Key Takeaways

- Elevated regulatory scrutiny, ESG concerns, and competition for renewable energy create long-term risks for profitability, financing, and sustainable growth.

- High operational flexibility and energy efficiency are advantages, but volatile Bitcoin prices and capital intensity threaten earnings stability and future returns.

- Heavy dependence on volatile Bitcoin prices, partnership-driven expansion, and new HPC ventures expose Cipher Mining to significant earnings, operational, and regulatory risks.

Catalysts

About Cipher Mining- Develops and operates industrial-scale data centers in the United States.

- While Cipher Mining is set to benefit from ongoing mainstream adoption of Bitcoin and greater institutional participation in cryptocurrencies, regulatory risk remains elevated; pending legislative changes in Texas and broader global scrutiny could materially raise compliance and operational costs, threatening future revenue stability and margin expansion.

- Although the company has developed a significant pipeline of energy-efficient sites that should allow it to capitalize on a future where Bitcoin is a more widely accepted digital store of value, the ongoing global push for ESG compliance and possible disinvestment from carbon-intensive mining poses a long-term risk to cost of capital and access to capital markets, impacting future earnings growth.

- Despite Cipher Mining’s access to low-cost, fixed-price power and industry-leading energy efficiency—factors that should help maintain attractive net margins even as mining difficulty rises—the need for constant hardware upgrades and high capital intensity could pressure free cash flow and lead to future equity dilution or increased debt, limiting long-term returns.

- While the company’s ability to adaptively expand and redeploy rigs in response to changing power and tariff conditions gives it operational flexibility, its revenue remains highly correlated with inherently volatile Bitcoin prices; prolonged downturns or unpredictable market shifts could significantly impair both earnings and cash flow, regardless of operational efficiency.

- Even with a clear advantage in scalable infrastructure and site selection for future HPC (High Performance Computing) and data center development, the increasing competition for renewable energy and the risk of delays or failures in tenant agreements for major sites like Barber Lake could restrain both near-term growth and long-term revenue realization, especially if management’s strategic pivots do not generate expected tenant or leasing demand.

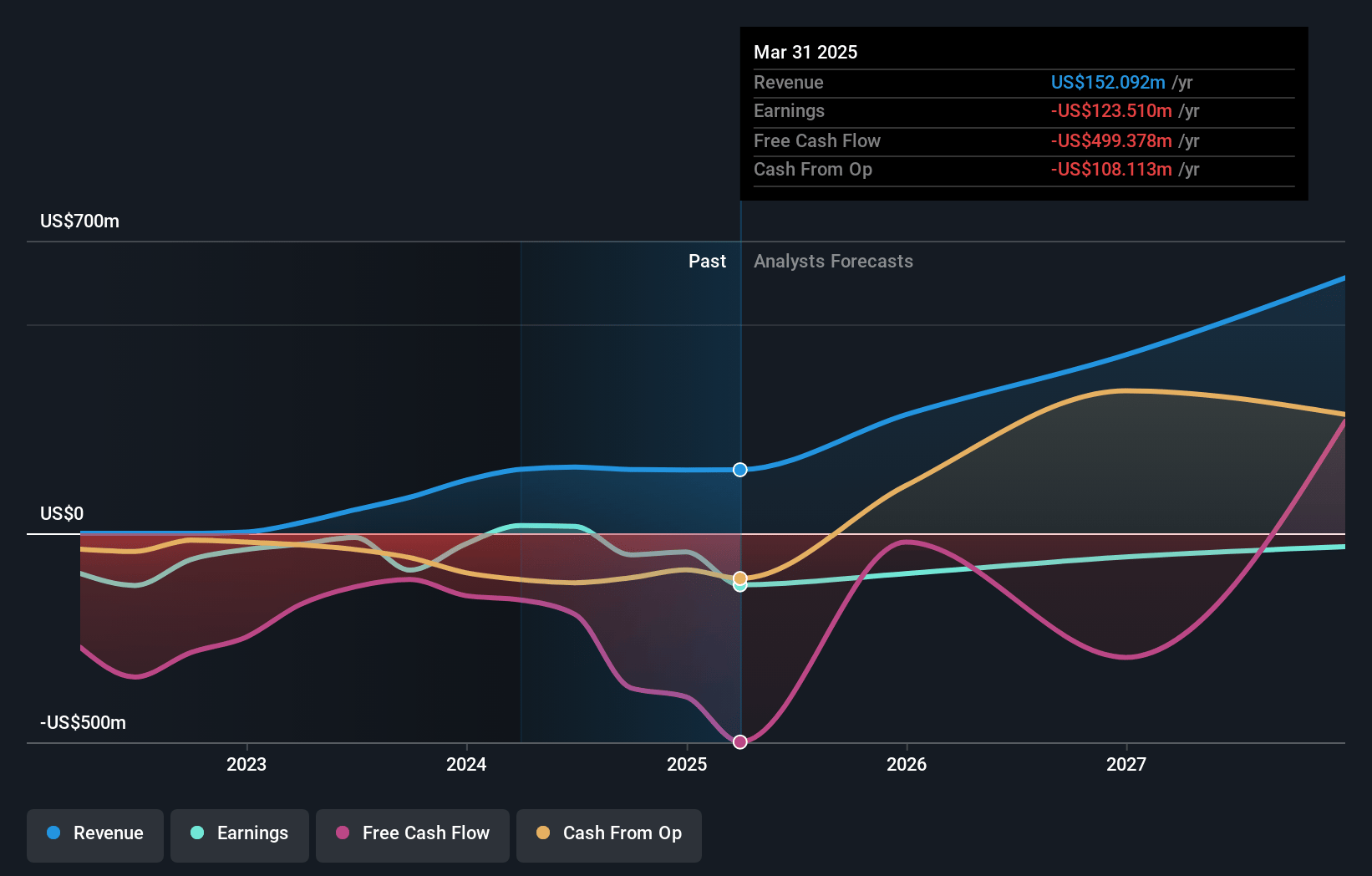

Cipher Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Cipher Mining compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Cipher Mining's revenue will grow by 39.2% annually over the next 3 years.

- The bearish analysts are not forecasting that Cipher Mining will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Cipher Mining's profit margin will increase from -81.2% to the average US Software industry of 13.2% in 3 years.

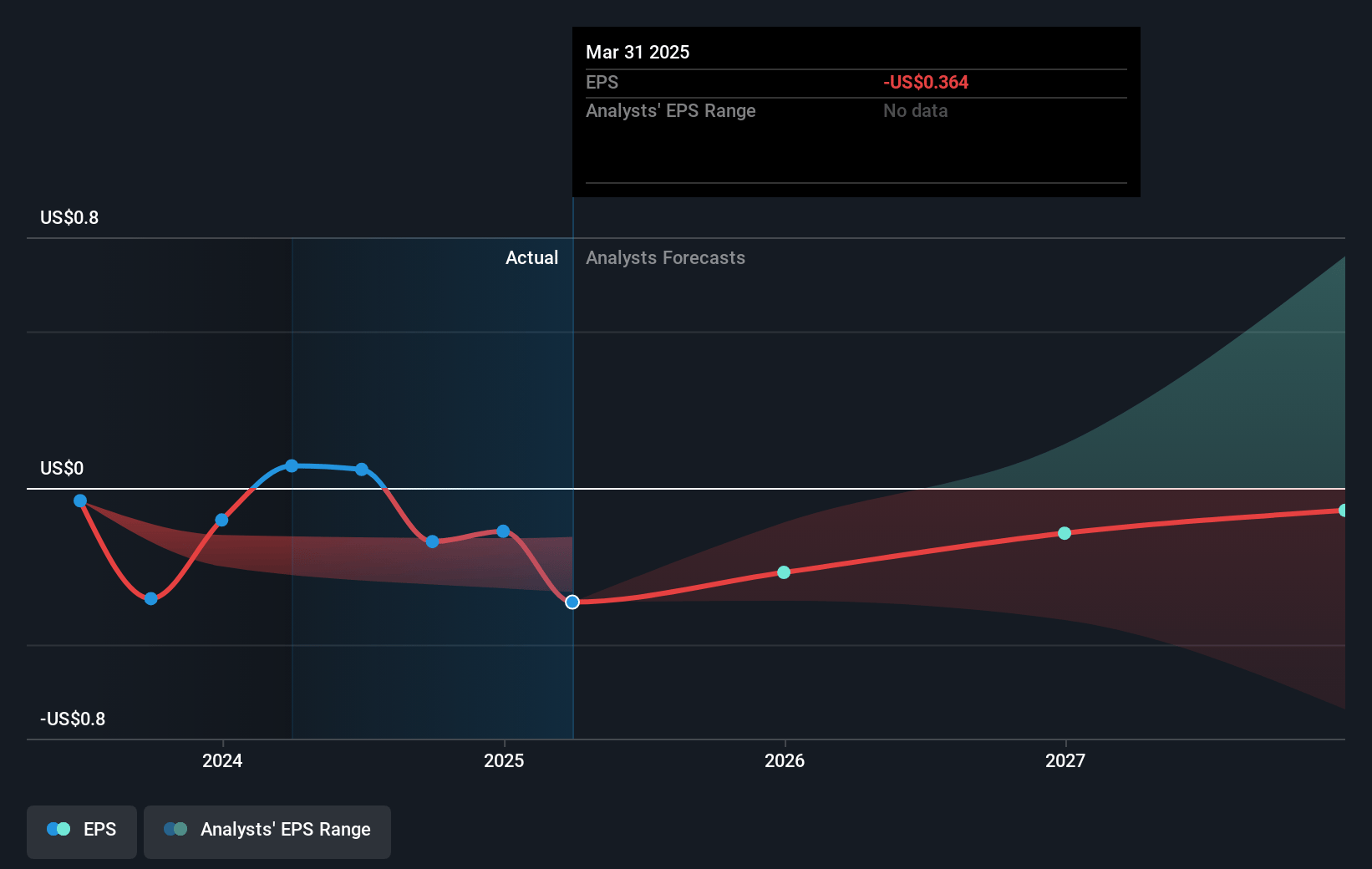

- If Cipher Mining's profit margin were to converge on the industry average, you could expect earnings to reach $54.4 million (and earnings per share of $0.12) by about July 2028, up from $-123.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 63.0x on those 2028 earnings, up from -18.8x today. This future PE is greater than the current PE for the US Software industry at 43.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

Cipher Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company’s financial results show sharp volatility, with a GAAP net loss of $39 million this quarter compared to a net income of $40 million in the same quarter last year, driven by unrealized losses on Bitcoin holdings and a significant increase in depreciation, signaling potential ongoing risks to earnings stability if Bitcoin prices are unfavorable or if asset depreciation continues to accelerate.

- Cipher Mining’s revenue and margins remain heavily dependent on the spot price of Bitcoin, and management noted that lower Bitcoin prices at quarter-end generated a $20 million unrealized mark-to-market loss, highlighting the vulnerability of revenues and net earnings to prolonged declines or stagnation in the price of Bitcoin.

- The company’s capital and expansion strategy relies extensively on external partnerships and joint ventures, like the recent arrangement with Fortress at Barber Lake where Cipher expects to own up to 49 percent of the economics; while this reduces upfront capital outlay, it can significantly dilute Cipher’s long-term share of profits and limit upside for shareholders as the business scales, which could cap long-term returns and operating income.

- The shift in focus from pure Bitcoin mining to high-performance computing (HPC) data center development introduces execution risk, as final project economics depend on securing large, long-term tenant leases in a highly competitive sector where delays or failures to close deals could leave substantial capacity underutilized, impairing both revenue and asset returns.

- The company faces ongoing operational and regulatory uncertainties in its core Texas market, including evolving interconnection rules and potential changes to how behind-the-meter data centers are charged for transmission, both of which could tighten access to new power capacity and increase costs, thereby threatening future site development and compressing gross margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Cipher Mining is $6.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cipher Mining's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $410.6 million, earnings will come to $54.4 million, and it would be trading on a PE ratio of 63.0x, assuming you use a discount rate of 7.9%.

- Given the current share price of $6.27, the bearish analyst price target of $6.0 is 4.5% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.