Last Update 26 Dec 25

Fair value Increased 17%APPF: AI And Resident Services Will Drive Stronger Long-Term Fundamentals

Analysts have raised their price target on AppFolio from $300 to $350 per share. This reflects increased confidence that accelerating revenue growth, improving margins, and new AI driven and resident services offerings can support stronger long term fundamentals despite recent share price underperformance.

Analyst Commentary

Bullish analysts view the recent pullback in AppFolio shares as disconnected from the strength of the underlying business, pointing to healthy demand trends, expanding product breadth, and a robust long term growth runway.

Several firms have reiterated or introduced Buy or Outperform ratings alongside price targets that sit comfortably above the current share price, underscoring conviction that execution on AI and resident services can support durable revenue acceleration and margin expansion.

Bullish Takeaways

- Multiple upgrades to Outperform and Overweight ratings, with price targets clustered in the high $200s to low $300s, signal confidence that the recent valuation reset is overdone relative to AppFolio’s growth and profitability outlook.

- Bullish analysts highlight that new and upcoming AI and resident services offerings should lift revenue growth back above 20 percent, a pace they see as underappreciated in current multiples.

- Recent user and investor events reinforced momentum in higher value tiers such as Plus and Max, supporting a thesis of stronger mix driven expansion and improving unit economics over time.

- Upcoming product launches and follow up investor communications are viewed as potential catalysts to re rate the stock as the market better recognizes the scale of AppFolio’s monetization and total addressable market opportunity.

What's in the News

- KeyBanc upgraded AppFolio to Overweight from Sector Weight with a $285 price target after its Future user conference, citing stronger momentum in Plus and Max tiers and expanded resident experience monetization opportunities (Periodicals).

- AppFolio raised its 2025 revenue guidance to a range of $945 million to $950 million, implying 19 percent midpoint growth driven by Plus and Max adoption, customer growth, and uptake of new products and services (Key Developments).

- At its FUTURE real estate conference, AppFolio launched its AI native Real Estate Performance Management framework and new Resident Onboarding capabilities, aiming to shift property management from task efficiency to outcome oriented performance and new revenue opportunities (Key Developments).

- SnapInspect integrated its property inspection and maintenance platform with AppFolio Stack Marketplace, automating work orders and real time data sync to improve maintenance efficiency and resident service quality for multifamily operators (Key Developments).

Valuation Changes

- Fair Value: increased from $300 to $350 per share, representing a modest upward revision in estimated intrinsic value.

- Discount Rate: risen slightly from 7.89 percent to 8.46 percent, reflecting a marginally higher required return or perceived risk profile.

- Revenue Growth: raised significantly from 9.22 percent to 20.58 percent, indicating a materially more optimistic outlook for top line expansion.

- Net Profit Margin: improved from 13.91 percent to 16.30 percent, signaling expectations for stronger underlying profitability.

- Future P/E: lowered notably from 88.27x to 58.63x, suggesting a less expensive valuation relative to forward earnings under the updated assumptions.

Key Takeaways

- Cloud-based, AI-enhanced platform and value-added services drive customer growth, improved efficiency, and recurring revenues in the digital property management sector.

- Industry consolidation and rising market demand position AppFolio for increased market share and long-term earnings expansion through innovation and strategic partnerships.

- Market dependency, intensifying competition, rising compliance costs, and challenges in expanding beyond core offerings threaten both revenue growth and long-term profitability.

Catalysts

About AppFolio- Provides cloud-based platform for the real estate industry in the United States.

- As more property managers and renters demand digital solutions to streamline and enhance their experiences, AppFolio’s cloud-based SaaS offerings and modern, mobile-first platform place it at the forefront of the ongoing shift to digital property management, driving sustained customer acquisition and ARPU growth, which directly benefits revenue.

- Rising rental housing demand from urbanization and shifting demographics expands the pool of multifamily units under management, supporting AppFolio’s continued unit growth momentum and opening opportunities to significantly scale revenue as well as increase customer stickiness in a growing market.

- Ongoing investment in AI-driven automation, including the adoption of Realm-X and other generative AI tools, is creating operating leverage by improving customer conversion rates and efficiency, which supports further expansion in net margins over time.

- The growing ecosystem of value-added services—including payment processing, screening, insurance, and new resident-centric features enabled through partnerships (such as with Second Nature and Zillow) and acquisitions (like LiveEasy)—enables AppFolio to increase recurring revenues and ARPU, which will drive top-line growth and potentially earnings expansion.

- Increasing consolidation in the property management software industry, combined with AppFolio’s innovation and strong balance sheet, positions the company to capture greater market share and pricing power, providing a long runway for above-market earnings and revenue growth.

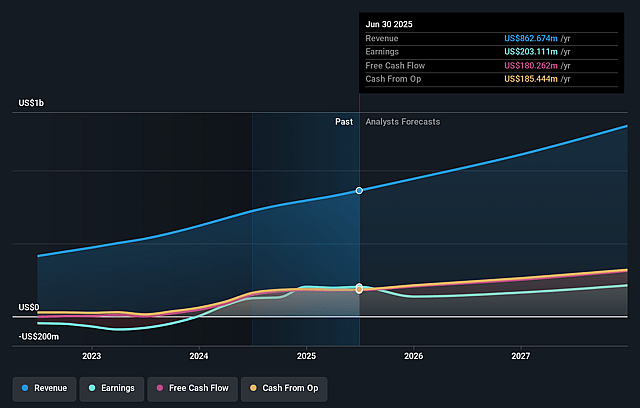

AppFolio Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on AppFolio compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming AppFolio's revenue will grow by 9.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 23.9% today to 13.9% in 3 years time.

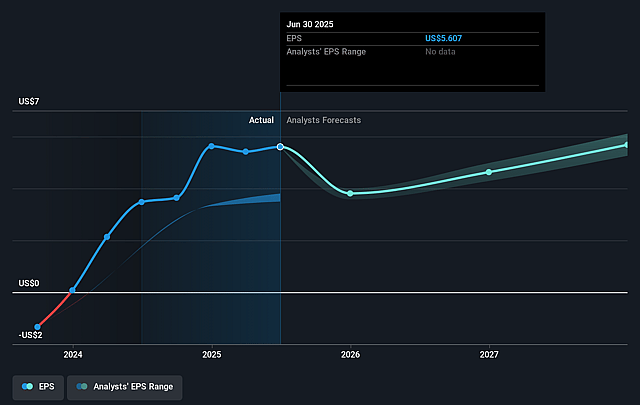

- The bullish analysts expect earnings to reach $149.4 million (and earnings per share of $4.28) by about July 2028, down from $196.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 88.3x on those 2028 earnings, up from 46.8x today. This future PE is greater than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to decline by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.89%, as per the Simply Wall St company report.

AppFolio Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- With AppFolio’s revenue and customer growth primarily concentrated in the U.S. residential property management sector, any prolonged slowdown or structural change in the U.S. real estate market — possibly driven by sustained high interest rates or falling demand for multifamily rentals — could cause significant volatility in its revenues and earnings over time.

- Increasing industry consolidation, with larger software competitors such as Yardi and RealPage gaining market power, may drive up customer acquisition costs and put pressure on AppFolio’s pricing, threatening both its future revenue growth and profit margins.

- Persistent investments in product development, AI innovation, and go-to-market strategies to keep up with rapid technological advances and meet customer expectations are already resulting in only modest headcount growth, but if operating cost increases outpace AppFolio’s pricing power, net margins could be pressured in the long run.

- Escalating regulatory scrutiny over tenant screening, fair housing, and data privacy demands greater investment in compliance and security features; this growing burden is likely to inflate general and administrative costs and weigh on future net earnings.

- As the market for property management software matures and core functionality becomes commoditized, AppFolio could face downward pressure on average revenue per user and greater customer churn if they fail to successfully expand into adjacent verticals beyond their current core, potentially capping long-term revenue potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for AppFolio is $300.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of AppFolio's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $300.0, and the most bearish reporting a price target of just $186.69.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $149.4 million, and it would be trading on a PE ratio of 88.3x, assuming you use a discount rate of 7.9%.

- Given the current share price of $255.49, the bullish analyst price target of $300.0 is 14.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AppFolio?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.