72.7x on those 2028 earnings, down from 342.0x today. This future PE is greater than the current PE for the US IT industry at 27.4x.

- Analysts expect the number of shares outstanding to grow by 5.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.06%, as per the Simply Wall St company report.

GDS Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Explosive growth in AI and digitalization is fueling strong and sustainable data center demand in Tier 1 Chinese markets, leading to a large backlog, high utilization rates above 75 percent, rapid move-ins, and 12 percent revenue growth, which directly supports future recurring revenues and top-line expansion.

- The company's ability to consistently monetize assets through ABS and plans for a C-REIT provide significant financing flexibility and allow for ongoing capital recycling, reducing leverage and supporting robust capital expenditure without increasing net debt, thereby protecting net margins and lowering financing risk.

- DayOne's rapid international expansion and ability to secure committed orders from world-leading tech companies in Southeast Asia and Europe diversify markets, increase addressable revenue streams, and produce higher EBITDA yields than China, which could materially improve overall earnings and margin resilience over time.

- Stabilized pricing in new business signings within major Tier 1 markets, along with deep relationships with major hyperscalers and cloud providers, contribute to predictable revenue flows and high occupancy rates, supporting stable or expanding EBITDA margins regardless of short-term market shifts.

- Asset-light value creation through successful asset sales, deconsolidation of debt, and positive free cash flow before financing in China demonstrates self-funding growth, improved return on equity, and enhanced financial sustainability, all of which mitigate risks to earnings and support long-term equity value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for GDS Holdings is $29.12, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of GDS Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $64.5, and the most bearish reporting a price target of just $29.12.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥15.2 billion, earnings will come to CN¥958.8 million, and it would be trading on a PE ratio of 72.7x, assuming you use a discount rate of 12.1%.

- Given the current share price of $37.72, the bearish analyst price target of $29.12 is 29.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.