Key Takeaways

- GDS's strategic asset monetization and regulatory positioning enable accelerated growth, lower leverage, and sustainable infrastructure investment, outpacing industry peers.

- Rapid international expansion and rising demand from digital transformation and regulatory shifts drive higher margins, pricing power, and long-term earnings growth.

- Regulatory challenges, growing competition, heavy capital needs, geographic concentration, and international expansion risks threaten growth, profitability, and funding stability for GDS Holdings.

Catalysts

About GDS Holdings- Develops and operates data centers in the People's Republic of China.

- Analyst consensus expects GDS to benefit from AI inferencing in Tier 1 markets, but this may be conservative, as management sees a runway to fully develop and monetize its entire 900 megawatts of held capacity within just four years, which implies a potential step-change in revenue and operating cash flow growth well beyond current forecasts.

- While the consensus narrative values GDS's asset monetization as flexibility, recent successful ABS and anticipated C-REIT transactions are likely to create a dual effect of substantially lowering leverage and unlocking new financing capacity, enabling GDS to execute on RMB 5 billion of annual CapEx sustainably-accelerating both EBITDA and earnings expansion compared to peer operators.

- International expansion through DayOne is gaining faster traction than anticipated, with committed power in Southeast Asia and Europe on track to surpass 1 gigawatt well ahead of schedule, positioning GDS for outsized revenue growth and higher-margin diversification from markets with better development yields than China.

- As digital transformation accelerates across China and Southeast Asia, GDS's blue-chip client roster and early investment in power and land bank create rising pricing power and occupancy in a tightening supply environment, providing long-term uplift to both net margins and top-line growth.

- Tightening regulatory barriers and focus on data sovereignty are starting to drive state-owned and private sector demand toward established, compliant providers; GDS's pre-existing power quotas and regulatory relationships uniquely insulate it from new entrant risks and position it for outsized capture of structurally increasing demand, supporting sustained earnings growth.

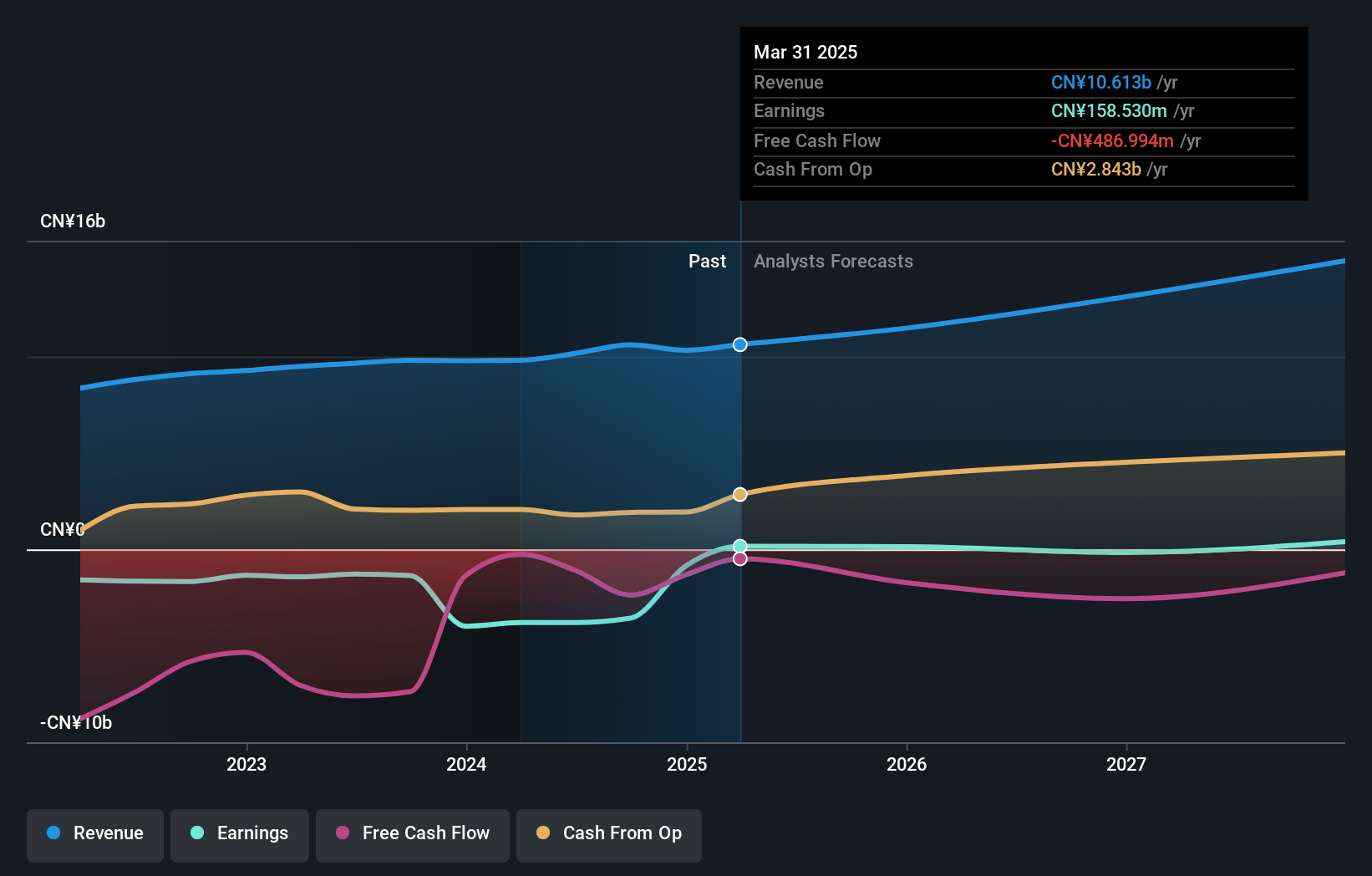

GDS Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on GDS Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming GDS Holdings's revenue will grow by 17.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.5% today to 4.8% in 3 years time.

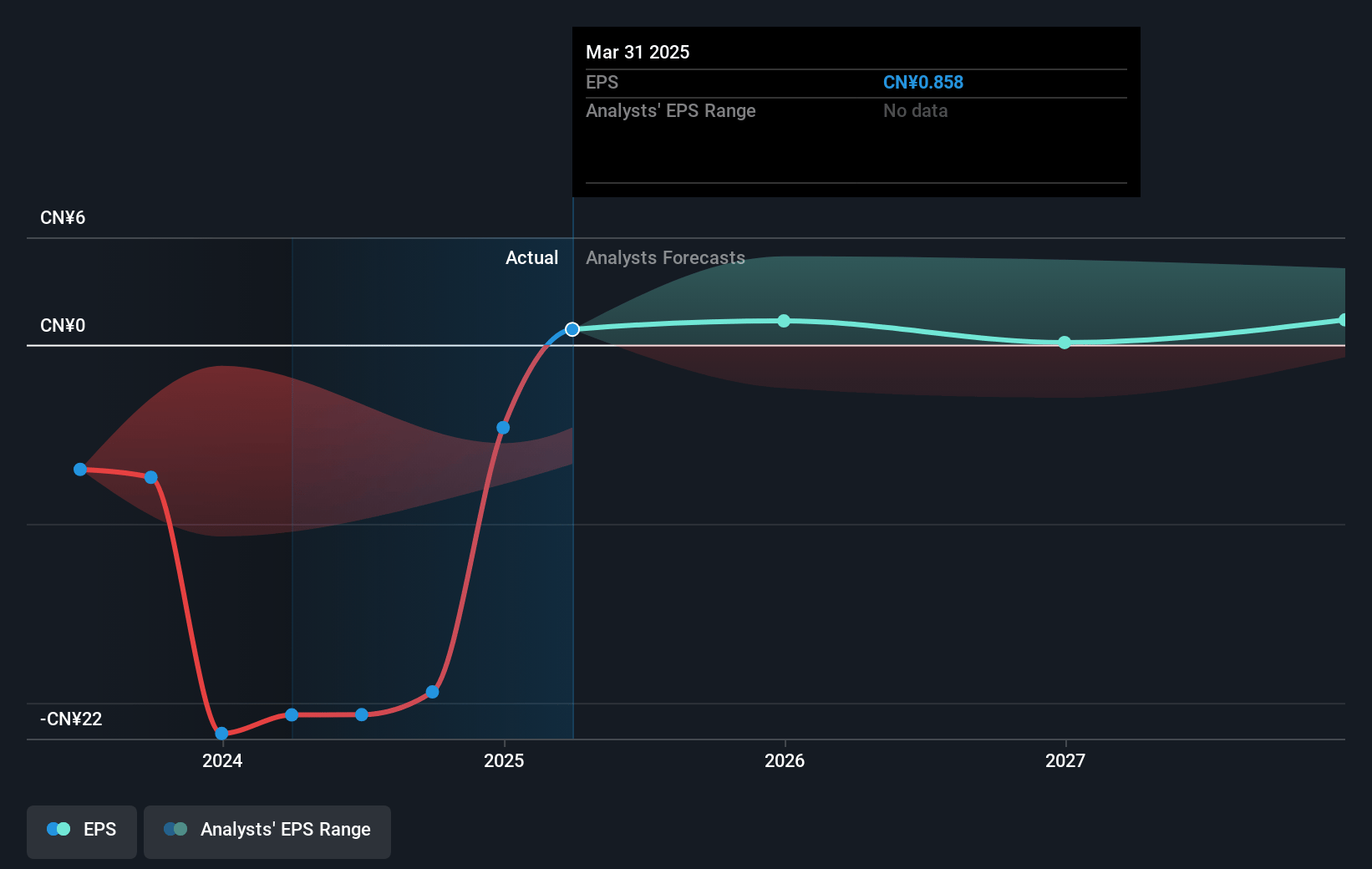

- The bullish analysts expect earnings to reach CN¥838.2 million (and earnings per share of CN¥2.75) by about July 2028, up from CN¥158.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 152.3x on those 2028 earnings, down from 307.3x today. This future PE is greater than the current PE for the US IT industry at 28.4x.

- Analysts expect the number of shares outstanding to grow by 5.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.1%, as per the Simply Wall St company report.

GDS Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened government regulations in China, such as new approval requirements for AI data center expansion and a potential preference for state-owned enterprises building these facilities, could restrict GDS's ability to develop additional capacity and directly limit its ability to grow recurring revenues.

- Intensifying competition from both domestic hyperscalers building their own in-house data centers and other third-party providers may reduce GDS's addressable market and lead to pricing pressure, eroding both revenue growth and net margins over the long term.

- The ongoing need for significant capital expenditure to maintain competitive, energy-efficient infrastructure means GDS must continue leveraging asset monetization and C-REIT transactions; should these financing channels wane or become less favorable, its ability to fund growth or refinance debt may be impaired, negatively impacting future earnings and cash flow.

- Persistent reliance on Tier 1 cities for new growth exposes GDS to regional overcapacity risks, which could further depress utilization rates and make it more difficult to improve returns on invested capital, thereby placing downward pressure on EBITDA and net margins.

- GDS's international expansion via DayOne into Southeast Asia and Europe brings substantial execution and regulatory risks; failure to operate successfully in these new markets could result in sunk capital, lower-than-expected yields, and ultimately depress consolidated returns and future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for GDS Holdings is $53.33, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of GDS Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $53.33, and the most bearish reporting a price target of just $29.11.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥17.4 billion, earnings will come to CN¥838.2 million, and it would be trading on a PE ratio of 152.3x, assuming you use a discount rate of 12.1%.

- Given the current share price of $33.91, the bullish analyst price target of $53.33 is 36.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.