Key Takeaways

- Strategic focus on large-scale, low-cost, renewable-powered data centers and high-performance computing partnerships is creating new, high-margin revenue streams and growth opportunities.

- Long-term cost advantages from power agreements and efficient mining investments enable Cipher to outperform competitors and capitalize on expanding institutional digital asset adoption.

- Exposure to Bitcoin price volatility, rising costs, environmental risks, and industry competition threaten margins, earnings stability, and access to capital for Cipher Mining.

Catalysts

About Cipher Mining- Develops and operates industrial-scale data centers in the United States.

- The accelerating development of Cipher’s 2.8 gigawatt pipeline of large-scale, low-cost, and renewable-powered data centers positions the company to capture outsized revenue growth and economies of scale as institutional adoption of Bitcoin and demand for digital assets expands globally.

- The strategic shift toward developing data centers for high performance computing (HPC) use, combined with joint financing partnerships like Fortress Credit Advisors at Barber Lake, creates new, high-margin leasing revenue streams and substantial optionality—potentially lifting both EBITDA margins and overall earnings.

- Cipher’s industry-leading power purchase agreements and fixed electricity prices lock in a significant long-term cost advantage, enabling the company to outperform smaller or less efficient miners on net margins, even as industry mining difficulty rises and broader energy volatility increases.

- Investments in the latest, most efficient mining rigs and rapid scalability—evidenced by on-schedule capacity launches at new sites—should boost Cipher’s hash rate share, driving higher Bitcoin production per unit cost and translating to growth in both topline revenue and operating cash flow.

- Surging demand for digital stores of value as economies digitize and financial institutions integrate Bitcoin into their platforms creates a structurally larger addressable market, supporting bullish long-term revenue and EBITDA outlooks for scale players with efficient operations and robust balance sheets like Cipher.

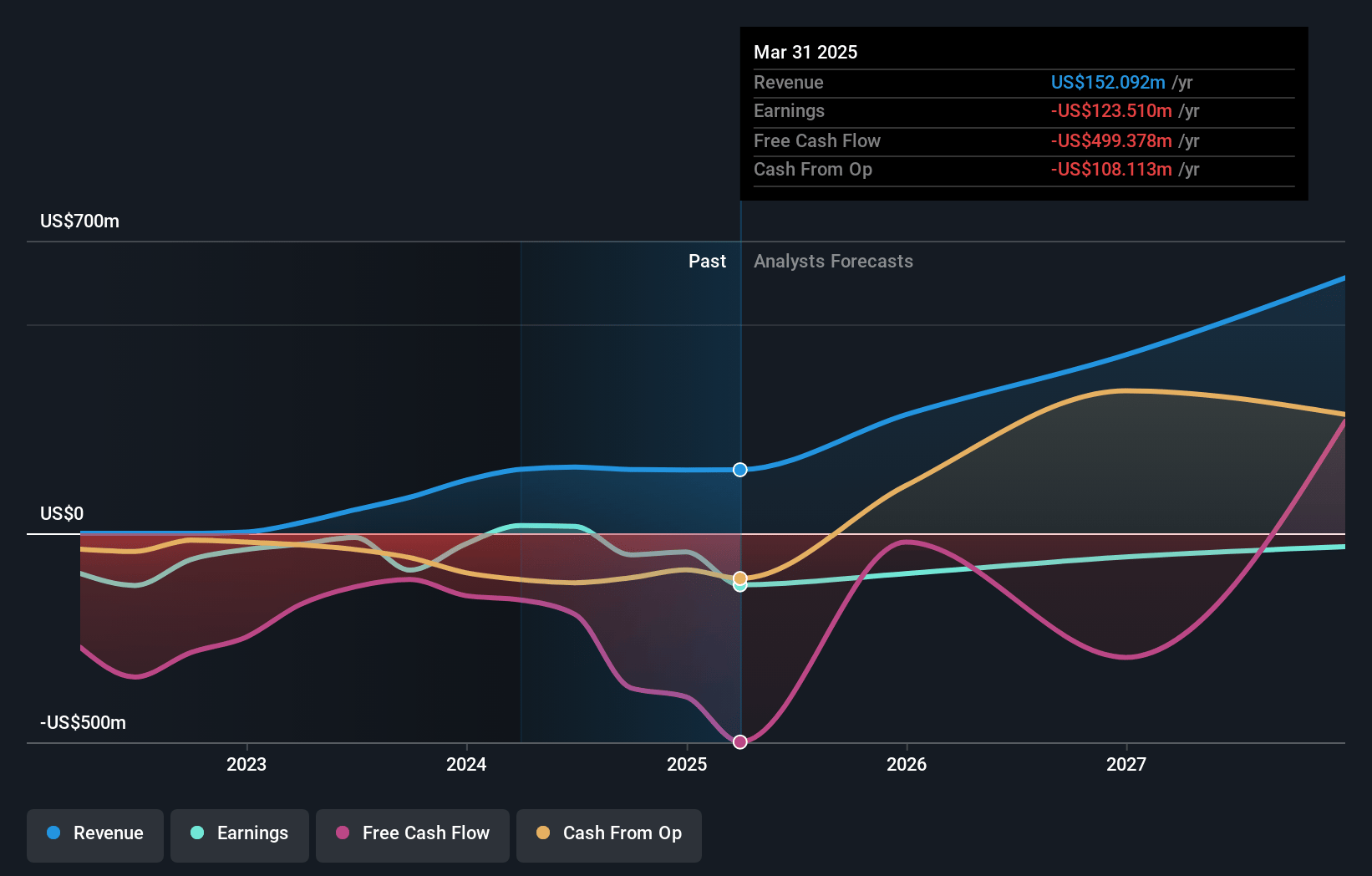

Cipher Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Cipher Mining compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Cipher Mining's revenue will grow by 83.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -81.2% today to 37.7% in 3 years time.

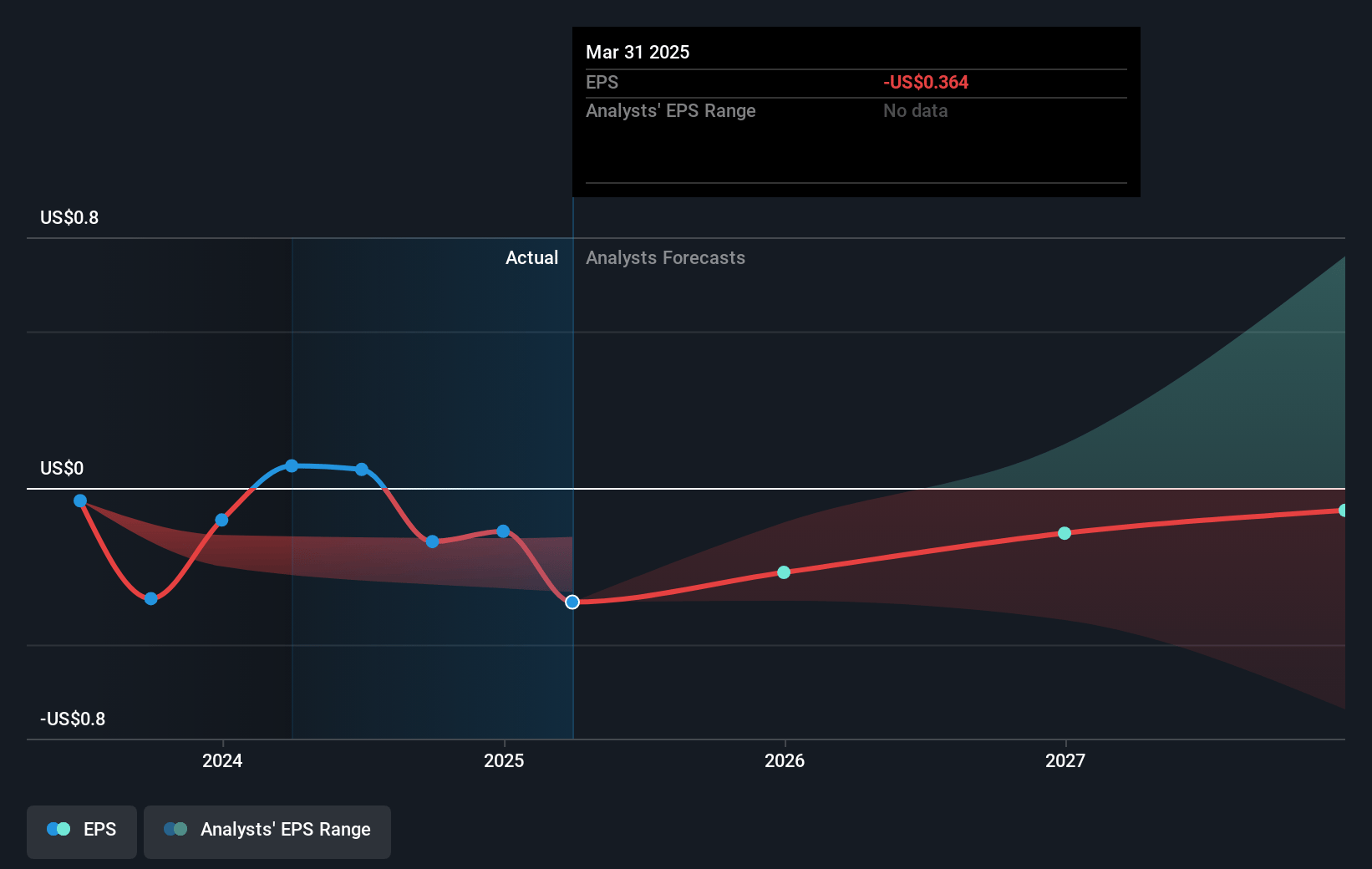

- The bullish analysts expect earnings to reach $355.9 million (and earnings per share of $0.88) by about July 2028, up from $-123.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, up from -20.9x today. This future PE is lower than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

Cipher Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Cipher Mining’s revenue and earnings remain deeply tethered to Bitcoin’s price, as evidenced by sharp swings in GAAP and non-GAAP earnings driven largely by mark-to-market changes and realized gains or losses on Bitcoin holdings, highlighting the risk of prolonged crypto downturns on both top line and net income.

- The company’s long-term cost advantage depends on its five-year fixed price power purchase agreement at Odessa, which expires in July 2027; any future changes, renegotiations, or adverse regulatory shifts could lead to higher electricity expenses, undermining Cipher Mining’s margins and net earnings.

- Increasing capital expenditures for ongoing fleet upgrades and data center development, combined with a change in depreciation schedules that shortens the useful life of equipment, has already resulted in significant increases in depreciation costs that sharply compress net profits and generate persistent cash flow pressure.

- The potential for tightening environmental regulations and growing ESG scrutiny threatens both Cipher Mining’s access to institutional capital and its operational cost base, as energy-intensive mining activities become primary targets for carbon taxes and stricter oversight, leading to reduced margins and more challenging capital raising environments.

- Intensifying industry competition and a rising network hash rate, paired with inevitable Bitcoin reward halvings, will continue to erode Cipher Mining’s share of mined rewards and revenues over time unless mitigated by substantially higher Bitcoin prices or diversification, exposing Cipher to both revenue compression and increased earnings volatility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Cipher Mining is $8.93, which represents two standard deviations above the consensus price target of $7.12. This valuation is based on what can be assumed as the expectations of Cipher Mining's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $944.3 million, earnings will come to $355.9 million, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 7.9%.

- Given the current share price of $6.94, the bullish analyst price target of $8.93 is 22.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.